Our Senior Vice President, Prabal Lakhanpal, has recently joined The Captive Insurance Companies Association (CICA)‘s board of directors. He also currently chairs CICA’s NEXTGen Young and New Professionals Committee; check out the full article here.

During The Captive Insurance Companies Association (CICA)’s 2023 annual conference, our SVP, Prabal Lakhanpal presented on behalf of our Managing Partner, Karin Landry, during which he present on what next-gen professionals value most in in a job. You can find Captive International’s recap here.

Each year, I use International Women’s Day to share my reflections on what it has been like to be a woman leading in a male-dominated industry, to be the mother of a daughter, and to uplift women’s organizations and the efforts I believe are critical to empowering women professionally. This year, I wanted to focus on action rather than reflections, so I am mapping out a three-step process for women to help make sure they are paid fairly relative to their male counterparts.

Past Imperfect

Pay inequity and gender discrimination has been a problem since the workforce diversified to include women and people of color. Fortunately, recent legislation at all levels of government from state to federal have adopted policies to help prevent this kind of discrimination. In some jurisdictions like Connecticut, Delaware, Michigan, and Atlanta there are laws in place that prohibit employers from asking candidates about salary history. And in California, companies with 100+ employees are required to report pay data by gender and race.

The bad news is that even with all of these policies, a gender pay gap still exists. In 2022, according to the Census Bureau, women in the U.S. made around 82 cents for every $1 a man earns. In C-suite roles, the ratio is 75 cents to a dollar. In fact, data shows that with the current rate of progress, executive positions will not achieve gender parity until 2060.1

It’s time to change that.

What You Can Do

Hopefully your employer is practicing pay equity. However, it doesn’t hurt to do your own due diligence by following these steps.

1. Benchmark yourself against the market

First, do your research. If you don’t know how much others make in your field, how are you supposed to know if you are being fairly compensated?

Platforms like Indeed, Glassdoor, PayScale and Salary.com share data on average salaries based on job title and skillset. As you do your fact finding, make sure you consider factors such as location, years of experience, the size of your company, special degrees or certifications you have, etc. Sharing a title doesn’t necessarily make you an equal candidate. It is also important to consider incentives outside of your normal paycheck, such as stock or equity, bonuses, 401(k) contributions or pension plans, benefits and other offerings. If you have friends or family in a similar field, see if they are willing to have honest conversations about their compensation. Alternatively, maybe you know someone in HR or recruitment whose brain you can pick.

Based on market data and your experience and skill level, determine a “fair” salary band and see where you fall on that spectrum.

2. Ask for what you deserve and need

Be clear about what you want from your job and your company, and give them the chance to do the same. One of my biggest takeaways from being a woman executive is that men are not afraid to negotiate or ask for raises or other incentives, and women are often reluctant to do so. My advice is not to assume that you will be handed a raise even if you truly do deserve one, and that there are many things in life you won’t get unless you ask.

Consider how other incentives that your company can offer like flexible hours, remote or hybrid work, etc. may impact your value through your employer’s lens. Speak to your manager and understand what might be required from you to advance to a next level, or why you aren’t there now. Don’t let gender be the limiting factor.

3. Pay it forward

Join a women’s leadership or mentorship program to expand your network. Is there a group you can join at your organization? If not, consider starting one. Look outside your company to see if there are women’s groups you could benefit from joining. Leverage your network, and if you find that your network is small, prioritize growing it. If you have concerns about DEI practices at your company, voice them. If you have experienced sexism in the workplace, speak with your HR department and/or manager – speaking up is an act of service in and of itself.

We have made headways in the fight for pay equity. For the first time, Forbes reported in January 2023 thatover 10% of Fortune 500 companies have a female CEO. While a milestone and proven progress, I can’t help but wonder if we should really be celebrating 10%, and instead focusing our efforts on 50%. So, this International Women’s Day, I recommend all women take a more active role in achieve pay equity. Widespread change can start at the micro level.

