Our SVP, Prabal Lakhanpal was quoted in an article from Insurance Business on the rise of popularity in captive solutions and how it is shifting market roles. You can find the full article here.

As spring unfolded, the 2025 Disability Management Employer Coalition (DMEC) Compliance Conference brought together absence management professionals from across the nation to explore emerging trends, compliance strategies, and innovative solutions in the world of leave management. Held in Columbus, Ohio, this year’s conference offered in-depth sessions on pressing issues, including compliance, mental health accommodations, technological advancements, and diversity in the workplace. Here’s a look at some of the key topics that were discussed:

1) Navigating Complex Compliance Challenges

With the ever-changing landscape of leave and accommodation laws, staying compliant remains a top priority for employers. This year’s conference offered valuable insights into managing the intersection of federal and state regulations. Experts shared practical advice on how to avoid common mistakes and streamline compliance efforts across diverse workforces. Here are some noteworthy sessions:

- DOL Updates: 2025 and Beyond

This session offered a deep dive into upcoming changes to the Department of Labor’s regulations and what HR teams need to do to stay ahead of the curve.

- When the PWFA, ADA, PUMP Act and FMLA Intersect: How to Unravel from a Tangled Mess

Speakers unpacked the complexities of these intersecting laws and shared strategies for managing situations where they overlap.

- Navigating the Bermuda Triangle: PFML Private Plan v. State Plans

Our team was joined by a regulator, attorney, carrier, and employer to outline the different use cases and provide audience members with a framework for making a decision about whether they should file a private plan or stay with the state.

2) Mental Health Support

Mental health remains a cornerstone of today’s workplace benefits, and the conference didn’t shy away from tackling this critical issue. Sessions focused on creating a supportive environment for employees experiencing mental health challenges. These discussions provided actionable strategies for maintaining compliance while prioritizing employee well-being:

- I’m Stressed! Managing Psychological Disability Claims in the Workplace

Experts explored best practices for managing mental health claims, with a focus on the unique complexities of psychological disabilities in the workplace.

- Balancing Care and Compliance in the Complex Landscape of Mental Health Accommodations and Leaves

This session helped employers navigate the delicate balance of offering accommodations while staying compliant with ADA and FMLA guidelines.

- The Mental Health LTD Challenge: Because Parity is Not a Priority… Yet

A deep dive into how mental health conditions are handled under Long-Term Disability (LTD) policies and the ongoing challenge of achieving true mental health parity in benefits.

3) Innovations in Leave and Accommodation Management

Technology continues to transform the way employers manage leave and disability claims. This year’s conference highlighted cutting-edge tools and strategies, including the use of artificial intelligence (AI) to streamline compliance processes, as well as other technologies to support for disability management. These sessions explored how employers can leverage technology and data-driven insights to improve leave management and drive better outcomes:

- Artificial Intelligence, Automated Systems, and Leave and Accommodation Compliance

This session explored how AI is reshaping leave management, helping employers automate compliance and improve accuracy in decision-making.

- Transforming Disability Management: Evidence-Based Solutions with Psychedelic-Assisted Therapy

One of the most forward-thinking sessions, this presentation discussed the growing role of psychedelic-assisted therapies in managing mental health conditions in the workplace.

- Remodeling Your RTW/SAW Program with 5 Innovative Tools

Participants learned about five new tools designed to optimize Return-to-Work (RTW) and Stay-at-Work (SAW) programs, improving the experience for both employers and employees.

The 2025 DMEC Compliance Conference provided a comprehensive overview of the challenges and opportunities facing HR and absence management professionals today. From navigating complex compliance requirements to embracing new technologies and supporting employee mental health, the conference highlighted the evolving nature of leave and accommodation management. With valuable insights and actionable strategies, attendees left the conference better equipped to address the needs of their diverse workforces while staying compliant with an ever-changing legal landscape. We’re already looking forward to what next year’s conference will bring!

With the announcement of Captive International’s Forty Under 40, our Consulting Actuary, Nick Frongillo, participated in a panel explaining why they chose captive insurance as a career. You can find the full Q&A here.

