Every year, the Captive Insurance Companies Association (CICA)’s Annual Conference stands as a beacon for professionals in the captive insurance industry, offering a platform for learning, networking, and collaboration. With a rich array of sessions covering diverse topics, this year’s event, held in Scottsdale, Arizona, provided attendees with invaluable insights into pressing issues and emerging trends shaping the alternative risk financing landscape. Here are a few pivotal topics that captured the attention of participants.

Navigating Regulatory Dynamics

Regulatory changes are a constant in the world of captive insurance, influencing everything from taxation to domicile selection. Professionals in the field must stay abreast of these shifts to ensure compliance and operational efficiency. Many captive insurance professionals spoke about adapting to evolving regulatory frameworks, emphasizing the importance of staying informed and proactive. Here are some notable sessions:

– The final session of day two, “International Tax and Transfer Pricing: Keys to Success” focused on international tax trends and how transfer pricing considerations are sometimes overlooked in captive endeavors.

– The presentation, “If It Ain’t Broken, Just Tweak It – Captive Domicile Update” brought together regulators from Vermont, The Cayman Islands and Tennessee to discuss the future of the industry and domicile-specific challenges they are facing.

– With recent aggressive audits on smaller captives from the IRS, a session titled “Combatting IRS Captive Challenges – 2024” reviewed recent compliance case studies and discussed potential future regulations.

Harnessing Innovation for Growth

Innovation lies at the heart of successful captive ventures, offering opportunities for enhanced risk management and increased cost savings. From exploring new risk transfer mechanisms to leveraging cutting-edge technology, captive professionals are continuously seeking innovative solutions to drive their organizations forward. The sessions below explore how to optimize risk management practices and capitalize on emerging opportunities for growth:

– Spring’s Vice President, TJ Scherer, presented a session titled “Breaking Down Barriers of Entry to Captives for Employee Benefit Professionals.” The session spotlighted ideal cases for a medical stop-loss group captive and common barriers that prevent the progression of captives.

– A group of service provider veterans explained the importance of “Building (and Keeping) Your Reputation” in the captive industry, including in-person networking, social media presence and more.

– Our Managing Partner, Karin Landry, presented on “Parametric Coverage: Bridging Gaps and a Bridge to the Future.” She helped lay out a roadmap for captive owners and risk managers to leverage parametric insurance to fund complex risks concurrently with their captive programs.

Addressing Emerging Risks

The risk landscape is constantly evolving, presenting new challenges and uncertainties for the captive industry. From cyber threats to climate change, emerging risks demand proactive risk management strategies to mitigate potential impacts. I wanted to share these sessions that focused on identifying and addressing emerging risks:

– The presentation “Insuring the Uninsurable: Finding Solutions to Challenging Risks” used California’s wildfire insurance crisis as a case study to explore how third-party coverage solves unique business problems.

– With nearly one trillion in runoff liabilities, the session “Runoff Liability Transfers: Mitigating Exposure to Your Captive” explained residual liability, the mechanisms for transfer to third parties, and the benefits, processes and timeframes.

– My session, “US Benefits and the Changing Landscape,” analyzed how employee benefit programs can potentially offer captive third-party coverages, improving the captive’s risk distribution framework and allowing for greater efficiencies and returns.

Fostering Diversity and Inclusion

Diversity, equity, and inclusion (DEI) are increasingly recognized as essential components of a successful captive operation. Ensuring all parties (including covered employees of all backgrounds) have equitable access to benefits and are properly informed is the bedrock of a successful program. Here are some presentations I thought best highlight the importance of prioritizing DEI initiatives to drive excellence and long-term success.

– A group of experts explained the importance of “Driving Captive Innovation & Growth Through Diversity” and the critical role diversity plays in fostering a well-rounded captive and benefits program.

– The session, “Bridging the Generational Divide: Strategies for Effective Communication & Collaboration” brought to light a unique perspective when it comes to training the next generation of captive experts and spotlighted the importance of collaboration and productive communication.

– One of my favorite parts of the conference is the annual CICA Student Essay! This contest gives undergraduates the opportunity to establish a captive for their specific case study, select policy options, determine underwriting, pricing and more.

As a board member of CICA and the association’s secretary/treasurer, it was a pleasure attending and presenting at this year’s conference. The annual conference serves as a catalyst for dialogue, collaboration, and innovation within the captive insurance community. I had a great time tuning into insightful sessions, chatting with industry experts, and enjoying some fun happy hours. I am excited to see what next year’s conference has in store for us!

With winter quickly approaching, the Cayman Captive Forum last week provided a great escape from the cold weather and a fantastic excuse to visit a tropical paradise. As Cayman is the second largest captive domicile (behind Vermont), it is more than a vacation spot; a rewarding opportunity to address top trends and practices in the captive insurance and risk management space. Here are some driving topics of interest this year:

AI and Risk Management

As concerns surrounding artificial intelligence (AI) dominate headlines and conversations worldwide, it was only fitting that it was a popular topic of discussion this year at Cayman. AI holds an interesting position in risk management, in that it can be used to help identify risks and create efficiencies; but also can create vulnerabilities in cyber and digital. Here are a couple of innovative sessions on AI’s impact on risk management:

– During the presentation “AI and your Captive,” beverage distributor, Southern Glazer’s Wine and Spirits explained how they were able to optimize their captive using AI and machine learning tools.

– In the eye-catching session, “Chat-GPT/AI Concerns in Claims/Risk Settings,” risk experts reviewed how AI is being used in cyberattacks, especially towards healthcare organizations. They also examined the recent emergence of AI chatbots in healthcare.