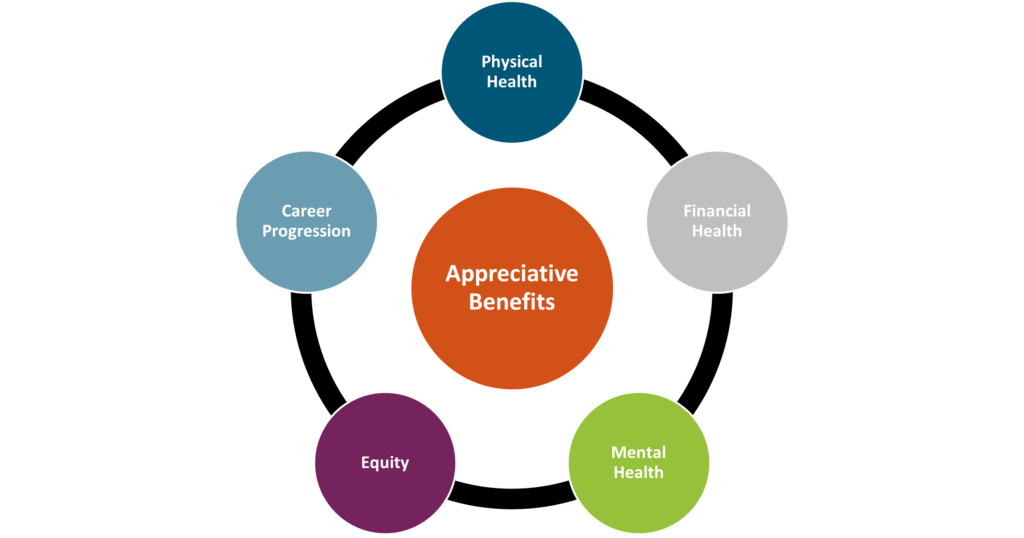

No matter the product or service you’re selling, or the impact your business makes in your community or the world at large, the consensus is that the most important asset an organization has is its people. Our HR and Benefits colleagues know very well that keeping employees happy and engaged (and keeping them in general) is not only makes for a positive atmosphere, but is also a strategic business move. So maybe you’re celebrating Employee Appreciation Day with a grateful shoutout, or a catered lunch, but don’t forget to look at the bigger picture of the precedent you’re setting – whether intentional or not – with your benefits programs.

Physical Health

Beyond the “it’s the right thing to do” mentality, benefits that support employees’ physical health are important for another reason: unhealthy employees will be far less productive, if present at all. Take a look at your health plans to ensure affordability, access, and breadth of care. Components like dental and vision insurance should also be considered here. Beyond health insurance, many companies offer supplementary tools or services that promote physical health such as fitness reimbursements, point solutions for things like diabetes management or musculoskeletal issues, health coaching services, walking challenges, and more.

Mental Health

Mental Health America reported that nearly 20% of Americans were experiencing a mental illness in 2022. The World Health Organization (WHO) states that depression and anxiety cost the global economy approximately $1 trillion every year. While employers cannot solve the mental health crisis, many believe that they do have a responsibility to provide related resources and prioritize employee mental health in some way. At Spring, we recommend tackling mental and behavioral health through the lens of its three most common barriers: cost, access, and stigma. Any programs offered should try and solve for these. For example, does your health plan cover mental health related appointments? In addition, there are a wide range of services available in this area. Some companies bring in yoga instructors on-site. Alera Group provides Spring Health at no cost to employees, which offers complimentary digital therapy sessions, coaching, and other tools. Apps like Calm and Headspace provide guided meditation and anxiety management practices. Paid time off for mental health or built-in “breaks” during the workday, such as designated times when meetings are prohibited, can also help. Simple tactics like demonstrating openness to discussing mental health in the workplace can go a long way to lessen any stigma.

Financial Health

Especially in today’s economy, employees need help saving for retirement, investing wisely, and being financially informed and educated. We also know that financial stress can be related to mental health, so by focusing on financial health you can impact multiple components of employee engagement. At a basic level, leading employers offer a 401(K) or similar retirement savings plan, with an employer match. As a next level, tax-friendly benefits like Health Savings Accounts (HSAs) can be helpful, and there has been a lot of buzz around student debt repayment programs which employers can choose to contribute to or just offer as a voluntary benefit. Other voluntary benefits like life insurance, identity theft protection and short- or long-term disability insurance can contribute to an employee’s financial wellness. Other perks might include financial counseling services and educational seminars.

Equity

Do your employees in different states have access to the same paid leave? To the same reproductive healthcare? To the same disability coverage? Do your executives and your more junior team members have the same benefits and incentives? Do your programs address a diverse range of needs, accounting for factors like location, race, gender, and age? Equitable benefits send the message of appreciation to all employees and instill the feeling of fairness and compassion.

