People

Topics

Share

As seen in Captive Insurance Company Reports (CICR)

For most companies today, its people are one of the largest investments its makes. COVID-19 accentuated this point and further showed us how the health of a company depends in large part on the health and wellbeing of its workforce. Providing competitive benefits is not just the right thing to do, but a sound business decision. Employee benefits usually account for one of the largest expense line items on an income statement for organizations. In a world where employee benefits consistently become both more important and more expensive, businesses of all types are looking for an affordable mechanism to finance these risks. One solution that has become central to discussions about employee benefits has been captive insurance.

To provide some background, a captive is an insurance or reinsurance company – which can help insure or reinsure the risks of its owners, the parent company (or companies).

Employee Benefits & Captives

Over the past decade as healthcare and benefit costs have been rising, captives have become the go-to solution for organizations looking to bend the healthcare cost curve as well as create a more efficient employee benefits program. More recently, however, organizations are recognizing the many qualitative advantages of a captive that can help attract and retain employees- a company’s most import asset. As we enter a new decade, these qualitative advantages or “soft costs” of human capital will drive the next iteration of captive insurance.

Traditionally, captives have been viewed as purely a funding mechanism for employee benefits that provides the following advantages:

- Improved cost savings

Cost savings can be yielded through: better control of premium costs, reduced frictional costs (commissions, taxes, insurer profit, administration), captured underwriting savings, earned investment returns, and improved cash flow for the parent organization.

- Improved risk management & increased control

- Enhanced reporting: Captive programs usually provide reporting in a more timely manner, allowing stakeholders to make decisions regarding potential plan design changes for the upcoming year.

- Centralized risk pool: From an organizational risk perspective, leveraging a captive allows risk managers to have a more complete understanding of the risks associated with the programs. Also, life and disability lines are usually considered to be third party risks and have a positive impact on the captive’s risk distribution.

- Non-correlated risk: Employee benefits usually add non-corelated risk for existing captive programs, thereby, reducing the risk exposure to the captive.

- Quantification of loss prevention programs and wellness initiatives: By utilizing a captive, the organization has the ability to implement data analytics programs that provide actionable insights on the effectiveness of existing programs and the current cost drivers.

- Design coverages and provisions for programs that are unique to the parent company: Every organization has a unique set of risks and captives can be used to fill in gaps in the existing benefit programs.

In our view, the next generation of captive insurance will have a sharper focus on the soft costs of human capital, such as:

- Intangible results

While employee benefits account for large costs for employers, they are running a significant risk by not providing the right benefits. By establishing a captive, employers can open doors to focus on human capital and the more qualitative aspects of a program. Further, a captive allows for customized benefits programs to meet the needs of your unique demographic. Employees a technology company will have different priorities and expectations than, for example, those that work in manufacturing. With a captive you can understand and meet those unique needs better than you could with a commercial carrier, in a cost-effective manner. This will go a long way with retention and engagement, and will make your employees feel their voices are heard.

Another intangible result of a captive program is the parent organization’s ability to capture enhanced data analytics. This data comes in months sooner than it would with a commercial carrier, meaning you can analyze your programs and make real-time decisions to yield better claims results. For example, if you know one of your biggest population health issues is diabetes, you can establish programs to address diabetes before your renewal is up. With commercial carriers, the information comes in too late to make changes for that plan year.

Which Benefits Can I Fund Through a Captive?

A wide range of employee benefits may be funded through a captive – the most common coverages are Medical, Life, Disability, Retiree Medical and Voluntary Benefits.

Captives can be used to fund Employee Retirement Income Security Act (ERISA), or non-ERISA benefits. ERISA benefits are primarily the benefit plans sponsored by and contributed to by employers. Life and Disability plans are usually ERISA in nature. These plans are subject to federal oversight, under the auspices of the Department of Labor (DOL) and require express approval from the DOL to fund them in a captive. Approval from the DOL is subject to meeting certain criteria – using an A rated fronting carrier, not paying any more than market rates for the coverages, no direct commissions as part of the contract, requirement for an indemnity contract, to name a few.

Medical stop-loss is usually not considered to be subject to ERISA and has become an extremely popular benefit to add to a captive. The reason for this has been two-fold. Firstly, the rising cost of catastrophic claims. Self-insured organizations are increasingly concerned about the financial impact of high-cost claims – unfortunately seeing $1M or $2M claims is becoming commonplace. One such large claim could have a material impact on the financial sustainability of the program. Second, the hardening insurance market is driving employers of all sizes towards a captive based stop-loss solution, as it reduces the opaqueness of the pricing process and helps employers get a much clearer understanding of their premiums and cost drivers. Usually a captive stop-loss program involves the employer creating an annual aggregate limit, and purchasing excess coverage from the commercial markets above the captive’s aggregate retention. Thereby, protecting the captive from most catastrophic claims.

Long-tail benefits such as group universal life insurance and long-term disability are ideal captive candidates. Benefits that pay out over multiple years (e.g. long-term disability and retiree medical), provide cash flow stability and loss predictability.