Cyber Risks

This year there have been over 327 healthcare data breaches reported to the US Department of Health and Human Services, involving more than 40 million patients’ data1. Cyber is a top priority for risk managers, especially those working for healthcare employers. Here are some highlights:

– The session, “Complex Cyber: Renewal to Claims” looked at current cyber insurance market trends for healthcare organizations and recommendations for protecting patient information from adverse incidents.

–With emerging technologies, cybercriminals have more tools than ever at their disposal. A presentation titled “Cybersecurity Trends and Tomorrow’s Challenges: Future-Proofing Your Organization” highlighted strategies to combat evolving cyber threats.

Risk Face by Healthcare Organizations

As Cayman is the largest domicile for healthcare organizations2, healthcare-related risks receive a lot of buzz each year, and 2023 was no exception. Healthcare organizations face unique challenges, some of which include:

a) Social Risks

Within the healthcare sector, risk management teams must balance distinctive social and legal issues on top of day-to-day operations. Some noteworthy sessions included:

– The presentation, “The Impact of Social Inflation on Captives and Others,” reviewed shifting trends in medical professional liability and explored how risk management teams can better understand changing social influences and the risks tied to them.

– One engaging session entitled, “Reproductive Care Post-Dobbs: Protecting Patients and Providers,” provided insights into how a healthcare organization was able to identify emerging risks associated with reproductive care.

b) Workplace Safety and Medical Malpractice

With unique risks come unique coverages. Healthcare organizations often must turn to specialty insurers and experts to evaluate risks associated with workplace violence and medical malpractice. These topics were widely discussed during the conference:

– In the one-of-a-kind session, “Active Shooter Workplace Violence – Claims Coverages Consequences,” the Captive Owner from the University of Pittsburgh Medical Center drew takeaways from their mass shooting over a decade ago.

– A session on “Implementing Structured Communication Processes to Avert Malpractice Claims & Reduce Patient Harm” spotlighted how nearly half of malpractice claims come from miscommunication and provided suggestions on streamlining communication.

– The final session of the conference “People Behaving Badly” reviewed a high-profile case where medical providers harmed patients and professional liability considerations for healthcare companies when disciplining or terminating staff.

c) Other Priorities

In addition to the topics discussed above, some other notable healthcare industry-focused sessions included:

– As virtual care continues to be popular post-pandemic, a group of risk experts discussed recommendations for “Managing the virtual practice of medicine in multiple states & the unique risks associated with this practice.”

– In a virtual session, “A total guide to total cost of risk,” an actuary and captive consultant discuss how to properly calculate and identify Total Cost of Risk (TCOR) and suggestions on how to adjust to changes in TCOR.

The Cayman Captive Forum was a strong finish to the year in terms of lessons learned and connections made. The farewell beach party is always an added bonus! We welcome this chance to reflect back and look forward to what 2024 has in store for the captive space.

1 https://www.urologytimes.com/view/health-care-cyberattacks-soaring-in-2023

2 https://caymanintinsurance.ky/about/

As we prepare for 2024, we are in an interesting time for HR teams in that they are facing challenges such as back to office strategies and changing workplace expectations, all on top of a full plate of duties. Last week I attended the Northeast HR Association (NEHRA) Annual Conference, which brought together leaders and industry experts to delve into crucial topics that have become front and center HR today. This year’s conference explored vital themes, including mental health/well-being, innovative leadership tactics, and the importance of Diversity, Equity, and Inclusion (DEI). Here are the highlights from this enlightening event.

Nurturing Mental Health and Well-being

One major theme at NEHRA’s Annual Conference this year was meant health and well-being, a popular topic in the world of HR. The discussions were both insightful and innovative, with presenters emphasizing new trends and practices to help support employees’ mental health. Here are some presentations I found impactful:

– In the session, “Neuroinclusion in the Workplace: A Win-Win for Both Employers and Employees,” a well-being expert discussed strategies to support neurodivergent employees to foster workplace collaboration and effective communication.

-The Founder and CEO of Wellbeing Works, Shanna B. Tiayon discussed how HR departments can support employees experiencing trauma though proper communication and resilient HR structures.

– The closing keynote, titled “Transform Your Workplace Through Connection & Community,” focused on developing an understanding of the benefits of having a connected work community and how to develop inclusive programs.

Innovative Leadership Tactics

One of the most pertinent points discussed was the role of HR in shaping leadership. The event brought forward outside-the-box ideas for fostering leadership excellence, creating an inclusive environment, and retaining and developing potential future leaders. Below are some presentations I would like to spotlight:

– A presentation titled “Who’s on Deck? Succession Planning that Eliminates Fears and Reduces Cost,” reviewed the advantages of promoting talent internally and tips for developing middle management for leadership roles.

-A leadership development expert explored top management tactics and the importance of developing workplace conditions that bring out the best in people. The session was titled “Reimagining Managers: Why the Best Managers Don’t Manage People.”

– In the era of hybrid work, effective and efficient meetings can be challenging. The breakout presentation, “Mastering the Art of Meetings: Powering Up Your Gathering,” reviewed ways to prioritize productivity without sacrificing workplace culture during meetings.

Championing Diversity, Equity, and Inclusion (DEI)

Developing and enhancing DEI efforts continues to be a top priority for HR teams. The importance of setting measurable goals, conducting bias training, and engaging with underrepresented communities was emphasized. The conversations highlighted that DEI isn’t just an HR issue; it’s a business imperative. Organizations that embrace diversity are better equipped to innovate, excel, and adapt to the ever-changing global landscape. Here are a couple of presentations with insights I wanted to share:

– Two HR professionals discussed “Practical strategies to imbed DEIB Considerations Into Your Hiring Practices.” Some main points included implementing blind resumes, training hiring managers and recruiters on unconscious bias and diversifying the interview panel.

-In the session “Building a Personalized and Equitable Benefits Program,” the presenter discussed effective and realistic tactics to improve DEI efforts in employee benefits without breaking the bank.