The 2025 Captive Insurance Companies Association (CICA) Annual Conference brought together professionals from across the risk management industry to explore emerging trends and challenges. Held in Tucson, Arizona, this year’s event featured thought-provoking discussions on regulatory updates, emerging risks, and innovative solutions. Below are the key themes that shaped the agenda.

1. Regulatory and Tax Updates

Regulatory changes continue to be a significant concern for captive owners. With the new administration and shifting regulations, staying up to date is critical for ensuring compliance and mitigating risks. Notable compliance-focused sessions included:

– “IRS Audits – Now and the Future”: This session examined the evolving landscape of IRS audits and the impact on captive owners, providing insights into anticipated changes.

– “What’s New / What’s Hot / What’s Not – Tax News You Need”: Presenters explored the latest tax updates that affect captive insurance structures, with a special focus on M&A implications.

2. Emerging Risks: Climate Change and Sustainability

As the world grapples with climate-related challenges, captives are increasingly seen as vital tools for managing environmental risks. This year’s conference addressed how captives can integrate climate resilience into their risk management strategies. Some notable sessions include:

– “Advancing Climate Resilience: Integrating Parametric Insurance and Carbon Credits in Captive Programs”: Spring’s Chief P&C Actuary, Peter Johnson, alongside a representative from the State of Connecticut and CEO of Ryskex, discussed how captives are incorporating parametric insurance and carbon credits to address climate risks.

– “Intersection of Climate Risk and Captives”: This presentation examined the growing intersection of climate change and captive insurance, exploring how captives are playing a role in mitigating climate-related risks.

3. Innovative Technologies in Captives

Technological advancements are revolutionizing captives, enhancing risk management, claims handling, and overall operational efficiency. Technology continues to be a key driver for the future of the industry. Several sessions focused on innovative technology being used in the industry:

– “Future-Ready Risk Control: AI in the Captive Landscape”: This session explored the role of artificial intelligence in transforming risk control within captives, offering a glimpse into how AI will shape the future.

– “Optimizing Captive Management through Best Practices”: Speakers focused on utilizing technology and innovative practices to optimize captive operations. This session provided actionable insights for improving efficiency.

4. NextGen and Diversity in Captive Insurance

The future of the captive industry depends on cultivating a diverse and dynamic workforce. CICA’s commitment to engaging young professionals and promoting diversity was evident throughout the conference. Here are some presentations I thought best highlighted the importance of prioritizing diversity and ensuring the long-term success of the industry.

– “Diversify Your Team, Multiply Your Innovation”: This session highlighted the importance of diversity in driving innovation within captive programs and provided strategies for building inclusive teams.

– “Amplify Women and NEXTGen Networking Luncheon”: A key networking event designed to connect young professionals with industry leaders, providing mentorship and career development opportunities.

As always, the CICA Annual Conference provided a valuable platform for networking, learning, and sharing ideas within the captive insurance community. It was a privilege to engage with so many passionate professionals dedicated to driving innovation and shaping the future of captives. From navigating regulatory complexities and embracing new technologies to addressing emerging risks and fostering diversity, this year’s discussions showcased the dynamic nature of the captive landscape.

As we look ahead, we remain committed to staying at the forefront of these evolving trends and delivering forward-thinking solutions to our clients. We look forward to continuing these conversations and seeing what next year’s CICA conference will bring.

There was a flurry of activity at the federal level that involved state and local paid family and medical leave (PFML) programs in the days leading up to President Trump’s inauguration. Both the Department of Labor (DOL) and the Internal Revenue Service (IRS) provided additional guidance and clarification, which is summarized in this Alert.

I. DOL Opinion Letter Clarifies Interaction of FMLA and State of Local PFML Programs

As the paid leave landscape has evolved, employers have struggled with how to reconcile compliance with the Family and Medical Leave Act (FMLA) with that of state or local paid family and medical leave (PFML) programs. While running FMLA, PFML, and other leaves concurrently has been a common and often recommended practice, understanding specific rules that apply in these scenarios has long been a concern for employers. The Department of Labor, in recently issued DOL Opinion Letter FMLA2025-1-A, finally addresses the interplay between the FMLA and state or local PFML programs when an employee’s absence qualifies for both.

