Background

With Ozempic in particular capturing headlines, a new generation of weight loss prescription medications have gained recent traction. According to the National Institute of Diabetes and Digestive and Kidney Diseases, more than 42% of American adults are obese or severely obese, a rate that has almost doubled since 19801. Although we remain a society hyper-focused on pant size, the potential health benefits of these medications should not be ignored.

The World Health Organization (WHO) reports that four million people die each year from underlying conditions related to obesity. Obesity has been known to increase your risk of developing type 2 diabetes, hypertension, cardiovascular disease, kidney disease, stroke, sleep apnea, osteoarthritis, and certain types of cancer, and can extend beyond the physical realm to negatively impact mental health as well2.

As employers and the nation work to combat soaring healthcare costs, obesity could be a critical piece of the puzzle since medical costs for the obese tend to be 30%-40% higher than those with a healthy weight3. A study by Xcenda estimates that if obesity rates in the U.S. were 25% lower, we would see a 115% decrease in IUC admissions and deaths related to COVID-194.

We all know that losing weight is not as simple as it sounds. In addition to your average obstacles, social determinants of health such as income, education, location, and food insecurity, as well as genetics and hormones play big roles in the obesity equation and should not be minimized. Although a magic pill rarely exists, it is possible these new drugs could be perceived by some as magical.

To sprinkle some of that magic without too much smoke and mirrors, employers can ensure their health plan and Pharmacy Benefit Manager (PBM) partners have the right policies and eligibility criteria in place to ensure these medications are available for the right people.

The Basics

Two drugs, Wegovy (semaglutide) and Saxenda (liraglutide) both manufactured by Novo Nordisk have FDA indications for weight loss. Trials for Wegovy and Saxenda produced 15% and 5-10% average weight loss results, respectively5. Although positive, the sample is small, and the long-term impact is unknown. Novo Nordisk’s marketing campaign created a frenzy, resulting in a national shortage of the drug. In 2022, Wegovy prescriptions increased by 284%6. The demand is so high, in fact, that Novo Nordisk is now prioritizing the limited supply to existing patients, making it harder for new patients to start the medication. Saxenda (liraglutide), which hit the market in 2015 experienced success, but preference has since shifted to Wegovy due to its once weekly injection and more robust weight loss potential.

Ozempic (semaglutide), also produced by Novo Nordisk, and Mounjaro, through Eli Lilly, are both currently approved for diabetes but are seemingly being used off-label for weight loss. Industry leaders believe Mounjaro, which is said to give off an even stronger fullness signal and reports even more weight loss than Wegovy. The initial results are positive with favorable weight loss in 80% of patients taking Mounjaro and average weight loss at 15%, based on information from The New England Journal of Medicine. It is expected the drug will be approved for weight loss later this year.

Side effects for these drugs do exist, although relatively mild, include nausea, vomiting, diarrhea and acid reflux. The good news is that that with time these side effects typically subside. Patients may also experience pain at the injection side, dizziness, or fatigue. There is a general warning with the GLP-1 receptor agonists drugs regarding the risk of thyroid tumors7 in specific populations. Individuals should work with their physician to evaluate their appropriateness for the drug.

Contrave is another weight loss drug produced by Orexigen Therapeutics that was approved for weight loss in the U.S. in 2014. Contrave is approved for people with obesity (a body mass index of 30 or more, or of 27 or higher with at least one weight-related condition). Contrave, an oral tablet, is a combination of two active ingredients, naltrexone and bupropion, which together work to suppress appetite and increase the feeling of being full after eating. Clinical trials report that Contrave can lead to a loss of 4%-8% of body weight. Similar Rx benefit policies and restrictions are in place but provide an alternative to patients.

Many medical experts recommend long term therapy for patients but with evidence still emerging recommendations are changing quickly. It has been reported that most people gain the weight back after stopping8 which would likely result in an endless cycle. While these drugs do yield hope, they still are not a silver bullet, and ideally would be one piece of a comprehensive health betterment plan that also focuses on healthier eating and exercise habits9.