In conclusion, the NEHRA Annual Conference 2023 proved to be a valuable platform for HR professionals to deepen their understanding of a plethora of challenges employers are facing. The event’s discussions and insights provided attendees with the knowledge and motivation needed to lead HR into the future, creating workplaces that are not only more productive but also more compassionate and equitable. The NEHRA Annual Conference continues to be a beacon for HR professionals in the northeast as they navigate the evolving landscape of the industry.

I had the pleasure of leading a panel last month at the 2023 VCIA Annual Conference entitled, “Tips for Communicating the Value of Your Captive,” and it was a lively discussion with great takeaways I wanted to share.

Background

Today’s economy is tough, and the insurance markets have hardened. As a result, organizations are in reactive mode, looking for combative strategies to mitigate bottom-line issues. A captive insurance program has long been a risk management tool that allows organizations to weather proverbial storms like these. For those organizations with a captive, risk managers might have to defend against a piggyback mentality from leadership or other stakeholders, because the current environment creates temptation to treat a captive like an ATM regarding surplus. In addition, goals and purpose surrounding a captive are likely to change over the years. As such, it’s important to be able to illustrate captive performance in tangible ways that will resonate with audiences outside the core captive team.

Captives as Problem Solvers

There is a time and place to leverage capital surplus from a captive, but a great strategy is to use that by pouring additional coverage and innovation back into your insurance programs. To do so, we recommend securing reliable relationships with your broker and actuary to understand your captive’s risk appetite, what problems could be solved via a captive, industry statistics and trends, and whether the risk is worth the reward for a particular initiative. TPA or data analytics partners are also critical to assess exposures and determine potential loss prevention measures. Lastly, your captive manager should serve as a valued second opinion and will help evaluate the ramifications of exposing equity in the captive to new potential losses.

The ultimate goal here should be to reduce the total cost of risk (TCOR).

To bring concepts to life, one of Spring’s clients used captive surplus to hire a return-to-work coordinator, which in turn improved overall disability and productivity goals. Another client worked to obtain sexual abuse & molestation coverage that was difficult to procure. A private equity firm was able to retain ransomware coverage after a significant claim hit and utilized the captive to buy down the retention for individual entities, mitigating premium increases.

Metrics to Consider

Every captive has different experience, objectives, and risks represented, so it is hard to pinpoint benchmarks that will hold true across every program. That said, there are some factors and calculations that should be top-of-mind regarding captive performance.

Qualitative

While numbers and hard ROI are often the priority, “soft” indicators, such as those listed below, should not be discounted.

- Goals achieved vs. intended purpose

- Ability of the captive to cover risks the commercial market will not insure

- Flexibility

- Risk distribution

- Captive expansion

Quantitative

For the numbers crowd like our actuaries, below is a non-exhaustive list of metrics to consider when working to gauge your captive’s success.

- Loss & expense ratio (i.e., combined ratio)

- Captive premium increase vs. commercial market increase

- Volatility of earnings by captive line of coverage, and in aggregate

- Leverage ratio (net written premium to surplus should be around 3:1 to 5:1 or lower)

- TCOR overall

- TCOR vs. market increase

Given the difficult markets we are facing as an industry, we are stressing to our risk manager clients the criticality of captive optimization, but also the need to truly have a pulse on your captive’s performance and be able to illustrate it to a wider range of stakeholders who may be under financial pressure. If you could use assistance in developing customized key performance indicators (KPIs) for your captive program, or in diving into these qualitative and quantitative measures at an organization level, Spring’s consultants and actuaries are ready to help.

As a mark to the end of summer, The Disability Management Employer Coalition (DMEC) hosted their Annual Conference in the beautiful (and beachy) San Diego! The conference is in a different city every year, and it was refreshing being by the water this time. DMEC is one of the leading organizations in the absence and paid leave landscape; their conference brings together stakeholders from all across the industry to connect and discuss trends and best practices.

Here are some buzzworthy topics I wanted to share from the conference:

1) Mental Health Support

Although the demand for employer support for mental health and wellbeing services may not be as high as it was during the COVID-19 pandemic, it remained a hot button topic at this year’s conference. As mental health support solidifies its place in the benefits industry, employers are looking at innovative ways to stand out and cut costs. Some related presentations I found insightful include:

-The very first session of the conference, “A Mental Health Culture Shift: Addressing It from the Top Down,” brought together representatives from multiple health systems to discuss the importance of developing mental health resources that work for employees of all levels.

– In the presentation, “The Echo Pandemic: Mental Health, Lost Time, and Benefits Spend,” the speaker reviewed the ROI impact of preventative wellbeing solutions on benefits spend and workplace culture.

– In a one-of-a-kind presentation, a licensed psychologist reviewed “Regulated Psychedelics for Mental Health & What You Need to Know.” As psychedelic therapies are expected to be approved in 2023-2024 for PTSD treatment, this session reviewed how this will impact employers and their mental health offerings.

2) Compliance Strategies

It seems like at every conference and event I attend, compliance is top of mind for employers across the nation. With shifting national, state, and local regulations, it can be difficult to stay compliant while satisfying a dispersed workforce. Here are some noteworthy sessions related to compliance:

– During my final session I was joined by industry experts to discuss “New Models for PFML: Education and Action.” We broke down various state programs, private versus state plans and considerations for PFML insurance policies under voluntary programs.

– Two compliance managers reviewed important cases when the DOL and EEOC disagreed with court decisions and how it eventually played out in their presentation, “Flip or Flop: When the Courts (and Regulations!) Disagree.”

– As mandatory paid sick and safe time (PSST) regulations continue to shift, presenters in the session “Time for a PTO Overhaul! Why the Legal Landscape Compels Us to Consider a Multi-bank Paid Time Off Structure,” discussed how to stay compliant while maintaining a single-bucket PTO approach.