The core issue explored in the opinion letter is how the FMLA’s “substitution” rule operates in these concurrent leave scenarios, particularly regarding the use of PFML and whether the same principles as those that apply to disability plans and workers’ compensation benefits apply to PFML. The substitution rule generally allows an employee to elect, or an employer to require that an employee, substitute accrued employer-provided paid leave (including vacation, PTO, or sick leave) while also falling under the protections of unpaid FMLA leave, which means that the employee can elect to have, or an employer can require, that the employer-provided paid leave run concurrently with FMLA leave. Employers have long been uncertain how to apply the rule when state or local PFML benefits are also involved.

The opinion letter clarifies that the FMLA substitution rule does not apply when employees receive benefits under a state or local PFML program, just as it does not when the employee is receiving paid disability or workers’ compensation benefits. This clarification means employees can choose, or be required by their employer, to use their state or local PFML concurrently with FMLA leave. The DOL emphasizes that this coordination is permissible even if the state or local law does not explicitly address the interaction with FMLA and offers employers a clearer framework for managing these often complex leave situations.

Another key takeaway from the opinion letter is that using state PFML concurrently with FMLA leave does not diminish the employee’s protections under FMLA. The FMLA’s 12 weeks of leave remain protected, regardless of whether the employee receives state or local PFML benefits during that time, thereby ensuring that employees receive the full federal protection of the FMLA while also accessing state or local benefits.

Additionally, the DOL’s guidance touches upon the implications of PFML providing partial income replacement. If an employer offers employer-provided accrued paid leave benefits in addition to state or local PFML, the opinion letter suggests that these employer-provided benefits can also be used concurrently with FMLA leave to “top off” the PFML benefit.

This opinion letter is significant because it provides much-needed clarity in an area where confusion often arises. The increasing prevalence of state and local PFML programs necessitates clear guidance on how these laws interact with the FMLA. By addressing the substitution rule in this context, the DOL helps employers navigate the complexities of concurrent leave and ensures employees understand their rights and options.

Ultimately, FMLA2025-1-1 aims to streamline the administration of FMLA leave when state or local PFML is involved, promoting a more consistent and predictable approach for both employers and employees. It reinforces the principle that the FMLA provides a baseline of protection, which can be supplemented by state benefits, without diminishing the federal entitlement.

Next Steps for Employers:

Employers should carefully review DOL Opinion Letter FMLA202-1-A and ensure that their current policies and procedures are consistent with the new guidance.

II. Navigating the Tax Implications of State PFML Programs

The rise of state-level PFML programs has brought a wave of tax-related questions from employers, employees, and other stakeholders. Previously, state guidance on PFML taxation was often vague, leaving many to seek expert advice. However, the IRS issued Revenue Ruling 2025-4, providing much-needed clarity on these complex issues.

Federal Tax Implications:

- Employer Contributions: Generally, employer PFML contributions are excluded from an employee’s gross income and are not subject to FICA, FUTA, or federal income tax withholding.

- Employee Contributions: Employee PFML contributions are typically considered after-tax and are therefore not subject to federal taxation. If an employer funds the employee portion, this payment is considered additional compensation and is subject to FICA, FUTA, and income tax withholding.

- Benefits Paid: The tax treatment of PFML benefits depends on whether the leave is for medical or family reasons, and whether the benefit is attributable to employer or employee contributions. Some states specify contribution allocations (e.g., Delaware, Massachusetts, Minnesota, New Jersey, New York), while others do not, potentially creating ambiguity for employers.

- Medical Leave:

- Employer-Attributable Benefits: Included in federal gross income as wages, subject to sick pay reporting rules, and considered third-party payments of sick pay.

- Employee-Attributable Benefits (or Employer-Funded Employee Portion): Excluded from federal gross income.

- Family Leave:

- Employer-Attributable Benefits: Included in federal gross income (not wages). The state must file with the IRS and issue a Form 1099 to the employee.

- Employee-Attributable Benefits (or Employer-Funded Employee Portion): Included in federal gross income (not wages). The state must file with the IRS and issue a Form 1099 to the employee.

- Medical Leave:

State Tax Implications:

State tax treatment of PFML contributions and benefits varies. Employers must consult the specific laws, rules, regulations, and guidance for each state program to ensure compliance.

