Last week we wrapped up Business Insurance’s 2023 World Captive Forum (WCF) in Miami, FL. This year’s conference brought together hundreds of stakeholders in the captive space to network and discuss leading trends in the industry. As a member of the advisory board, I’m glad the event was such a success; below are some of the topics I found most prevalent during this year’s conference.

1) Captive Updates

When it comes to captive regulations, we have seen many changes in just the last year. With the growth and development of different domiciles all around the world comes new regulations to which captive owners and employers must adhere. Below I have included a couple interesting sessions that explain how regulations surrounding captives have changed across the globe.

– Government insurance representatives from North Carolina, Vermont, Oklahoma, Bermuda and Michigan discussed trends, best practices and laws impacting the captive industry (and their respected domiciles).

– As Latin America has been growing their position in the captive space, a session featuring the Official Advisor for Latin American Affairs from the Government of Bermuda spoke about current LATAM trends and what we can expect to see from the region moving forward.

2) Cyber Captives

Although writing cyber liability coverage into a captive is not a new practice, it is still nowhere near as common as placing medical stop-loss or property & casualty lines into a captive. This year cyber coverage was a hot-button topic at the conference and will most likely continue to be, as cyber attacks continue to pose substantial risks.

– In a breakout session titled “Cyber Captives” a group of risk experts discussed current trends in cyber insurance and the limitations for captive coverage in cyber.

– In a session titled “Secrets Cyber Criminals Don’t Want the Insurance Industry to Know”, the CEO of BlackShield Cyber, Dioly Alexandre, explained how cybercrime has changed over time and what insurance companies need to do to keep up.

3) Healthcare & Captives

Whether an employer in the retail space is looking to use a captive to fund health benefits, or whether a hospital organization is leveraging a captive for its medical malpractice and other unique liabilities, captives and healthcare have always been closely intertwined. At WCF this year some highlights of this dynamic included:

– Spring’s Managing Partner, Karin Landry, presented on trends in medical stop-loss (MSL) and how this tactic can help employers proactively manage healthcare costs and lessen the impact of catastrophic claims. The discussion included a deep dive into what is driving upticks in healthcare costs; walk-throughs of case studies illustrating MSL advantages, including an overview of Canon USA’s captive story; and a detailed explanation of Medical Expense Cost Containment (MECC) and how it comes into play.

– The first session of the final day reviewed implications of medical malpractice coverage following the Supreme Court’s decision on abortion services and best practices for healthcare providers.

– In the session “Global Medical Claims Developments – Covid-19, Hyperinflation, Musculoskeletal and Mental Health,” the panelists discussed how captive managers should address specific medical conditions and unusual medical claim patterns.

4) The Future of Captives

Although nobody knows for certain the future of the captive industry, we are seeing various patterns that suggest we will see many changes to come. Aside from new domiciles and new types of coverages, we are also seeing different approaches when it comes to current captive practices.

– In a session on “Hybrid Captives,” I presented on innovations in the property & casualty market that allow captives to more meaningfully control property exposures and premiums.

– As a newer member to the World Captive Forum Advisory Board, I was joined by University of California’s Karen Hsi in a roundtable for younger professionals entering the industry, including a discussion of what the next generation of talent is looking for and how they can get themselves on a promising career trajectory.

– As diversity, equity, and inclusion (DE&I) is a current top priority for many companies, this session discussed how by reinvesting underwriting profits, captive programs can be used to finance DE&I strategies to meet the needs of a diverse workforce.

Getting a break from Boston winter was a plus, but the ability to reconnect with industry leaders and collaborate on strategies was the real draw. We are excited to see what the World Captive Forum holds in store for us next year and we will continue to keep you up-to-date with developments in the captive space.

the International Foundation of Employee Benefit Plans recently wrapped-up their 32nd Annual Health Benefits + Conference Expo (HBCE) in Clearwater Beach, Florida. The conference brought together healthcare and benefits professionals from a range of industries to discuss leading topics and share expectations for the future. Having heard such positive feedback about the event, Spring was glad to attend, exhibit, and speak at the conference. Below are some of our biggest takeaways.