The Numbers

These medications have high price tags with Wegovy retailing at approximately $1,300 a month and lack of coverage without strict prior approval criteria. Even with the high price tag, some patients are willing to cover the cost out of pocket and can find manufacturer programs to offset some of their costs. This industry has a projected market value of approximately $100 billion in less than ten years. Reuters reported on March 29, 2023, that WHO is considering adding obesity drugs to their ‘essential’ medicines list, but this remains to be seen.

If we know that obesity rates are linked with environmental, generic, and social determinants of health, only a tiny piece of the epidemic can be mitigated with these drugs which does not serve as an equitable solution. In that vein, we are keeping our eyes on the proposed bill entitled the Treat and Reduce Obesity Act, which could alter insurance requirements for obesity treatments like these, but carriers may hold out until long-term effectiveness can be proven.

It is worth nothing again that only Wegovy, Saxenda, and Contrave are currently authorized for weight loss alone, but there is evidence that other versions of the drug (i.e. Ozempic and possibly Mounjara) are being used off-label for weight loss by non-diabetics.

Employer Considerations

As I mentioned, many insurance carriers only cover medications in this category in the case of diabetes. However, a survey conducted by the International Foundation of Employee Benefit Plans (IFEBP) states that 22% of employers in the U.S. cover prescription drugs for weight loss, and 32% offer weight management programs. This is driven by the fact that 25% of employers report obesity as the largest detriment to healthcare costs.

Given this, it’s likely important for employers – at least self-insured employers – to consider a formal but flexible policy related to weight loss medication as research evolves. A thoughtful program must consider all options available and pinpoint if these medications will positively impact your population and plan costs. A comprehensive policy will likely require prior authorizations, potential lifetime maximums and perhaps coverage in collaboration with other treatments (i.e. nutritionist, diet programs, workout routines, etc.). In addition, coordination with your pharmacy benefit manager will be critical to ensure you can take advantage of competitive pricing and rebates where appropriate.

Conclusion

Excess weight can take a hefty toll on a person’s body and mind. It can lead to serious health conditions which can lead to premature death, substantial disability, and/or negatively impact memory and mood. The fact is that obesity diminishes almost every aspect of health and the charge to “lose weight” or “maintaining a healthy weight” is frankly daunting. It is also very frustrating that the high costs of these medications are often cost prohibitive for many and inappropriate prescribing does not help our efforts to “reign in” pharmacy costs.

As employers we must look at the entire picture; both short- and long-term goals and educate ourselves on what coverage really looks like with our medical and PBM partners. We have a responsibility to ensure they have criteria in place to closely monitor authorization and utilization of these medications so to ensure the right person has the right drug at the right time and continues to benefit from it over time. Spring is happy to be the conduit for your organization in analyzing population health data, evaluating coverage options, ensuring the appropriate protocols are in place, and working with your PBM to build a strategy for prescription weight loss drugs into your larger benefits program.

1 Obesity Statistics. The European Association for the Study of Obesity.

2 https://www.webmd.com/diet/obesity/obesity-health-risks

3 Public Health Considerations Regarding Obesity. StatPearls

4 https://galen.org/2023/new-treatments-for-obesity/

5 https://www.nbcnews.com/health/health-news/weight-loss-drug-affordability-rcna60422

6 https://www.usatoday.com/story/news/health/2023/03/22/ozempic-wegovy-mounjaro-weight-loss-medications-explained/11510967002/

7 https://www.npr.org/sections/health-shots/2023/01/30/1152039799/ozempic-wegovy-weight-loss-drugs

8 https://dom-pubs.onlinelibrary.wiley.com/doi/10.1111/dom.14725

9 https://www.hsph.harvard.edu/obesity-prevention-source/obesity-consequences/health-effects/

The U.S. is one of the only countries in the world without a federally mandated paid parental leave policy. This gap has motivated many states to take matters into their own hands, creating their own statewide paid family and medical leave (PFML) laws, which typically include parental leave (bonding with a new child) but also additional absences from work due to common life events such as a serious illness or to care for a sick family member. Similarly, individual companies often have their own parental leave offerings, knowing that it is critical to a successful employee attraction and retention strategy.

In years past, the focus was on the mother’s access to maternity leave, and any paternity leave offered was perceived as a “bonus.” However, modern assessments of equity and discrimination should have employers reassessing how their parental leave programs are framed, especially given guidance recently released by the Equal Employment Opportunity Commission (EEOC).