PFML Contribution Requirements:

In 2025, state PFML programs have varying requirements for employee and employer contributions when the employer participates in the state plan. Exceptions may apply based on employer size or private plan offerings. Consult the specific state program details for accurate contribution requirements.

Next Steps for Employers:

Employers should carefully review Revenue Ruling 2025-4 and any related state guidance. During the 2025 transition period, adjustments to taxation practices may be necessary. This may include updating employee handbooks, policies, FAQs, payroll systems, and other relevant resources. Proactive compliance is crucial, as employers are generally responsible for the correct administration of these programs.

For further questions or assistance regarding either the DOL Opinion Letter or the IRS Revenue Ruling, please contact Spring.

History of MHPAEA

Mental Health Parity is designed to ensure individuals receive equal access to Mental Health and Substance Use Disorder (MH/SUD) benefits as they do for Medical and Surgical (MED/SURG) benefits. This quest for parity began legislatively in 1996 with the Mental Health Parity Act (MHPA), prohibiting insurance companies from imposing more restrictive annual or lifetime dollar limits on mental health benefits than MED/SURG. Since then, many regulations have been passed to help achieve this goal.

- In 2008, the Mental Health Parity and Addiction Equity Act (MHPAEA) incorporated additional provisions, enforcing that financials (copays or deductibles) and treatment limitations (number of visits or days of coverage) were equal, as well as applying all requirements to substance use disorder benefits.

- Additional MHPAEA regulations were published in 2013, providing much more guidance on how to achieve compliance.

- The Consolidated Appropriations Act of 2021 introduced the requirement to perform a comparative analysis of non-quantitative treatment limitations (NQTL), such as preauthorization, network administration standards, or step therapy. However, nearly all the analyses submitted were found insufficient.

Despite previous efforts and regulations, disparities between MH/SUD and MED/SURG benefits have continued to grow over the last 15 years. In 2022, according to the Substance Abuse and Mental Health Services Administration’s (SAMHSA) National Survey on Drug Use and Health (NSDUH), almost 54.6 million people aged 12 and older were diagnosed for needing treatment for substance abuse, and only 24% of that population were able to receive treatment.1 Additionally, a study by RTI International showed that in 2021, out-of-network behavioral health clinician office visits were reported to be 3.5 times higher than all MED/SURG out-of-network office visits.2

Final Rules to the MHPAEA were released by the Departments of Labor, Health and Human Services, and the Treasury on September 9th, 2024, with the intent to rapidly address these barriers. These rules take effect on January 1, 2025, with some requirements having a delayed application until January 1, 2026. The Final Rules expand on previous requirements, provide clarification for group health plans and health insurance issuers to stay compliant with MHPAEA, and aim to eliminate any restrictions on MH/SUD treatments or resources, ensuring the same level of coverage as MED/SURG benefits.

The final regulations are complex and will be cumbersome for all employers, especially those with self-insured plans. At the core of the regulation are two requirements: a Benefit Coverage Requirement and an NQTL Comparative Analysis Requirement.

Benefit Coverage Requirement

This review must ensure that financial requirements and quantitative treatment limitations (QTL) are not more restrictive when comparing MH/SUD and MED/SURG benefits. The final rules remove away from the tests mentioned in 2013 and emphasized that plans cannot impose an NQTL that is more restrictive on MH/SUD benefits compared to MED/SURG benefits. To determine whether the NQTL meets the requirement to be no more restrictive, the plan must satisfy both a Design and Application Requirement as well as a Relative Data Evaluation Requirement.

Design and Application Requirement: Plans must show that the processes, strategies, evidentiary standards, and other factors used when both designing and applying the NQTL are comparable, rather than the previously only evaluating the application itself. Additionally, a key provision prohibits using discriminatory factors or evidentiary standards when designing the NQTL.

When evaluating the plans, the regulation is clear that health plans must provide “meaningful benefits,” which entail covering at least one core treatment in each category for MH/SUD benefits, as they do for MED/SURG. The six recognized categories are emergency services, in-network inpatient, out-of-network inpatient, in-network outpatient, out-of-network outpatient, and prescription drugs. For example, if a health plan covers a hospital surgery in the inpatient category, it must also provide access to mental health treatment, such as inpatient psychiatric care, in the same category. If they provide antibiotics in the prescription drugs category, they must also provide antidepressants.