1) Pharmacy Cost Containment

This year there was a lot of talk surrounding the price of prescription drugs and tactics employers can adopt to help control costs without cutting benefits. There are many factors influencing the high costs of pharmacy drugs, some of which include chronic disease prevalence, the aging population and the growing volume of specialty medications. Below are some of the top sessions focused on controlling Rx costs.

– Representatives from Express Scripts explained the upsides to working with a Pharmacy Benefit Manger (PBM) and how they can help address pharmacy policies in their session titled, “How to Work With Your Pharmacy Benefit Manager.”

– The CEO and Co-Founder of TruDataRx, Cataline Gorla, discussed how comparative effectiveness research (CER) is being used by other countries to decide which drugs work best for specific medical conditions, and how self-insured employers can save money with said data.

2) Addressing Chronic Conditions

According to the Center for Disease Control (CDC), 90% of the nation’s healthcare spending goes towards people with chronic and mental health conditions1. As chronic diseases are very common among the American workforce, employers have started implementing specific benefits and policies to address common conditions, such as diabetes and obesity. Some of the sessions around this topic that we found most interesting include:

– Speakers representing the Nashville Public School System explained how they were able to introduce free resources such as telenutrition and fitness center access to help combat obesity and other health disparities.

– Dr. Mudita Upadhyaya from St. Jude Children’s Research Hospital presented on prevention strategies to address mental health and obesity in a pre- and post-COVID world; and why a mixed approach may be best.

– The Diabetes Leadership Council’s CEO, George J. Huntley spoke on diabetes and chronic disease risk management strategies, including medicines and technology that can help patients manage and prevent the disease.

3) The Future of Healthcare & Benefits

In recent years we have seen a great shift in the healthcare and benefits industry; we saw a great increase in telehealth, mental health resources, new/alternative types of paid leave, including sick leave and more. As we transition to a post-COVID world, we expect the evolution to continue. Below are some of the top trends professionals believe we will face in the coming years.

– Our Senior Vice President, Teri Weber, presented on market forces employers can utilize to meet future absence management challenges. Her session listed techniques employers can adopt to improve day-to-day administration of disability, absence and accommodations.

– In a session titled “Innovative Health Care Models—The Future of Direct Primary Care,” the presenter explained how many employers are changing to value-driving healthcare models to boost access and reduce costs.

– A session titled “Breaking the PTO Mold, Without Breaking the Bank,” reviewed how typical Paid Time Off (PTO) programs can be altered to better support employees’ well-being and financial health.

– The final session of the conference spotlighted how the pandemic has led to an increase in personal, economic and other stressors and has had a drastic impact on mental health, substance misuse and addiction. Attendees were informed on how they can implement workplace solutions that address these issues as well as identify warning signs.

The warmer weather was certainly a bonus, but the insights we gleaned and connections we made were what will keep us coming back to the HBCE conference. We want to thank IFEBP and our fellow colleagues who took the time to share their experience, stop by our booth, and make the energy so positive.

1https://www.cdc.gov/chronicdisease/about/costs/index.htm

After a two-year hiatus, it was great being able to attend The Cayman Captive Forum in person this year. As the Cayman Islands is the second largest captive domicile, and the first for healthcare captives1; it is the perfect location to share leading trends in the captive world, and the warm temperatures and tropical views made it all the more enjoyable. If you weren’t able to attend or could use a refresher after returning to the “real world,” this quick recap might be of interest. Below are some of the buzziest topics at this year’s conference.

1) Tax Updates

On large attraction to captive insurance (and certain domiciles) relates to tax advantages. It’s complicated, though. Some of the tax-focused sessions presented at the conference were:

– Mike Domanski, a lawyer from Honigman LLP, discussed offshore federal tax considerations and U.S. tax reporting requirements in his session titled “Captive Insurance: Basic Tax Fundamentals.”