What You Need to Know

- Under FMLA, both new mothers and fathers can take leave, and no gender is favored regarding duration of leave or other factors. Employers are legally prohibited from rejecting parental leave requests based on gender, and also from terminating employment due to a paternity or maternity leave under the FMLA. Please note that not every worker is eligible for FMLA – you can see eligibility provisions here.

- Title VII of the Civil Rights Act of 1964 prohibits employer discrimination on the basis of race, color, religion, sex, or national origin when providing family or medical leave. Under Title VII, if an employer allowed a woman to take leave to care for a newly born, adopted, or placed child, but did not offer the same leave to a man in the same situation, that would constitute discrimination based on gender.

- Additional leave may be offered due to medical complications from pregnancy or labor. This type of leave is admissible to be only offered to those who are child-bearing, but this leave should be viewed as a medical leave of absence, not maternity or parental leave.

- Under the Pregnant Workers Fairness Act ( PWFA), a new law that goes into effect on June 27, 2023, workers have the right to “reasonable accommodations” for pregnancy, childbirth recovery, and related medical conditions, including lactation, unless it would create an undue hardship on the employer. Accommodations may include additional breaks, ergonomic enhancements, or schedule changes. The new law closes a gap in that the worker does not need to have a pregnancy related-disability to be afforded accommodations, and it applies to both pre-and post-labor. The PWFA will apply only to those who give birth or have given birth, and offers accommodations, not leave.

- State PFML laws also do not discriminate against gender. This means that leave for bonding with a new child must be the same for mothers and fathers, with the same level of pay and other provisions which vary by state.

- Corporate policies must keep durations for bonding consistent and avoid terminology that separates benefits based on gender or implies a gender bias (i.e., primary vs. secondary caregiver).

Parental leave is a key example of how employers can ensure they are putting their diversity, equity, and inclusion (DEI) values to work. Recent guidance, legislation, and general buzz around this topic make it a prime time to ensure that your programs are compliant. Please get in touch if you should have any questions about leave laws or best practices in this area.

This World Health Day, we’re reflecting on COVID-19, which flipped our worlds upside down and took over our thoughts and behaviors for a long time. We can think about the “before” times, when perhaps we didn’t even own a mask, didn’t think twice about a handshake, and never missed a wedding or family gathering. Now, we are entering the “after” times, whether we’re ready or not the COVID-19 National Public Health Emergency is scheduled to end on May 11th. For many, COVID-19 protocols are a thing of the past, but while we can all resonate with the urge to move on, “long-haulers” may feel left behind.

The hard facts on Long COVID remain hard to pin down. New Hampshire’s WMUR9 news station reports that between 16 and 35 million Americans have contracted Long COVID, leaving an estimated 4 million Americans unable to work, at least for a period of time. In an NBC News analysis of data reported from the Census Bureau, 11% of those surveyed who had ever contracted COVID-19 were actively suffering from long COVID in February 2023, which was down from 19% in June of 2022. Medical experts estimate that the likelihood of coming down with Long COVID is around 5-10% for those fully vaccinated and 15-20% for the unvaccinated1. Certain demographics may be more vulnerable; a review in the journal Nature indicates that women and people with Type 2 diabetes or ADHD may have an elevated risk of contracting Long COVID.

Regardless of exact numbers, employers should not lose sight of Long COVID, which could leave a significant portion of its workforce with brain fog, respiratory problems, depression, or other symptoms that make it difficult to do their day jobs. While we do seem to be moving in the right direction in terms of quantity of diagnoses, we all know that the prevalence of COVID can ebb and flow, and that no two cases seem to be the same. We recommend having open and frequent dialogues with employees who report Long COVID debilitations, as you may be able to make accommodations or assist in identifying the resources they need. Understanding if and how your leave, sick, and disability plans account for Long COVID is also important. In some cases, a severe Long COVID symptom could result in a disability covered in your short-term disability plan, or an employee may be eligible for leave under the FMLA or other applicable program. For employees dealing with Long COVID, knowing that they have options to either take leave, adjust their job requirements or schedule, or generally receive support can go a long way.