Data Evaluation Requirement: Plans must collect and evaluate data to assess the relevant outcomes of applying the NQTL. Plans and issuers must identify material differences in access to services and take reasonable action to address them. Although the Departments will not provide a set list of required data, they expect plans to collect data relevant to most NQTLs, allowing flexibility based on the NQTL in question. If data is lacking, plans must state why it is missing, how they will collect it in the future, or provide a reasoned justification concluding no data exists.

If the Departments determine that the NQTL is more restrictive and that the above requirements are not met, they can enforce plans to stop imposing the NQTL on their MH/SUD benefit offering.

NQTL Comparative Analysis Requirement

The Final Rules reiterate the need for an NQTL comparative analysis, which has been a requirement since the CAA (2021). The analysis requirements are robust, requiring the Plan to explain how and why the Benefit Coverage Requirements are satisfied within their NQTL Comparative Analysis. This narrative must be detailed and include the following Content Elements:

- Description of the NQTL, including identification of benefits subject to the NQTL

- Identification and definition of the factors and evidentiary standards used to design or apply the NQTL

- Description of how factors are used in the design or application of the NQTL

- Demonstration of comparability and stringency, as written

- Demonstration of comparability and stringency, in operation, including the required data, evaluation of that data, explanation of any material differences in access, and description of reasonable actions taken to address such differences

- Findings and conclusions

This analysis must consider all facets of the plan, including core treatment, standards of care, utilization, access, networks, prior authorizations, etc. The plan must assess any material differences and what meaningful actions are being taken to ensure compliance.

For ERISA-covered plans, the named plan fiduciary must verify an appropriate analysis was conducted with a prudent process. Fiduciaries are also responsible for continually monitoring the plan and compliance with the NQTL analysis.

The comparative analysis must be readily available upon request and provided within the specific timeframe: 10 business days for the relevant Secretary, and 30 days for participants or beneficiaries. If an insufficient analysis is determined, plans must submit additional information within 10 business days. If there is an initial determination of noncompliance, they have 45 calendar days to make corrections. If there is a final determination of noncompliance, the plan must inform all enrolled participants and beneficiaries within 7 days and provide the Secretary with a copy of this notice, along with the names of everyone involved in the process.

Action Plan

The Departments recognize that employers with self-insured health plans rely on TPAs and service providers for plan administration and understand the challenges in obtaining the necessary comparative analyses or required data. However, plans and issuers are ultimately responsible for compliance with MHPAEA. If you don’t already have a comparative analysis on hand, it should become a top priority due to the quick turnaround response times outlined. It is recommended to consult with a legal partner for an in-depth analysis. Additionally, the MHPAEA Final Self-Compliance Tool, finalized in 2020, serves as a valuable resource, guiding plans and issuers to meet compliance with MHPAEA’S parity requirements. This tool has not been updated, but that is expected.

The Final Rules generally apply starting January 1, 2025, though provisions like meaningful benefits and certain comparative analysis requirements are delayed until January 1, 2026, to give employers more time to comply.

Although we recommend that employers carefully examine their plans and work toward immediate compliance, a lawsuit has been filed and more are anticipated. The lawsuit from ERIC (The ERISA Industry Committee) indicates that the new regulations are fundamentally flawed, exceed the statutory authority that Congress provided to the agencies and threaten the ability to offer quality and affordable benefits in compliance with applicable laws.

1 SAMHSA (2023), Key substance use and mental health indicators in the United States: Results from the 2022 National Survey on Drug Use and Health (HHS Publication No. PEP23-07-01-006, NSDUH Series H-58), https://www.samhsa.gov/data/report/2022-nsduh-annual-national-report.

2 Mark, T.L., Parish, W. (2024), Behavioral health parity—Pervasive disparities in access to in-network care continue, RTI International, https://dpjh8al9zd3a4.cloudfront.net/publication/behavioral-health-parity-pervasive-disparities-access-network-care-continue/fulltext.pdf.