– In a session titled “The State of Tax: What You Need to Know,” experts discussed U.S. federal tax updates and how taxes will be affected by the Inflation Reduction Act and updates to Section 831(b).

– The penultimate presentation titled, “U.S. Tax Update” tackled IRS and compliance updates in the U.S. on both the federal and state levels.

2) Cyber Risks

Since the start of the pandemic, employers had to adjust to remote and hybrid workplace policies. This transition forced employers and employees to rely more on digital tools to conduct day-to-day operations and made organizations more susceptible to breaches. This is not the first year that cyber took the spotlight, but there were some great discussions around risk in this area, including:

– A session titled “Placing Cyber Liability in Your Captive” reviewed current trends in cyber treats and how insuring cyber in a captive can prevent devastating losses.

– Risk and Cybersecurity experts from the Cleveland Clinic explained why the healthcare industry commonly falls victim to cyber attacks and outlined steps to take to protect patient and caregiver privacy in their session, “Current & Future Cyber Risks In Healthcare: ‘Will you still love me, tomorrow?’”

3) Healthcare-Specific Coverages

In recent years, we have been seeing an increasing number of healthcare organizations leverage their captive to bring new and industry-specific lines. At this year’s Cayman Captive Forum we learned about how captives can be used for the following emerging and alternative risks:

a) Medical Malpractice/Medical Errors

As the Cayman Islands is the most popular captive domicile amongst healthcare organizations, there was a large focus on healthcare-specific risks. There was a particular emphasis on how healthcare employers can reduce and prepare for potential medical malpractice/errors as noted in the following sessions:

– Presenters from the “Criminalizing the Clinical Defendant: Straight from the Headlines” session facilitated a mock deposition to address common medical malpractice trends and how they should be addressed.

– A session titled “Can your Captive Eradicate the Impact of Covid on its Medical Malpractice Program? Will It Ever End?” reviewed how medical malpractice can impact claims and legal outcomes.

– Dr. Dan Shapiro Ph.D., explained his experiences with burnout in the healthcare industry and steps employers can take to support healthcare workers in his presentation “Labor Shortages, Employee Burnout & Medical Errors: Working Together to Improve Results.”

b) Workplace Safety & Patient Care

Workplace safety is another non-traditional captive line (outside of employee benefits and Property and Casualty [P&C]) gaining traction. Healthcare organizations and, more specifically, healthcare workers and patients are prone to violence and discrimination more so than staff in other industries.

– In the session “Workplace Violence in Healthcare,” Trinity Health’s Diane Moritz explained initiatives their captive board are taking to prevent workplace violence injuries and support victims of patient violence.

– Children’s National Hospital’s Chief Diversity Officer, Denice Cora-Bramble discussed biases in data reporting for diverse patients, and experiences minority patients face when seeking health services in the session, “DEI Impact on Quality and Safety of Care.”

– I was joined by lawyer, Michael Domanski in a pre-recorded session titled “Using a Captive to Fund Long-Term Care,” during which we reviewed the current LTC market and different captive models (both taxable and tax-exempt) that can cover long-term care policies.

As we transition into a new era of captive insurance, this year’s Cayman Captive Forum acted as a perfect vehicle for addressing current and future themes in the industry. It was a strong end (almost) to an exciting year and we look forward to next year’s conference to continue these and other important discussions. Our team was fortunate to be part of the action in the Cayman Islands this year and is here to answer any questions you may have related to an existing or new captive program. Check out our captive expertise here and let’s chat!

1 https://caymanintinsurance.ky/about/

It is estimated that ~44 million Americans are experiencing long COVID symptoms. During a recent Spring webinar, our SVP, Teri Weber was joined by a pulmonologist and a representative from Goodpath to review common long COVID symptoms and how it is impacting productivity and claims. You can access the webinar here.