3) Returning to the Office/WFH Approaches

As the worst of the pandemic echoes behind us, many employers are trying to revert to tradition and get people back in the office (or find some middle ground). Decisions made regarding this dynamic will lay the foundation for employee culture and how employers approach leave management. Below are some relevant presentations I wanted to highlight:

– Experts discussed “Transitional Return-to-Work Programs that Last,” this included the cost benefits of these programs and tactics to educate and motivate front-line managers.

– A representative from Headversity, provided tips and resources to help empower future generations of women leaders. This included addressing accommodations that support the work-life balance of female employees.

4) Leveraging Tech

Tech in the absence and disability space continues to evolve with the introduction of new innovations and tools that can help create efficiencies and drive best practices. Even building on existing tools and systems can help us better understand current patterns and trends. Here are some presentations I found most insightful:

– In an interactive session with DMEC’s CEO, Terri Rhodes, Spring’s Jackie Myers and me, the attendees engaged in DMEC Benchmarking Jeopardy, which spotlighted DMEC’s new benchmarking platform that Spring helped build, which will give users an easy and user-friendly way to compare and contrast absence management policies and procedures.

– My colleague Marcy Updike and I reviewed survey data that analyzed the monetary value of flexible time off programs and their potential impact on recruiting and retention during our session, “The Value of Workforce Flexibility: Impact & Tradeoffs.

– Representatives from three different absence software companies discussed “Key Considerations for Selecting & Implementing Software as a Solution.” They reviewed employee considerations for implementing absence software and tips for managing day-to-day operations.

As a regular attendee and partner of DMEC, I have to say this may have been my favorite destination to date! As we approach the end of summer, it was great enjoying a few days of sunny weather. Throughout the busy few days, the Spring team and I had a great time reconnecting with industry leaders and deepening our knowledge of innovations in the leave management space. We are excited to see what next year’s conference has in store for us!

At the end of 2022, Vermont became the largest captive domicile globally with 639 active captive insurance companies. So, it was only fitting that the Vermont Captive Insurance Association (VCIA) had one of the biggest turnouts this year at their annual conference, which brings together insurers and reinsurers, captive owners and risk managers, regulators and other industry professionals to network and discuss current trends in the industry. This year the Spring team and I had the pleasure of once again exhibiting and speaking at the conference in beautiful Burlington, Vermont. Below are some of the topics that took the spotlight.

1) Managing economic fluctuation

From groceries to rent it seems like nobody can avoid inflation, which is no different in the captive insurance and risk management sectors. Due to increased claims, stricter underwriting and high healthcare costs, many employers are looking into alternative risk financing options to stretch the dollar. Below are some of the sessions from VCIA I found most pertinent when addressing the economic landscape.

– In a session titled “The Economic Landscape & Your Captive’s Investment Portfolio,” speakers reviewed how interest rates, inflation, and other economic indicators have changed the captive industry post-COVID.

– The session “Impact of Inflation on Your Captive” reviewed how rising inflation and supply chain interruptions are impacting the captive industry, and what we can expect moving forward.

2) Pitching captive insurance

Although captive insurance can increase savings, reduce risk, and lead to investment opportunities, C-suite and other stakeholders may be hesitant due to resources and risk. No matter how efficiently a captive program is designed, it can’t be maximized without buy-in from all parties. Here are some presentations I found most insightful on boosting communication.

– Two captive board members and a consultant presented on “Innovative Ways to Fire-Up Your Board,” where they provided tools and tactics to boost some life and creativity into captive board meetings.

– My colleague, Karin Landry was accompanied by a captive owner and a tax auditor to discuss the need for strong communication amongst risk managers, captive owners, board(s) and other parties to ensure the captive remains successful. The session included a list of recommended Key Performance Indicators (KPIs) for risk managers to have as a tool in their toolbox when illustrating captive performance to other stakeholders.

3) A look forward

In just the past half decade we’ve seen drastic developments globally including devastating climate events, a widespread pandemic and war spreading overseas. These events remind us that there are always factors beyond our control that can complicate established best practices, but VCIA speakers gave their views on what’s to come.

a) Prepping the next gen

As an annual attendee at VCIA it was great to see the sheer number of new faces and developing talent at the conference. This year VCIA made sure to include an array of introductory level sessions designed to solidify foundational captive knowledge for those entering the industry. Some of the sessions I found most intriguing include:

– A two-part session titled “(The) Newcomer’s Guide to the Captive Industry” brought emerging leaders together to express their unique experiences in the captive space and tips for others entering into captives for the first time.

– In an interactive discussion group on “Building Talent in the Captive Industry,” industry leaders discussed major workplace challenges and tactics for building a strong talent base that will one day drive the future of the industry.

b) The future of captive insurance

Although often thought of as a traditional sector, we continue to see innovative approaches to risk financing across employee benefits and P&C. Here are forward-looking presentations I found interesting.

– A captive owner and business professional explored recent innovations and solutions in the ‘captive insurance laboratory’ during their session, “Where Will Captives Go Next? The Latest Uses for Captives.”

– One group of speakers took an interesting approach and spoke on “Leveraging New Tech and Data Visualization Tools for Captives.” They reviewed how various stakeholders can utilize tech to bolster actuarial analyses and efficient decision-making.

As a regular VCIA attendee, I found this conference to be the most fun to date. Aside from all the happy hours, free giveaways and tasty meals, I had a great time reconnecting with industry leaders and deepening my knowledge of captives. On behalf of Spring, my colleagues and I enjoyed the opportunity to exhibit and look forward to next year’s conference. Lastly, I had the pleasure of being accompanied by a captive owner and stop loss carrier to present on risk management strategies that are impacting employer-sponsored health plans and the rising costs associated.