We recently published an article on Neebc.org spotlighting some Paid Family and Medical Leave updates across New England in 2025. You can find the full article here.

The past year has seen a surge in class action lawsuits against some of the largest employers in the country, alleging that fiduciaries are breaching their duties in deciding how to allocate forfeitures. While these claims are not necessarily valid, it may be prudent to take a moment during your next benefits committee meeting to review what your plan document requires, assess what your plan is currently doing, and determine whether any changes are necessary.

Before this recent litigation, the issue of forfeitures appeared to be well settled. Participants in a 401(k) or similar defined contribution plan are always fully vested in their own contributions. However, many plans impose a vesting period before participants become fully vested in employer contributions (such as matching contributions). If a participant leaves the company before completing the vesting period, the employer contributions are forfeited. According to the IRS, these forfeited amounts can be used by the plan sponsor to offset plan expenses or reduce employer contributions. Consequently, many plan documents allow both uses of forfeitures and leave the decision to plan fiduciaries.

In these class action lawsuits, plaintiffs allege that using forfeitures to reduce employer contributions, though permitted by the IRS under the Tax Code, violates ERISA’s fiduciary duties, which are administered by the Department of Labor (DOL). Plaintiffs argue that forfeitures are plan assets and, as such, may only be used to pay benefits or the reasonable expenses of the plan. They further contend that ERISA’s duty of loyalty requires fiduciaries to prioritize participants’ interests over those of the plan sponsor. Specifically, the lawsuits claim that using forfeitures to reduce employer contributions rather than to offset participant-borne plan expenses constitutes a fiduciary breach.

It is important to note that these cases are in their early stages, that the legal theories involved are novel, and that the DOL has never taken the position that using forfeitures to reduce employer contributions is a fiduciary breach. Nevertheless, given the current controversy, plan fiduciaries may benefit from reassessing their approach to forfeitures by addressing three key questions.

1. What does your current plan document provide?

Plan documents often take different approaches to forfeitures. Some mandate a single use, while others specify an order of priority for different uses or allow multiple uses at the fiduciaries’ discretion. Fiduciaries should be familiar with the requirements of their specific plan document.

2. What is your plan actually doing?

Fiduciaries are obligated to follow the terms of the plan document. For example, if the document requires forfeitures to be used to offset plan expenses, using them to reduce employer contributions would constitute a breach of duty, and vice versa. Unlike the recent lawsuits, the duty to adhere to plan terms is a well-established legal principle that the DOL has enforced in the past. Fiduciaries should ensure their practices align with their plan document and consult legal counsel if any discrepancies are identified.

3. Does your current plan language reflect your intentions?

In light of recent litigation, it is worth considering whether the current plan language aligns with your goals. Do you want fiduciaries to have discretion, or should the plan document provide clear direction? For instance, if the plan document specifies that forfeitures will be used to reduce employer contributions, fiduciaries must follow that directive unless it is determined to be unlawful. Clear guidance in the plan document may shift the decision from a fiduciary responsibility to a “settlor” decision by the plan sponsor, reducing fiduciary discretion and potential liability.

There are several approaches to handling forfeitures, and fiduciaries should consult with legal counsel to evaluate the specifics of their plan and circumstances. However, taking the time to review your plan’s current practices is a straightforward and valuable step and a sensible addition to your 2025 fiduciary checklist.

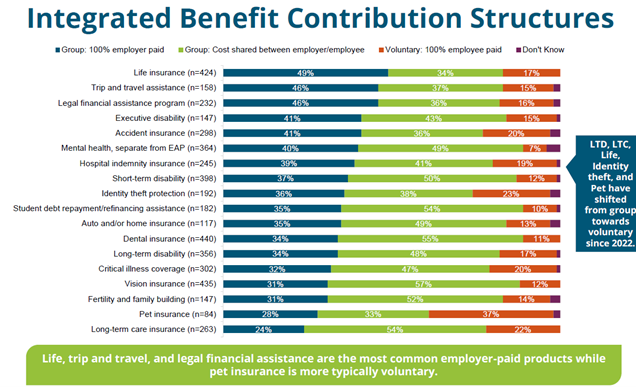

In today’s rapidly evolving workforce, one-size-fits-all benefits are no longer sufficient to meet the diverse needs of employees. As expectations shift toward personalized and flexible offerings, voluntary benefits are emerging as a vital solution. These supplemental programs empower employees to customize their benefit packages by adding coverage tailored to their unique personal, health, and financial circumstances.