Within the last couple of years, we have seen drastic shifts in the wants and needs of employees nationwide. The COVID era sparked and enhanced new practices and benefits that were not popular in the past, such as mental health resources for remote workers, utilizing tech in HR and addressing burnout. Now that COVID effects are less severe and we have returned to more normalcy in many ways, employers must grapple with remote, on-site, and hybrid work models while keeping their workforce happy and engaged. These trends were evident in this year’s Annual Conference hosted by the Northeast Human Resources Association (NEHRA). NEHRA is one of the leading organizations that brings together HR industry professionals to network and share best practices. This year’s conference took place in Newport, RI and Spring had the pleasure of attending and exhibiting.

Here are some of the areas most focused on this year:

1) Adapting to a Hybrid Workforce

Although hybrid and remote work may seem like the norm for many of us, employers are still struggling to keep their workforce connected and satisfied while retaining efficiency. During the peak of the pandemic, many organizations moved to fully remote and are now looking at whether they will require employees to be in the office full-time, part-time, or not at all. Below are some of the sessions that best tackled this issue.

– A session titled “Driving Career Development in a Hybrid World” explored how the adoption of technologies during the pandemic has led to an increase in professional career development tools, but on the other hand, has prevented many employees from showcasing their true talents.

– In the Closing Keynote Panel, three local HR executives from Mersana, Progress and Ocean State Job Lot explained how their organizations have maintained award-winning workplace cultures with a dispersed workforce.

2) Acquiring/Retaining (Next Gen) Talent

As baby boomers are exiting the workforce and Gen Zers are entering, it has caused a great shift in office culture and employee benefits. Gen Z grew up in a technological world with an emphasis on mental health, and often expect their organization to reflect the same standards. Here are a couple of noteworthy sessions related to attracting and retaining next gen talent:

– During “Bridging the Generational Gap through Wellness Initiatives,” a representative from the Town of Barrington, Rhode Island, described how their wellness initiatives have helped increase retention and alleviate burnout among cross-generational employees.

– Experts from Apprentice Learning and FHL Boston explained how organizations can introduce a workplace culture that attracts young people of color in their “Engage Your Employees to Build an Equitable Workforce for the Future” presentation.

3) Reinforcing Employee Wellness

At previous NEHRA conferences and other industry-related events we have seen a giant emphasis on mental health. This year the topic of mental health resources has taken a back seat and many industry leaders chose to focus on the related subject of employee wellness practices instead, spotlighting the importance of…

a) Creating a Culture

Creating a workplace culture with employees of different ages, experiences, locations, and expectations can be a daunting task as an employer. Below are a few of the sessions that provided insights on how to best establish an inclusive company culture.

– National Behavior Health Leader, Dr. Joel Axler discussed signs and symptoms of someone struggling with mental health challenges employers should look out for during his session “Empathy in the Workplace.”

– Roman Music Therapy Services, Meredith Pizzi spotlighted unique ways HR teams can generate workplace cultures that reflect the company’s vision while also inspiring employees.

b) Just Add Joy!

Creating a workplace culture with employees of different ages, experiences, locations, and expectations can be a daunting task as an employer. Below are a few of the sessions that provided insights on how to best establish an inclusive company culture.

– In the Keynote Presentation titled “Create a Workplace People Love – Just add Joy!” the Co-Founder of Menlo Innovations, Rich Sheridan, suggested organizations move away from outdated corporate traditions and adopt new approaches based on what employees want.

– In the breakout session, “What is Stealing Your Joy? Simple Steps to Bring it Back,” attendees had the chance to openly discuss what obstacles are weighing them down at work and possible solutions.

All in all, the conference was a great success and provided an excellent atmosphere for networking and discussing industry trends. Every year I feel like I’m seeing more young talent, which gives me a good feeling about the future of our industry. I am already excited to see what next year’s conference brings!