A summary of our webinar with the Northeast HR Association (NEHRA)

When it comes to health and productivity programs, the past several years have been a time for Benefits and HR professionals to test out a range of initiatives in response to pandemic and post-pandemic challenges, priorities, and employee expectations. Now, however, the market is in a different place and it is time to assess the impact of recent program offerings; does the reward outweigh the risk?

The Big Picture

Today’s economy is creating urgency around making sure benefits programs are properly managed. High inflation rates touch everything; the impact doesn’t stop at the grocery store or the gas pump, it extends to already high healthcare costs. In addition to the economic reality, we have seen an increase in healthcare utilization coming from new treatments and technologies available, further increasing costs. Relatively low unemployment may have shifted attraction and retention goals for some organizations, but a rise in layoffs is having tangible effects on the labor market at large which trickles down to employer strategies. It’s not just employers facing challenges, though, as healthcare services have become unaffordable for many and consumers/employees are also feeling the cost burden.

As a starting point, take a look at your data to answer questions like:

- What does your population look like in terms of demographics and health trends?

- What are your employees selecting for benefits?

- What is driving your costs?

- How might you segment your population?

- Are you accounting for future population shifts and resulting needs (e.g., company growth)?

You should then be able to assess whether or not your benefits align with your population as well as your corporate objectives. When determining true return on investment (ROI), it’s important to consider both human and financial perspectives.

Now that we have established a bird’s eye view of the risk versus reward equation, let’s drill down into key plan components that factor in.

1. Risk Management

There are a range of risks to consider within your benefits strategy. There is the risk of buying insurance, and the allocation of funds. There is the risk to your employees of undertaking a high cost treatment, if necessary, which may not be feasible for lower wage workers.

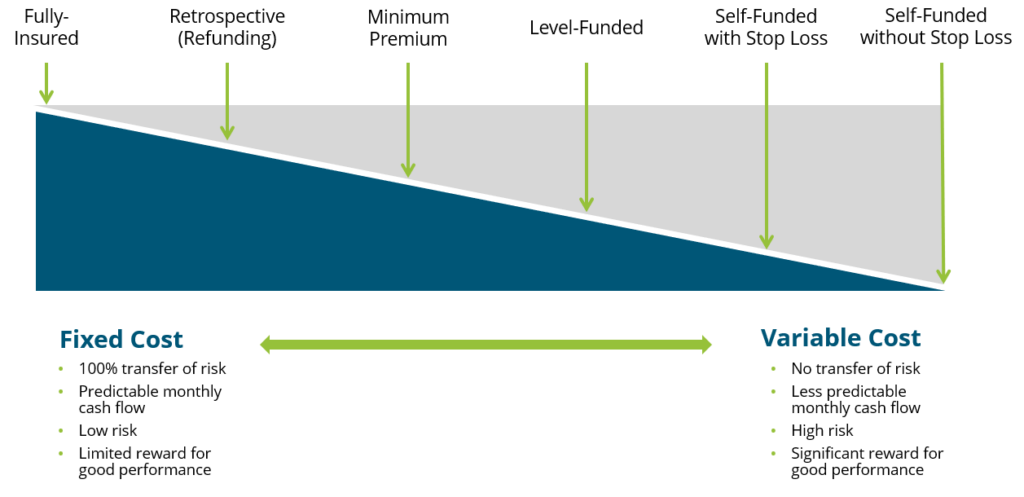

When it comes to benefits funding, the following graphic illustrates the spectrum of options available, where the risk taken by the employer increases as you move toward the right.

While a fully insured plan largely frees the organization of risk, there is typically a lot of overhead and administrative costs involved and less governance when it comes to claims management. Overall, though, we encourage our clients to consider this spectrum and determine where they fit in related to risk appetite, budget and resources, specific health trend, and more.

2. Financial Management

Related but separate from risk management comes the financial management of your benefits program(s). There are three key activities that fall within this bucket:

- Program Strategy

- Account for long-term costs and variability

- Cost Projections and Rate Setting

- Provide budget updates

- Adjust for economic changes

- Includes premium equivalent rate projections and employee contribution rate setting

- Plan Governance

- Establish framework

- Ensure sufficient reporting and monitoring cadence

- Account for actual versus expected, large claims reporting, key cost drivers, retiree medical valuations, etc.

The insights gleaned from the financial management arm should be embedded into your overall benefits and risk management strategy, rather than live in a silo.

3. Pharmacy

Pharmacy has been top of mind for employers, understandably so given the rapid rise in prescription drug costs, which now constitute anywhere from 20-25% of total healthcare spend in the U.S. Specialty medications account for 50% or more of pharmacy spend even though only about 2% of the population is using them. Brand and generic drug costs are also rising at rates we have not seen in the past, perhaps in correlation with inflation. Suffice it to say, employers are struggling to mitigate their own costs as well as the costs for their employees. So, what can be done?

Within the pharmacy benefits landscape, two areas have been getting a lot of attention: weight loss drugs and biosimilars.

Weight Loss Drugs

Chances are you’ve heard about a new wave of “Hollywood diet” drugs. There has been an enormous amount of marketing going on around these new weight loss drugs, especially in the realm of social media and influencers. All of the buzz has also gotten the attention of employers, who are asking us questions surrounding coverage, costs, and pros and cons.

To provide some background, of the four weight loss drugs taking center stage, only two have indications for weight loss, while the other two are being used off-label. Weight loss drugs are not new, but these varieties are showing results we haven’t seen before, and their arrival on the market is timely, as about 42% of the population is either overweight or obese.

From a health and productivity standpoint, we know that obesity increases a person’s risk of developing a chronic condition, which leads to higher healthcare costs. But we also know that there are financial and non-financial reasons to foster a happy and healthy workforce. Can and should weight loss drugs be an answer for employers?