Career Progression

Most employers take pride in hiring ambitious and hard-working employees. Don’t let your corporate structure or practices inhibit that ambition. Employees feel appreciated when they have a clear path for growth and opportunities to step up. From a benefits perspective, this might mean incorporating mentorship programs, education or certification programs, tuition reimbursement, or formal training programs.

Employees should feel appreciated on a regular basis, and not just on Employee Appreciation Day. By making sure you have these five pillars accounted for in your benefits program, you can create a positive culture of appreciation and satisfaction.

Captive Review releases their annual Power 50, where they showcase top leaders in the captive space. This year, they selected our Managing Partner, Karin Landry, #7. Check out the top 10 professionals here.

Every year, Captive Review releases their Power 50 list, which spotlights top professionals in the world of captive insurance. This year our SVP, Prabal Lakhanpal was featured on the list at #42. Check out the full article here.

When it comes to Actuarial Services, many people are unclear what it entails. The video below breaks down how actuaries can help cut costs and optimize benefits plans.

This year we had the pleasure of spending Valentine’s Day with some of healthcare’s sharpest minds within the Boston area at the Boston Business Journal’s “State of Healthcare” luncheon. Spring was excited to sponsor the event again as we take pride in both our Boston roots and in our commitment to advancing innovation in healthcare. As attendees enjoyed a delicious lunch, an impressive panel took the stage to share their different viewpoints on healthcare: Anne Klibanski, MD, President and CEO of Mass General Brigham (the Brigham); Lora Pellegrini, Esq., President and CEO of the Massachusetts Association of Health Plans (MAHP); Kevin Tabb, MD, President and CEO of Beth Israel Lahey Health; and Greg Wilmot, President and CEO of the East Boston Neighborhood Health Center.

After every conference or event, I like to take the time to reflect. Here are my five key forces impacting healthcare today, in Boston and beyond.

1. Capacity

Anne kicked things off by addressing a crisis in national healthcare: capacity, meaning there is not enough room to take in the patients who need the kind of care in which Massachusetts prides itself. In fact, every day over 200 patients within the system sit in the emergency room or elsewhere because there is no bed for them. This type of emergency capacity used to happen once every few months, but it is now the daily norm.

The problem is obvious. What is not so obvious is the solution. However, Anne provided the following insight: access is capacity. So, when we think long-term, we need to focus on efficiency and access in order to solve for capacity issues. The discussion called to mind the following questions:

– Are community hospitals being fully leveraged for the kind of care they are best suited for?

– What kind of care can be delivered virtually, and are we maximizing those capabilities? A recent development here is virtual urgent care.

– How can we increase hospital at home usage? The fact is that people prefer this method, and it increases care while decreasing costs.

– How can we increase our ability to treat patients in an outpatient or ambulatory setting? Massachusetts is near the bottom in the country when you look at the number of outpatient sites available. We need more sites, closer to home, with a lower cost model, so that we can save beds at highly specialized facilities like the Brigham for patients who need them most.

2. Affordability

Lora joined the stage to help uncover the factors behind the longstanding issue of affordability. At MAHP, they are focused on trying to make healthcare both simpler and more affordable. In Massachusetts, Lora said, we have the best data in the country regarding the drivers of healthcare costs, and that data identifies the two top drivers as unit price and pharmaceutical costs. Lora stressed the importance of the pharmaceutical and life sciences companies taking responsibility and being a part of the conversation around healthcare costs. While health plans traditionally take very little margin, and instead make most of their money from investment income, pharma on the other hand is taking in approximately a 30% profit for drugs that are sometimes federally funded. In this regard, more transparency around pricing and accountability is needed. Additionally, Lora highlighted the following affordability factors:

– Technology can and should be leveraged for things like prior authorization and streamlined credentialing. “There should be no paperwork,” said Lora. While you might be surprised that telehealth is not its own item on this list, the panelists pointed out that it is critically intertwined with affordability. Kevin pointed out that the big costs in healthcare are not individual visit payments, but rather frequent trips to the ER and people becoming sicker because they didn’t get care sooner. By marrying this goal of moving more people to outpatient or community health centers when appropriate with the access benefits of telehealth, we can make a difference in costs.

– Healthcare costs are prohibiting employers from offering other innovative benefits to employees. How can employers find a balance? For self-insured employers, which Lora says make up about 60% of the MA market, there is more of an ability to customize programs and invest in wellness initiatives and other perks. On the flip side, for fully-insured employers, especially small businesses, this is harder to do. What we see sometimes is when costs are added due to new legislation or another development, employers start considering a self-insured model, but when more parties leave the merged market, the older and sicker populations are left behind.