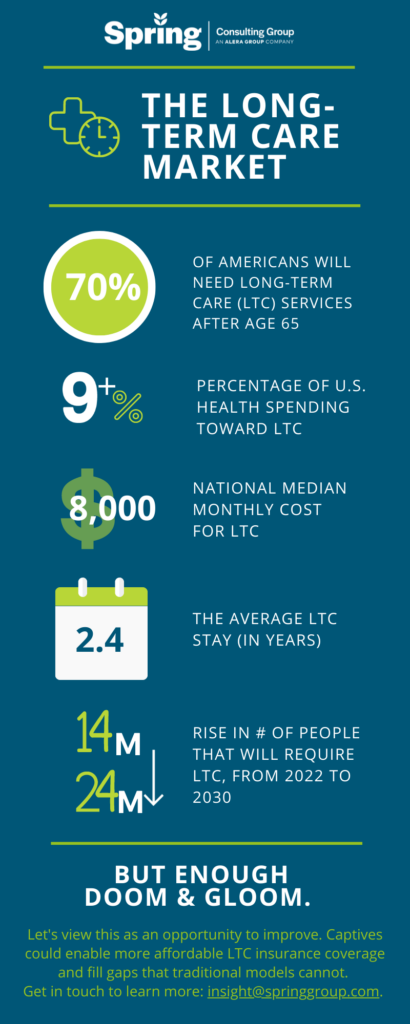

At the VCIA 2022 Annual Conference, our Managing Partner participated in a panel that highlighted the scary long-term care landscape, but that ended on a high note in exploring the possibility of captives as a next generation solution for long-term care insurance.

With innovation embedded in the DNA of both Spring and captive insurance, we are interested in helping reshaping the long-term care market of the future. Check out the other discussions our team members had on VCIA session panels, or get in touch to talk in more detail about long-term care captive strategies.

A (Brief) VCIA Session Recap

I had the pleasure of speaking at Vermont Captive Insurance Association (VCIA) Annual Conference last week, joined by two colleagues with impressive backgrounds. Jeff Caudill, Director of Risk Management at Haskell and a client of Spring’s, and Mary Ellen Moriarty, Vice President, Property & Casualty at College Insurance Company (EIIA) joined me to discuss different ways that captives can be used to tackle the hard market hurdles we’re currently facing in the insurance industry.

With myself as the moderator and consulting actuary, Jeff representing a brand new single parent captive, and Mary Ellen representing a veteran captive, it was a well-rounded panel that pulled in multiple perspectives.

The Clouds Behind the Hard Market

This visual does a great job at illustrating the many challenging atmospheric effects in the insurance air right now, particularly on the property & casualty (P&C) side of the fence (no pun intended). With Mary Ellen representing the higher education space, we felt it important to highlight unique risks that colleges and universities are grappling with, in addition to the other complicating factors (or clouds) we see here.

In my work I’ve seen that this climate has resulted in increased carrier profitability for certain lines over the last couple of years, such as auto liability, but decreased carrier profitability in others (such as cyber and commercial property).

In higher education, Mary Ellen explained there have been hard market consequences due to underwriter inability to achieve profitability, and as noted in the visual, they are dealing with risks many organizations don’t need to think about, like traumatic brain injuries, the general public accessing the property, and a different kind of medical malpractice. As a result, there are a limited number of carriers willing to provide coverage in this space. As a nod to captive advantages, EIIA was able to grow surplus from their captive prior to the hard market, from 2002 to 2022, which has been extremely helpful in this “stormy environment.”

This success story led us to a discussion around the business case for captives, a snapshot of which you can see here in this video.

Jeff then gave a bit of a play-by-play regarding the process, implementation, timelines and driving forces behind Haskell’s decision to switch from a group captive to a single parent captive (a synopsis of which you can find in this case study).

Looking Ahead

Both Jeff and Mary Ellen described some next steps for their captives, which may include writing in:

- Integrated deductible plans

- Directors & officers

- Cyber

- Employee benefits

- Other P&C lines

Food For Thought

Like most good things in life, you kind of had to be there to get the full experience and maximize your take-aways. So I don’t want to give it all away, but I will leave you with some food for thought that came out of the Q&A for the session. If you want to know the answers, please get in touch!