Watch the recording of our webinar, Why Long COVID Needs Short-Term Attention, where we dive deep with a pulmonologist on the state of Long COVID and offer employers strategies to mitigate what could be long-lasting affects on claims costs and workforce productivity.

1https://www.nbcnews.com/health/health-news/current-risk-getting-long-covid-rcna73670

Our Managing Partner, Karin Landry will be presenting at The Connecticut Captive Insurance Association (CTICA)’s webinar titled “How to Level Up Your Medical Stop-Loss Program” later this April. You can learn more about her presentation here, and register here.

Background

According to Pharmacy Times, between July 2021 and July 2022, more than 1,200 medications had a price increase that surpassed the inflation rate during that time of 8.5%, with the average increase across these drugs coming to a staggering 31.6%. Overall prescription drug spending is projected to rise at an average annual rate of 6.1% through 2027.

Why are we seeing this uptick? An aging population, healthcare services costs, and administrative costs (e.g., financial transactions and patient services) are likely partly to blame. There are a range of strategies and tactics to help combat rising pharmacy costs within your benefits program, but it is important to understand what is driving these costs both globally and specifically within your organization. There is much talk about the skyrocketing costs of specialty medications. Specialty medications are now responsible for over 50% of total pharmacy costs, yet only about 2% of the population is using them.1 Unfortunately, a significant portion of pharmacy spend is going towards innovative and/or targeted therapies that treat rare, complex, genetic or inherited diseases, and cancer – all of which are usually beyond our control.

Preventing the Preventable

On the other hand, however, there are several behaviors that have a strong influence on health outcomes: tobacco use, alcohol consumption, physical activity, and diet.6 A direct correlation between cigarette smoking and the risk of heart disease has been shown and it is in fact the single most important modifiable risk factor for heart disease. Cigarette smoking has also been linked to certain cancers, which is the second leading cause of death in the United States. In fact, 16 million Americans have at least one disease caused by smoking, costing over $240 billion in healthcare costs annually.1

Obesity has been linked to multiple chronic diseases including heart disease, diabetes, and musculoskeletal conditions impacting bone health. The Centers for Disease Control and Prevention (CDC) reports that obesity adds another $173 billion worth of burden on the healthcare system per year because of resulting complications. Several studies have documented the adverse cardiovascular health effects that plague overweight adults. This is partly because obesity adds increased demands on the heart to supply blood to the body. Excess body weight and obesity are linked with an increased risk of high blood pressure, diabetes, heart disease and stroke. Losing as little as 5 to 10 pounds can make a significant difference in your risks. Even if weight control has been a lifelong challenge, taking small steps today can go a long way.2

Diet and physical activity are behaviors that directly influence weight. However, they may also have direct effects on diseases.

- The brains of middle-aged adults may be aging prematurely if they have obesity or other factors linked to cardiovascular disease.

- Almost 25% of adults have metabolic syndrome, a set of factors that in combination significantly increase a person’s risk of heart disease, diabetes, stroke, and other illnesses. Research has shown that people who have two or more of these conditions have even higher risks of heart disease.

Wellness interventions provide an opportunity for us to have some control over the healthiness of our workforce. These interventions play an important role in moving the needle by working to solve for the root causes at play. Employers should be incentivized to implement these preventative programs not only because wellness programs are considered as “nice perks” that increase employee morale and productivity, but also and more importantly, they are tangible solutions that can reduce the burden of health and pharmacy costs. If less employees need prescription drugs in the first place, pharmacy spending could decrease dramatically. Seems easy, right?

Let’s Get Tangible: Wellness for Outcomes

The higher the risk factor prevalence within a population, the greater healthcare costs are likely to be, both within the pharmacy realm and overall. Therefore, wellness initiatives targeted towards combatting, reducing, or preventing these risk factors will have a more tangible impact on reducing costs and improving health outcomes.