These new drugs are retailing for about $1,300 a month, so we need to consider annual costs and the longevity of how long an employee will need to stay on the medication. For employers considering them to their plan, we recommend it being one piece of a comprehensive strategy that also includes wellness initiatives and/or a commitment from those prescribed the drug. In addition, you must build strong monitoring protocols to judge effectiveness and impact on overall plan costs and utilization.

The inclusion of weight loss drug coverage in a health plan will make sense for some employer groups, and not others. We recently talked with an employer client who saw enough value in even a 10% reduction in body weight to convince them to cover the drug. However, any decisions need to be based, once again, off of population data and corporate objectives. This is a new and evolving sector, so your strategy should remain fluid as we see developments.

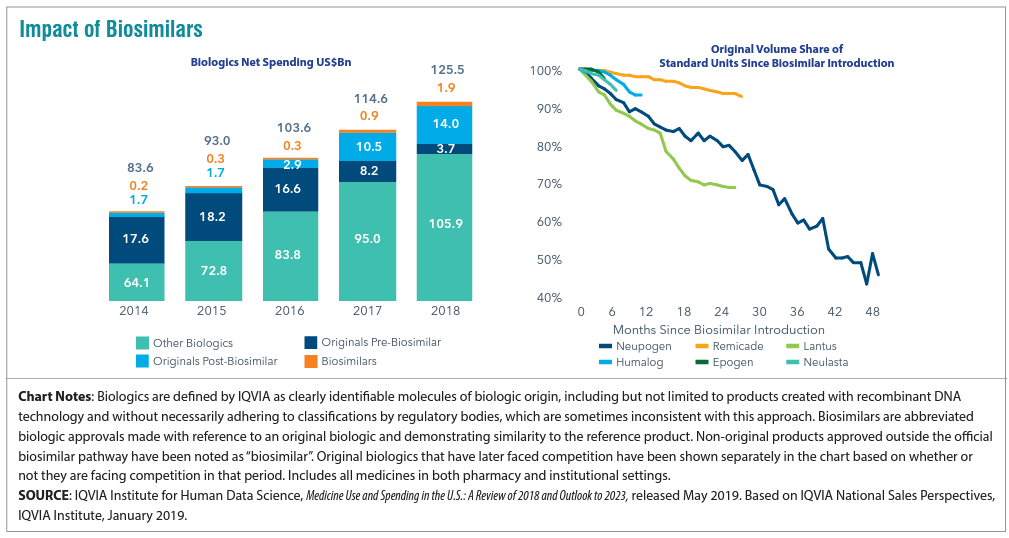

Biosimilars

Biosimilars are non-generic alternatives to those specialized medications that are very targeted in how they work and on what conditions they combat. There has been a lot of anticipation surrounding biosimilars as a solution to the specialty drug cost crisis. At the beginning of the year, a biosimilar of Humira, the number one drug dispensed in the U.S. which is used to treat inflammatory conditions, entered the market as the first biosimilar. While there has been some impact, to date it has not been the silver bullet we were hoping for. We can see below that biosimilar adoption rates are all over the map depending upon the condition for which it’s being utilized.

For employers, what’s important is vigilance in understanding where your Pharmacy Benefit manager (PBM) has positioned biosimilars as far as coverage is concerned. We have found that PBMs are placing biosimilars typically at the same parity with the reference, or brand name product. In this case both Humira and its biosimilar would be considered tier 3 medications, which does not yield the anticipated savings. Why is this? Well, there may be additional rebates available to employers and health plans if they continue to use the reference product.

This is a complicated space that continues to change at a rapid pace. Overall, though, if biosimilars are working the way we want them to, we need to figure out a way for all stakeholders to embrace them as a lower cost alternative instead of being locked into brand name drug prices. In some cases, the drugs are life-changing, so we do want to cover them but in a more sustainable way. We work with clients to ensure they are informed of and ready for these advancements and nuances.

4. Targeted Point Solutions

The term “point solutions” now represents a large umbrella of tools, however it typically references programs that target specific diagnoses such as diabetes, oncology, and hypertension. In recent years there has been significantly more interest in point solutions from our employer clients, and, especially with multiple solutions running at a time, these can be a slow leak on spend. Now is a good time to take a step back to answer that risk versus reward question for point solutions.

The best place to start in assessing point solutions whose reward outweighs the risk is data analytics. Try to use any data you are getting from your health plan, internal teams, or the industry to benchmark your spend. In areas where your spend is high relative to benchmarks, do a deep dive for potential solutions that can help. Some pitfalls in this area include:

- The more point solutions you implement, the harder they become to monitor and manage

- Point solutions embedded in your health plan may seem like a no-brainer, but they usually yield very low take-up rates

- Overlap between different point solutions/benefits programs can cause confusion for all stakeholders

- Focusing purely on dollar ROI may not be the play; listen to your gut about what is right for your workforce and understand the qualitative advantages around camaraderie and culture to be gained

5. Absence Management

Absence management is highly correlated with your health plan performance, since the vast majority of your high cost claims will also include a leave of absence, so there are both plan costs and productivity rates at play here.