- With a newer captive that hasn’t had time to build up surplus yet, how do you think about keeping your captive adequately capitalized?

- What are the next coverages or exposures you see on the horizon for higher ed that you would like to add to the captive program?

- What were the key drivers for your CFO to be on board to establish the captive?

- Can you talk about how reviver statutes have impacted obtaining/maintaining abuse coverage?

- As we face uninsured risks like communicable disease, how do you assess the use of the captives together with unique insurance solutions like parametric options? What is the value pitch to the organization?

- What type of coverages perform well in the hard market and why?

- Does forming a captive in a hard market only make financial sense if your company’s loss ratio is below the industry average?

- How do you handle cyber in a captive? Do you have a TPA on retainer?

- Are you using the captive for deductible reimbursement? Do you take any quota share or excess layer risk?

- What does your auto exposure look like and what risk mitigation strategies have you implemented (via the captive or otherwise)?

- How do you market your captive to new members who may not understand captives? Especially in light of the hard market, where captives are especially attractive.

And last but perhaps most importantly:

- What do you think the impact to the insurance market will be if the Browns win more than 2 games this year?

As you can see, we can have some fun in the captive world, and much of it was had at VCIA! Before you leave, check out our captive business case video here, inspired by this presentation.

With healthcare costs skyrocketing and employee needs shifting, many employers are examining how they can save money while still providing strong benefits packages. Last week I spoke at the Vermont Captive Insurance Association (VCIA)’s 2022 Annual Conference on current medical stop-loss market trends and how captives can help cut costs. My fellow panelist, Tracy Hassett, President of edHEALTH, a collection of educational institutes and client of Spring’s spotlighted their captive which has seen significant savings.

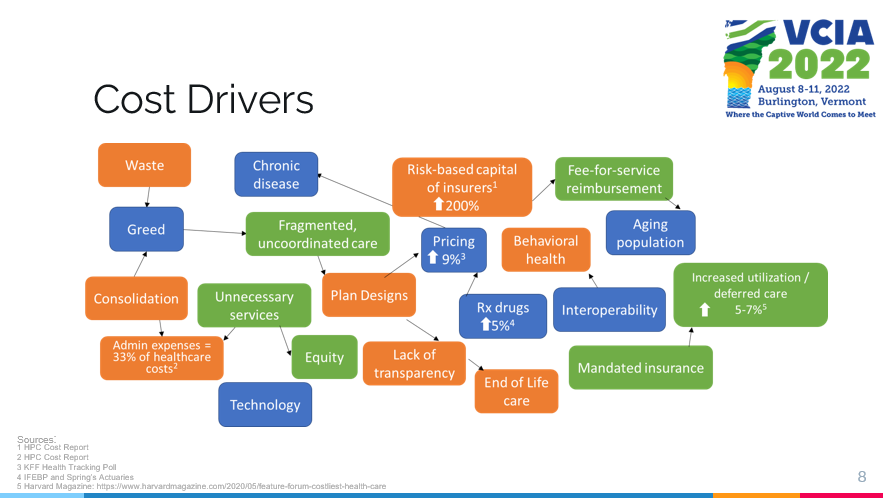

Cost of Healthcare

Healthcare costs keep climbing for both employers and employees and our actuaries predict an increase in medical trends for 2022 between 4%-7%. Looking back further, within the past decade healthcare costs have risen roughly 80% for employees and 60% for employers while economic growth has been consistent at 2.5% annually. This increase in costs is coming from a range of factors including administrative expenses, prescription drug prices, increased utilization/deferred care, and risk-based capital of insurers.

We are also seeing a transition in what employees want out of their benefits packages. Our working population is changing; boomers are retiring and transitioning from employer health insurance to Medicare. Millennials have different needs and are looking for straightforward and convenient benefits without high costs. These shifts in healthcare priorities along with high costs have slowly made self-insurance the norm, with a Spring survey reporting 64% of all employers are now self-insured.