A Targeted Approach

There are six key lifestyle behaviors that promote a long and heathy life3:

- Getting enough sleep

- Eating a healthy diet, full of fruits and vegetables, healthy fats, and reduced sodium

- Being physically active for at least 30 minutes a day

- Maintaining a healthy body weight

- Avoiding tobacco use and exposure

- Limiting alcohol consumption

The goal is to reduce the need for prescription medication by stopping problems before they even exist. In a study of 55,000 people, those who made healthy lifestyle choices such as avoiding smoking, eating healthy, and exercising lowered their heart disease risk by about 50%.4 In fact, unhealthy lifestyle behaviors such as those that oppose those listed above cause approximately 70-90% of chronic diseases, which yield up to 75% of total healthcare spend in the U.S.5 As such, when it comes to medical and pharmacy costs, the most successful wellness programs will be those aimed at those six pillars and affecting long-lasting behavioral changes.

Wellness Point Solutions

The good news is, the wellness industry awakened with this realization a decade or so ago, in the midst of out-of-control healthcare costs, and now there are a plethora of wellness companies and tools available for employers to leverage. In fact, in the U.S., the wellness industry represents $1.2 trillion in revenue6. Homing in on the six behaviors above, employers might consider the following*:

- Tools like Foodsmart and Noom are focused on forming healthy eating habits and ensuring a well-balanced diet.

- Pivot and Wellable are some of the tools available aimed at smoking cessation.

- Employers can take advantage of services like Vantage Fit and MoveSpring that help employees with fitness and movement goals.

- Drinkaware can assist employees in understanding and lessening alcohol consumption, while Virgin Pulse has a more overarching suite of wellbeing services.

- Mental health has been at the forefront of workplace wellness conversations for some time now, and tools like Headspace and Kona offer stress mitigation techniques and alert managers to burnout warning signs. A healthier mind leads to more and better sleep.

- Weight Watchers and incentaHEALTH are geared toward weight management.

A range of wellness point solutions are out there, and the all-encompassing ones will have tools pointed toward all six of our wellness pillars. Additionally, larger employers have started to introduce onsite health clinics and resources to make employee engagement in their health more convenient. Some incentivize through walking or step challenges. Health plans build in wellness incentives such as reimbursements for gym memberships. Whatever it looks like, introducing preventative measures that lessen the prevalence of disease and poor health outcomes; reduce the need for prescription drugs, lost work days, and absence from work; and improve mental health; can lessen overall healthcare costs and prove advantageous for your workforce.

Before you make any decisions around wellness solutions, be sure to understand what is driving your pharmacy spend within your own organization. We recommend working with a consultant or actuary to take an unbiased and robust view of your data. Better yet, consider taking the next step to…

Work With a Clinical Pharmacist

Even the best wellness programs cannot prevent or reverse existing and/or genetic health problems within a workforce population, and there are times when prescription medications are necessary. Typically, a clinical pharmacist is not part of your health benefits team, weighing in on strategy and dissecting the needs of your workforce population. I firmly believe this is both a gap and an opportunity.

An experienced clinical pharmacist can look at the full array of options available through a different lens, putting all the pieces together (medical, Rx, wellness, etc.) and provide targeted recommendations to improve outcomes while controlling costs.

Another important role of a clinical pharmacist is the ability to recognize signs of medication non-adherence, which can cause disease progression and adverse outcomes. If your organization is spending money on prescription drugs that are not being taken correctly and therefore cannot have the intended effect(s), a pharmacist can flag that up.

Get in Touch

When it comes to healthcare and pharmacy costs, many of the factors involved are out of our hands. However, we do have some power to affect change and take control through preventative, wellness, and innovative and targeted pharmacy solutions. Given the current climate, why wouldn’t we aim to do so?

If you need assistance assessing your current wellness programs, navigating the marketplace of vendor solutions, conducting a Request for Proposal (RFP), auditing your pharmacy benefits contract terms and utilization data, or are interested in leveraging a clinical pharmacist to yield customized and impactful results, our team would love to chat with you.

*Please note, Spring’s intent is neither to promote nor recommend any of these specific solutions, but rather to portray a snapshot of what is available in the market.

1https://www.wellsteps.com/blog/2020/01/02/benefits-of-wellness-lower-health-care-costs/

2https://www.stroke.org/en/about-stroke/stroke-risk-factors/risk-factors-under-your-control

3https://www.verywellhealth.com/lifestyle-factors-health-longevity-prevent-death-1132391

4https://www.health.harvard.edu/blog/lifestyle-changes-to-lower-heart-disease-risk-2019110218125#:~:text=The%20good%20news%20is%20that,disease%20risk%20by%20nearly%2050%25.