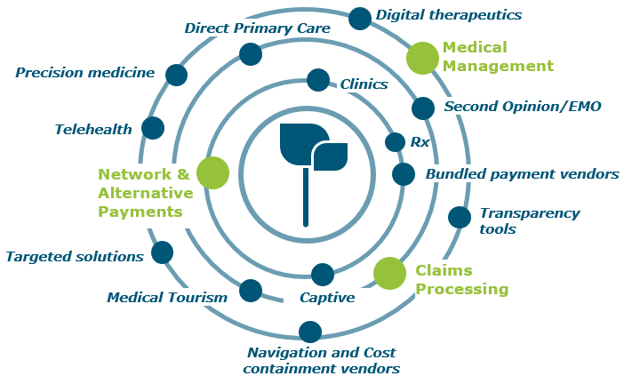

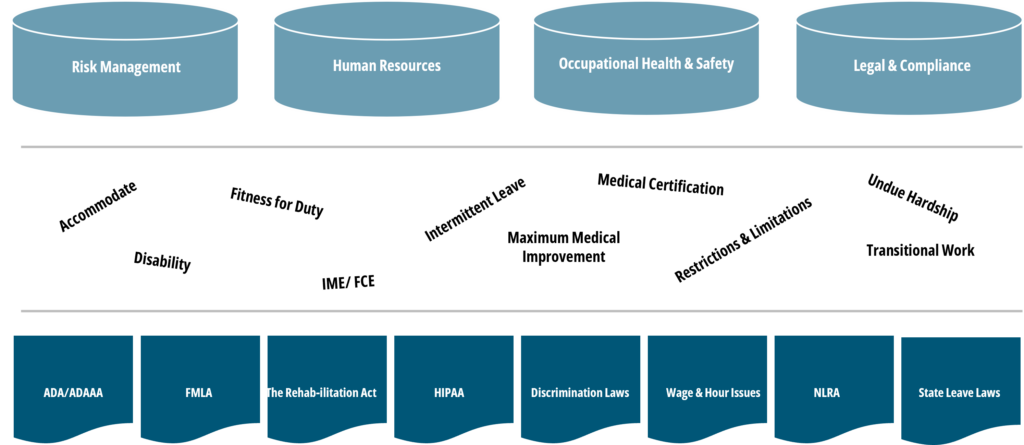

Making absence programs more challenging is the volume of stakeholders involved and laws with which you need to comply (as seen below).

Further, when we talk about absence management, we account for a wide range of benefits including short- and long-term disability, statutory disability, workers’ compensation, FMLA, ADA state paid family and medical leave (PFML), and others.

With absence, different than with medical plans, your company’s managers and supervisors are directly involved when it comes to plan design, governance, staff training, etc., so it is an area where you typically need to look inward to drive change.

When it comes to the risk/reward balance of an absence management program, employers can make sure corporate programs are set up the way they want, for example, promoting the right attraction and retention strategy. Remember that the more generous your programs are, the more they will cost and the higher the risk you take on. If shifting some responsibility to an outsourced partner, be sure you still have monitoring protocols in place.

Closing Thoughts

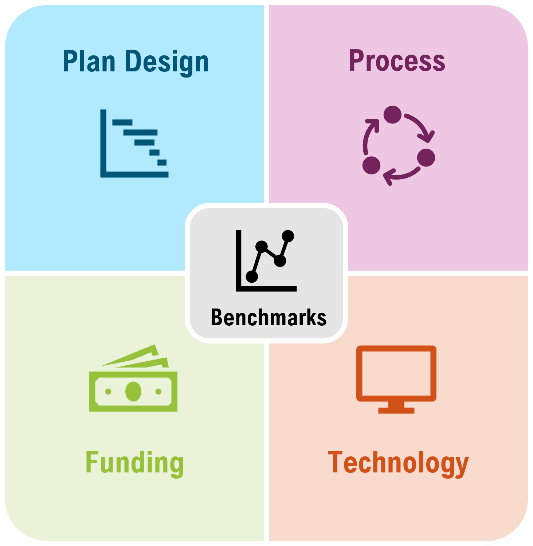

Across these five areas and more, we encourage you to get familiar with your organization’s plan and demographic data. Depending on your size, the level and depth of data available might be different, but there is always some data available, such as industry standards and benchmarks. Whether you are focused on weight loss drug strategy, funding, or point solutions, you can take those data-driven insights and apply them across these four pillars to determine your best practice.

If you are having trouble getting started, or could use specific guidance surrounding the topics mentioned, please get in touch with our team.

As we wrap up Mental Health Awareness Month, it was only fitting that the New England Employee Benefits Council (NEEBC) hosted their Annual Summit just a couple of weeks ago. Mental health awareness and wellbeing resources are top of mind for employers and HR teams across the nation, and, as we saw at NEEBC, specifically a focus in New England. Some additional hot button topics during the conference included:

1) Inflation/cost control strategies

Maneuvering around inflation and costly claims are top priorities for benefits professionals nationwide and was a constant topic of discussion by both presenters and attendees. The first keynote panel focused on the “Current Economic, Political and Cultural Landscape: Where We Are. Where We’re Going. Why It Matters.” They explored typical cost drivers, workplace trends (hybrid, remote, and on-site), and how HR teams can help preserve New England’s unique culture within their workforce.

2) Understanding the needs of your workforce

As many employers have shifted to remote and hybrid models, communication and understanding the needs of the workforce has been challenging for many. One session that really resonated with me included two benefits specialists from ZOLL Medical; they reviewed how benchmarking and survey data helped give their workforce a voice when it comes to their benefits. On the other side, they also looked at pitfalls and obstacles they faced initially and how they overcame them, and steps they took to optimize their survey process.

3) Promoting wellbeing and mental health

Finally, mental health and employee wellbeing continue to be top-of-mind at HR and benefits conferences across the nation. As mental health resources have become a mainstream benefit area, employers are now looking at alternative and new programs to stand out and retain/attract talent. A professor from Northeastern University’s Department of Health Sciences presented on social determinants and their impact on employee health and wellbeing. He leveraged his research to outline best practices and how HR teams can alter their offerings to fit the needs of a diverse workforce.

As a pharmacy consultant, I was excited to see the interest people had in Rx cost control tactics, PBM logistics, and specialty drug strategies. The costly and challenging landscape of pharmacy benefits should motivate employers to implement program changes; we can help. Here are some considerations and tools employers can utilize to address employee wellness, which, in turn has a direct impact on pharmacy costs. Thank you to NEEBC for another insightful event and we look forward to the next one.