– The Massachusetts Health Policy Commission (HPC) is doing great work, but Lora says they hold too little authority, something that needs to change.

To expand upon this topic, Greg pointed out that the key to the cost problem was to increase access and utilization of primary care and preventative medicine, stressing that by improving health outcomes upstream, we can mitigate the downstream impacts on the rest and more expensive aspects of our health system. Community health systems like the East Boston Neighborhood Health Center plays a big role here.

3. Workforce

Kevin brought us up to speed on the core challenges in healthcare related to workforce, a topic which he emphasized is a widespread issue across industries and geographies. In healthcare, though, he explained that it is the top issue keeping executives up at night and described it as an “acute on chronic crisis.” Importantly, Kevin noted that the workforce crisis didn’t come to fruition overnight, and we won’t get out of it overnight either. We were at the edge of a precipice, and the pandemic tipped us over. At Beth Israel Lahey Health, they are focused on competitiveness of job offers, adaptation of roles and flexibility, and partnering to train up both within the community and within their system.

As Greg noted, healthcare workers have “been running a marathon at a sprinter’s pace.” He is focused on rebuilding the workforce, one that is reflective of the populations they serve and emphasized the need to focus on the next generation of talent.

On the topic of workforce, Anne added that it’s not just about salary. At the Brigham they are rethinking how to create a safe and healthy work environment. We have seen a rise in workplace violence in healthcare and beyond, so how do we better protect our staff? “We are what we tolerate,” remarked Anne, so we need to make sure we’re not tolerating behaviors and practices – both from staff and from patients and other constituents – that we shouldn’t. This brings us to our next point.

4. Equity

As Anne pointed out, allowing gender-based or racist remarks, or violent behavior prohibits the development of a safe and inclusive workplace. Greg brought a unique viewpoint to the conversation as his community health center serves a very diverse population. Smaller clinics and health centers are often over-looked, but as Greg noted, one in five MA residents are receiving care at a community health center. He stressed the need for a two-prong approach:

- What happens in the exam room, which at community health centers is largely primary care and preventative medicine.

- What happens outside the exam room. Here Greg noted the importance of social determinants of health such as behavioral health, housing stability, food insecurity, education disparities, language barriers, and technology. How do we bring these issues into governmental policy? How do we invest in communities of color to address things head-on instead of waiting until they fester into bigger problems? How do we ensure equitable opportunities in the job market?

Greg argued that only by focusing on these two health components in tandem will we make any difference in health equity, and healthcare at large.

When it comes to telehealth, a digital divide still exists related to broadband, Wi-Fi, devices, medical literacy, and age (there is a large gap in senior utilization of telehealth). This needs to be part of the equity equation too. Do we need fancy technology? Or, as Kevin pointed out, “almost everyone has a phone.” Could a phone call suffice in some cases?

Lastly, all panelists agreed that COVID-19 highlighted the inequities that had been there all along, creating an urgency around equity that we very much needed.

5. Unity

Greg left us with a powerful, albeit brief poem by Muhammad Ali to ponder: “Me, We.” His point was that while we all have a personal responsibility for affecting change, we also can’t achieve that change on our own. It takes a “me” and it takes a “we.” The consensus was that each stakeholder has a role – providers, insurers, pharmaceutical companies, the government, and so on. When these cogs in the wheel operate in silos, the wheel does not turn.

Anne remarked that when the pandemic hit, it created a galvanizing force that brought all types of parties, including so-called competitors, together for the common good. Now, the impacts of COVID-19 have faded, but the panelists pondered why we can’t use our broken system as the next galvanizing force to bring everyone to the table. Numbers 1-4 on this list cannot be addressed without prioritizing number 5. This will require more active listening and compromise.

Overall, the Boston Business Journal’s State of Healthcare luncheon provided a thought-provoking and multifaceted conversation that gave me much to think about. But as we move toward what is hopefully a brighter future for healthcare, I will leave you with one final thought from Greg Wilmot:

“If we were to rewrite our [healthcare] system, would we design it the same way? We have been writing the same story and changing the last chapter and expecting a different outcome. That doesn’t work. We need to go back and start at the beginning, and rewrite chapters 1-10.”

Greg Wilmot

Spring Consulting Group provides a wide range of Captive Services when it comes to the Employee Benefits and Property & Casualty (P&C) industries. In this Whitepaper, you can learn more about our captive services and how we approach captive implementation/optimization.