5https://www.wellsteps.com/blog/2020/01/02/benefits-of-wellness-lower-health-care-costs/

6https://www.zippia.com/advice/health-and-wellness-industry-statistics/#:~:text=Here%20are%20some%20statistics%20about,products%20is%20about%20%24168%20billion

Captive Review has released a Q&A featuring our Chief Property and Casualty Actuary, Peter Johnson, where he explains the impact of inflation on insurance and risk management practices and how how it intersects with captive insurance. Check out the full Q&A here.

Title:

Director of Client Services/Brokerage Practice Leader.

Joined Spring:

I joined Spring in 2015, before Spring was acquired by Alera Group.

Hometown:

I am a New Englander through and through! I was born and grew up in Boston and lived in Jamaica Plain and Roslindale.

At Work Responsibilities:

As Spring’s Brokerage Practice Leader, I work directly with employers and carriers to implement top-tier employee benefits programs for employers of all sizes. Some of most common areas include group health plans, dental, life insurance, disability, and FSAs, HRAs & HSAs.

Outside of Work Hobbies/Interests:

I love being outdoors (when the New England weather allows!). Some of my favorite things to do outside of the office are hiking, fishing, boating, and sports.

Fun Fact:

Many people don’t know this, but I was actually an extra in the movie, “Blown Away”.

Describe Spring in 3 Words:

It’s very tough simplifying my nearly decade at Spring into just 3 words. But I guess I’d have to go with professional, caring, and reliable.

Favorite Movie/TV Show:

I enjoy the classics, my favorite movies are To Kill a Mockingbird and Casablanca.

Do You Have Any Children?:

Yes, I have two children, Ryan and Kaleigh, they’re both in their 20s now.

Favorite Food:

Italian and Japanese!

Favorite Place Visited:

Although these two places are almost polar opposites, my favorites are Italy and Alaska.

Favorite Band:

I love my 80s music, so I’ll have to go with U2.

Bucket List:

I really want to visit the Pyramids in Egypt.

If You Won the Lottery, What Would You Do With the Money?:

I would start a scholarship program for disadvantaged children, to help give them a full ride through college.

It seems like every year we are seeing new developments in the world of captive insurance on both the national and international scales. After recently attending The Captive Insurance Companies Association (CICA) 2023 International Conference, I wanted to share some of the hot topics on the minds of captive professionals around the world. As a board member of CICA and chair of CICA’s NEXTGen young and new professionals committee, I was excited to be so involved this year. The conference definitely did not disappoint; in addition to “extra-curriculars” like the golf tournament and brewery tour, the event also provided great opportunities for networking and learning about current trends and best practices in the world of captives and what the future holds for the industry. I hope you enjoy these highlights.

1. Regulatory and Tax Updates

As per usual, regulatory updates were a highly discussed topic during the conference. As a long-term attendee and speaker at CICA’s annual conferences (and other captive conferences alike), regulatory updates are always pertinent, as laws and best practices are constantly shifting, as seen in the following:

– In a session titled “The Lay of the Land: Captive Taxation,” speakers explored recent administrative, legislative, and judicial updates affecting captive taxation, with a focus on 831(b) small captives.

– Following the addition of 87,000 IRS agents (following the Inflation Reduction Act), a group of tax experts and a lawyer discussed how this will most likely impact audits of small captive cases.

– Three state regulators from North Carolina, South Carolina, and Oklahoma discussed updates we can expect to see from various domiciles during their session, “There’s a New Sheriff (Regulator) in Town.”

– On the second day of the conference, I presented on “What’s New with the DOL and Employee Benefits?”, where we delved into the upsides of writing employee benefits into a captive and how it intersects with DOL regulations.

2. Navigating Inflation

From eggs to rent, no sector can avoid inflation, including the captive/alternative risk financing arena. With that being said, controlling costs and reducing risk is a top priority for many employers across industries and around the world. This year I heard some exciting ideas when comes to addressing inflation, some of which included:

– The second session of the conference looked at innovative captive risk and finance tools captive owners should consider in the current economic landscape and how to mitigate uninsured risks often excluded in captive structures.