Using a captive for voluntary benefits has recently risen in popularity. This is a cost-efficient way of offering benefits that your employees can choose to participate in, or not. More and more employers are turning to this strategy as healthcare becomes more expensive, as a way to supplement benefits and lessen both their financial burden and the financial burden faced by their employees. One of the most attracting elements of writing voluntary benefits into your captive is that voluntary benefits typically have a very low loss ratio, which means they can generate a lot of savings within a captive. Those savings can then be leveraged to reduce premiums for employees or expand the coverage offered. An example of a prime voluntary benefit often offered in a captive structure is hospital indemnity, which can be critically helpful coverage, but one that is often otherwise too expensive to fund.

How it Works

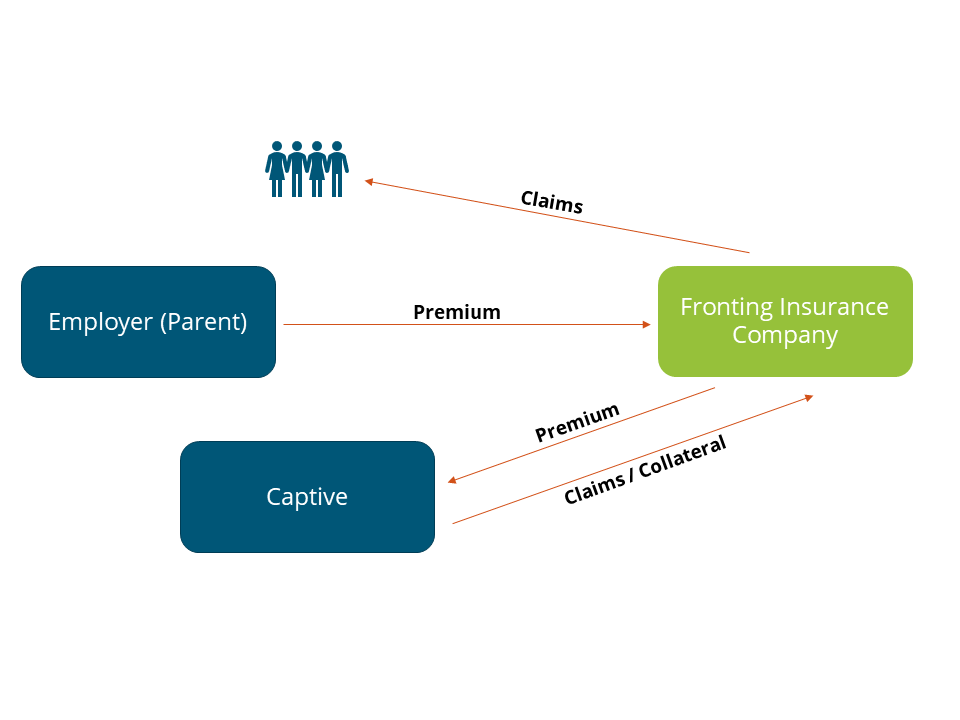

Unlike property and casualty lines of coverage, employee benefit lines have a unique value proposition. They allow organizations to recapture dollars that would have otherwise gone to an insurance carrier. Both life and disability coverages use a fronted carrier, i.e. a commercial carrier stands in front of the captive so that from an employee perspective there is no change in the way they interact with the insurance company. On the back end, the carrier cedes risk and premiums to the captive.

The following illustrates how a typical fronted captive program works.

Under such an arrangement the fronting insurer to continue to administer the program. The employer pays the fronting insurer an annual fee for its services, allowing the captive to retain underwriting profit (if any) from the program. Depending on the risk appetite of the organization and the results of the actuarial modeling – the employer may choose to buy reinsurance for the program.

In Closing

The typical steps involved in adding benefits to an existing captive or forming a new captive are a feasibility study which outlines qualitative and quantitative factors for consideration, such as potential savings, program structures, design alternatives, insurance considerations, and implementation requirements.

Today those in the insurance industry are facing difficult circumstances on a variety of fronts. The recent pandemic has led to hardening of markets. We are seeing substantial rate increases for clients. Captives offer a solution to mitigate these increasing costs in a sustainable manner. In addition, captives provide access to additional data and insights that can help organizations get a clearer understanding of claims drivers and therefore allow for implementation of solutions and tools that reduce claim costs. Further, captives provide organizations the ability to impact the soft costs of human capital by identifying and crafting unique solutions to meet their employees’ needs, more important now as the pandemic shed light on gaps in coverage many did not realize existed.

Captives are useful and versatile risk financing tools, especially for employee benefits. They provide significantly better cash management than can be provided through a trust and can produce impressive cost savings as compared to fully insured guaranteed cost plans.

We hope we’ve piqued your interest and we’re here for you. Over the next months, we will dive further into employee benefits captives to cover things like types of captives, moving to a self-insured program, medical stop-loss, feasibility studies, solutions for small and mid-sized businesses and more. We hope you’ll keep reading.