Every year The Risk and Insurance Management Society (RIMS) hosts their annual RISKWORLD conference, which brings together thousands of risk professionals from across the globe to network and discuss current trends and new innovations in the industry. This year the conference took place in Atlanta, GA and featured a wide range of fun activities including a pickleball tournament, a golf event, and a group of service and therapy animals to play with. Outside of all the “extracurricular” activities the conference had to offer, it helped paint a clearer picture of what is driving the risk management sector and how employers are combating different obstacles. We noticed that the following five areas got a lot of spotlight at RIMS this year.

1. Career Development

It seems like every year increasingly more sessions are focused on the future of the risk management sector and how young professionals can grow into industry leaders. As boomers begin to retire and millennials start taking on larger roles, conferences like RIMS are recognizing the need to be sure the next generation has the tools they need to be successful. Below are some of the top sessions I found most interesting:

– A session titled, “How to Take Risk Off the Books and Demonstrate Your Value to the C-Suite” focused on strategies risk professionals can take to properly explain risk mitigation strategies to C-suite executives to help elevate their value.

– Risk Directors from two different universities presented on the importance of teaching the next generation about non-traditional risks and preparing them for future barriers (ex. cyber liabilities, ESG, climate change, etc.).

– One session took a unique approach and brought together three industry leaders that were originally on the same team but all accepted different opportunities. Each presenter gave insights into their specific journey and what young professionals can do to drive the trajectory of their careers.

2. Claims Management

As inflation is top of mind for businesses across the globe, cutting costs and managing claims is a high priority for risk teams. This year presenters looked at a range of business lines and various approaches to handling claims processes.

– As cyber is still an emerging risk, a presentation titled “Cyber Claims Management: Dispelling Myths and Distilling Realities,” reviewed common misconceptions, and detailed how to integrate cyber coverage into incident response plans.

– A session on managing operational risk and internal processes in workers’ comp coverages outlined best practices for third party administrators (TPAs) and key performance indicators when evaluating a workers’ comp program.

– A lawyer and a VP of Risk Management discussed the legal landscape and settlement processes when it comes to managing and valuing claims. They also included tips for organizations to ensure they are protected in settlement efforts.

3. Cyber and Technology Risk

Although cyber is not a new concern the risk-world (no pun intended), we are seeing a lot of evolution and maturation in this space. This year speakers tackled cyber coverage from many different points of view, some of which included:

– In the session, “Ransomware Postmortem: The Anatomy of a Cyber Breach,” the presenters expressed what employers can do at different stages of a cyber breach to mitigate losses, and what is going through the minds of hackers during planning, execution, and post cyberattacks.

– In response to the Ukraine-Russia War, one group presented on current cyber warfare trends and how international sanctions can impact regulations and cyber claims.

– The session, “Understanding Autonomous Vehicle Risk and Insurance,” speakers gave a comprehensive review of autonomous vehicle risks and market conditions to pay attention to, such as legislative developments and availability of insurance products.

It seems like every year we are seeing new developments in the world of captive insurance on both the national and international scales. After recently attending The Captive Insurance Companies Association (CICA) 2023 International Conference, I wanted to share some of the hot topics on the minds of captive professionals around the world. As a board member of CICA and chair of CICA’s NEXTGen young and new professionals committee, I was excited to be so involved this year. The conference definitely did not disappoint; in addition to “extra-curriculars” like the golf tournament and brewery tour, the event also provided great opportunities for networking and learning about current trends and best practices in the world of captives and what the future holds for the industry. I hope you enjoy these highlights.

4. Diversity, Equity, and Inclusion (DEI)

As we progress through 2023, employers across the nation and internationally are working to develop programs that address DEI efforts. Although DEI was not the leading topic of discussion this year, I still wanted to share some of my favorite sessions that address unique social issues in the risk management/insurance space.

– Workers’ Compensation experts clarified how understanding DEI needs of injured workers can directly help with the recovery process and their return to work. Furthermore, they explained how greater communication can reduce the risk of continued disability and litigation.

– As Artificial Intelligence (AI) is making headlines globally for its potential (both negative and positive), many fear for perpetuated biases the systems may hold. One presentation investigated potential discriminatory liabilities when it comes to automating recruitment and other employment decisions and how it can intersect with different compliance regulations.

– A group of 5 female executives tackled the issue of women in leadership positions in the risk management/insurance space and tools they utilized in their career paths to help combat gendered stereotypes and achieve leadership roles.

5. Strategic and Enterprise Risk Management

When it comes to developing a concrete and concise program, risk management teams have an abundance of options and strategies to consider. This year, enterprise risk management (ERM) was a hot button topic, with sessions covering:

– The session, “Social Media: Managing the Continuous Stream of Emerging Risks” explored a new stream of liability, social media risks. Speakers from Oracle and Salesforce reviewed the history of social media risks and potential response plans for future incidents.

– Two insurance executives reviewed how the pandemic forced organizations to integrate resilient and adaptive programs, opposed to more traditional and defensive programs we saw pre-pandemic. They then laid out risks and disruptions organizations should be ready to face in the post-pandemic world.

– A representative from Merit Medical dove into her company’s approach to ERM and how they optimized their program through strong leadership support. Her session was titled, “Enterprise Opportunity Management: Optimizing the Value of ERM with a Focus on the Positive.”

As a regular RIMS attendee, I have to say, this conference was one of the best. I was able to connect with so many interesting people and deepen my understanding of best practices and trends. Aside from the socializing and happy hours, Spring had a great time exhibiting and attending the informative sessions; I look forward to next year’s conference! In the meantime, our team will continue to assure we provide clients with industry leading captive and alternative risk financing services.