For employers, voluntary benefits offer significant advantages, including enhanced employee engagement, improved retention rates, and a more comprehensive approach to wellness. Additionally, since employees often bear the cost of these programs, they present a low-risk, cost-effective investment that boosts satisfaction and productivity.

What Are Voluntary Benefits?

Voluntary benefits are optional, supplemental offerings provided by employers in addition to traditional health insurance and retirement plans. These benefits are typically employee-paid, allowing individuals to select the coverage that best meets their needs.

Common examples of voluntary and supplemental benefits include:

- Health and Wellness Coverage: Critical illness, hospital indemnity, accident insurance, dental, vision, and other health-related services

- Financial Support: Life insurance, accidental death and dismemberment (AD&D) insurance, disability insurance, long term care, and other financial safety nets for employees and their families

- Legal Protections: Legal services, identity theft protection, and other personal security-related offerings

- Pet Insurance: Coverage for employees’ pets, offering financial protection in case of veterinary emergencies.

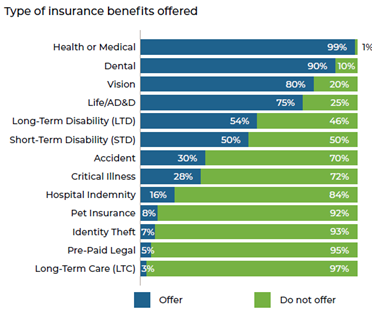

This graph breaks down the most common insurance benefits offered according to Alera Group’s 2024 Employee Benefits Survey:

Meeting Employee Needs: The Rise of Voluntary Benefits

As the workforce becomes more diverse, employees are seeking benefits that go beyond traditional offerings. Over 75% of employers offer Medical, Dental, Vision, Life, and AD&D, with the number and type of benefits varying by employer size. Larger employers tend to offer a greater variety of benefits and are more likely to offer supplemental products, such as pet insurance. Employees want to feel valued, and a broad range of benefits demonstrate an employer’s commitment to their well-being, while also allowing employees to select products that best fit their needs.

Voluntary benefits align with the growing demand for personalized, flexible workplace solutions. With more employees working remotely and managing diverse personal circumstances, the ability to choose supplemental benefits has become increasingly important.

The Value of Voluntary Benefits for Employers and Employees

For Employees:

- Customization: Employees can select the benefits that best fit their lifestyle, such as additional health coverage, financial protection, or wellness services

- Financial Accessibility: Group rates make many voluntary benefits more affordable compared to individual plans

- Peace of Mind: A broader range of benefits provides employees with greater confidence in managing health, financial, and personal challenges

For Employers:

- Attracting Top Talent: A comprehensive suite of voluntary benefits enhances an employer’s appeal to prospective employees

- Improved Employee Engagement: Employees who feel supported by robust benefits are more likely to remain engaged and productive

- Cost Efficiency: Since employees typically cover the costs, employers can expand their benefits offerings without significant additional expenses

How Can Employers Implement Voluntary Benefits?

To introduce voluntary benefits successfully, employers should follow these steps:

1. Understand Employee Needs

Use employee surveys or analyze workplace trends and healthcare data to identify areas where employees might benefit from additional support, such as health coverage, financial protection, or wellness initiatives.

2. Evaluate Vendors and Packages

Assess potential vendors and benefits packages based on factors like cost, employee participation rates, and ease of administration. Ensure employees have easy access to these benefits and understand their value.

3. Communicate and Educate

Clear communication and ongoing education are crucial. Employers should regularly inform employees about available options, provide updates, and encourage participation.

Voluntary benefits are becoming an essential tool for employers seeking to support their workforce in ways that go beyond traditional offerings. By offering flexibility and choice, voluntary benefits empower employees to address their personal health, financial, and well-being needs while helping employers enhance engagement, retention, and overall satisfaction.