– Actuarial experts discussed how inflation will impact unpaid claim liabilities and future funding levels and approaches actuaries are taking to combat this. The session was titled “The Impact of Inflation and Other Economic Trends on Captive Programs.”

– In contrast to typical inflation sessions, one panel focused on social inflation, and reviewed how captive owners should prioritize safety culture, utilize user-friendly insurance technology, and ensure suitable hiring and retention practices.

3. The Captive Formation Process (Experiences from Captive Owners)

A couple sessions turned the tables and looked at captives from a different point of view: that of the captive owner. It was very interesting hearing from captive owners on their experiences with forming a captive and what goes through their minds during the process.

– The presentation, “Captive Formation Stories,” featured three captive owners and a moderator from Captive International, to discuss their internal strategies, domicile selection, and how their experience has been to date with their captive.

– Panelists from the “CaptiveLand: A Journey to Forming a Captive” session took a unique approach and styled the presentation like a board game (Candyland), helping risk managers navigate the obstacles and milestones when setting up and maintaining a captive. The panelists included two captive owners and a state regulator.

4. Shaping the Future Captive Arena

As the Chair of CICA’s NEXTGen young and new professionals committee, I was impressed with the focus CICA put on providing sessions and events aimed specifically towards young professionals looking to enter or grow within the industry. As regulations, best practices, technology, lines of services and more constantly change, it is essential that the next generation of captive professionals are equipped and ready to shape the future of the practice.

– One of my favorite parts of the conference was the CICA Student Essay Contest. University students were given 3 case studies to select from and wrote an essay on establishing a captive for their specific case study (including selecting policy options, determining underwriting and pricing, etc.).

– During the session, “Building Your Personal Board of Directors – Considerations During the Different Stages in Your Career,” speakers discussed the upsides to developing a personal Board of Directors to support career growth and how to get started.

– Finally, I spoke on a panel that discussed what NextGen captive professionals value most in a job. We looked at ways to combat the great resignation and how organizations can better align with young professionals’ career goals.

With many conferences under my belt, CICA never fails to provide a great platform for networking and sharing ideas, I am excited to see what the future has in store for the association and for captives overall. In the meantime, our team will continue to keep our fingers on the pulse of captives to assure we provide clients with industry-leading captive and alternative risk financing services.

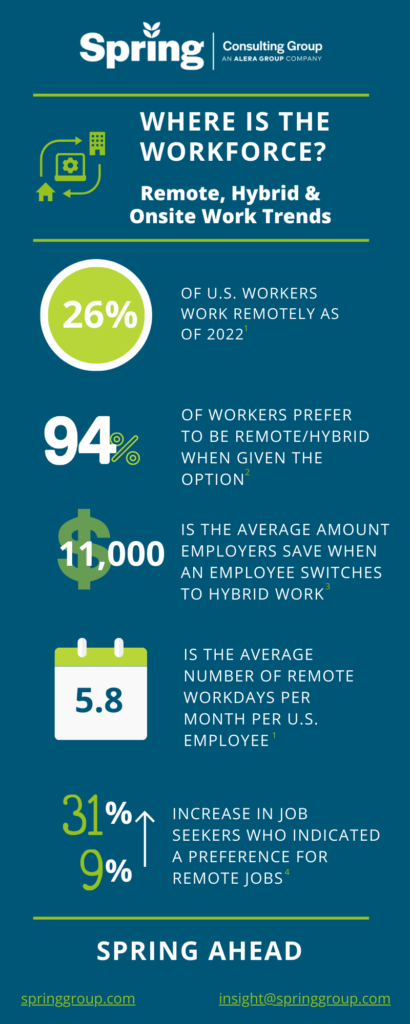

As we transition past the pandemic, we are seeing shifts in remote, hybrid, and onsite practices across the US. Below are some of the top trends impacting workforces nationwide.

1Zippia. “25 Trending Remote Work Statistics [2023]: Facts, Trends, And Projections” Zippia.com. Oct. 16, 2022

2Alera’s EB Market Outlook

3https://globalworkplaceanalytics.com/telecommuting-statistics

4https://fortune.com/2023/01/25/workers-prefer-remote-first-roles-hybrid-work/