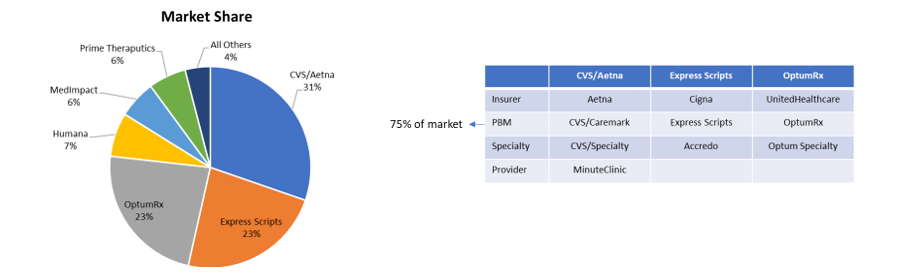

When looking at the healthcare market the vast majority of pharmacy spending is through pharmacy benefit managers (PBMs). Employers estimate outpatient pharmacy to be about 18% of health spending, with an additional estimated 10% within medical claims. Also in 2020, overall drug spending rose by almost 5%, with utilization and new drugs driving most of this increase.

Self-Insurance

We are seeing a fundamental change in the healthcare market, and all parties within the healthcare continuum are being asked to handle risk and chase healthcare dollars. This has pushed many employers to move towards self-funding plans which allow for greater customization, more control over risk, and potential cost savings. Many of these self-insured programs are looking at putting medical stop-loss into a captive, with a Spring survey reporting that although less than 50% of self-insured programs have stop-loss coverage, 42% of those that do have it within a captive.

Within the COVID era we have also seen many changes in the industry and numerous employers are reevaluating their healthcare packages. There has been a giant spike in mental health and COVID-19 resources like telehealth, and a decline in elective surgery. These trends have left hospitals and providers with the short end of the stick, leaving self-insured employers and health plans as the parties saving the most in the insurance landscape.

Case in Point: edHEALTH

Tracy Hassett led the case study portion of the presentation, with edHEALTH being a prime example to of a captive successfully yielding savings in healthcare costs as well as flexibility of options. edHEALTH is a consortium of 25 higher education institutions who came together (originally as a group of six schools) to bend the trend in rising healthcare costs. Today, edHEALTH covers almost 15,000 employees (~30,900 lives) and aim to better understand and control their healthcare costs and risk. Tracy explained edHEALTH’s captive structure and how the captive retained savings of $6.7M since inception through 2020, in addition to paying out $3.2M in dividends.

These universities all have similar risks when it comes to healthcare, so investing in a group captive was the ideal solution. Each member chooses their own level of risk and pays for their own claims (below the established self insured retention level [SIR]), but still has control of their program. Tracy continued to explain how prescription drug costs are one of their largest challenges when trying to save money in creating/reevaluating healthcare plans. However, with their captive in the past four years edHEALTH members have saved an estimated $50M on Rx costs.

All in all, I was honored to join in the thought-provoking discussions that took place at VCIA. Since medical stop-loss is one of the biggest areas of focus for our clients right now, it was a pertinent conversation and I was glad to have the opportunity to share my perspective, as well as the success of edHEALTH. Burlington remains as perfectly quaint as ever, and I look forward to next year’s event.

Whether or not we have seen the worst of The Great Resignation, savvy employers are not new to adjusting their benefits and “perks” programs to better align with workforce desires. At the Disability Management Employer Coalition (DMEC) Annual Conference last week in Denver, I spoke specifically on whether Flexible Time Off (FTO) has taken over as the frontrunner, versus the more traditional Paid Time Off (PTO) approach. I thought you might be curious to know the answer, at least in my opinion, so I’m jotting down the key points from my presentation here.

Background

As with so many things in business and in life, in order to clearly understand the current state of PTO, it’s critical to look back at the history of the concept. In 1910, President Taft proposed 2-3 months of required vacation, “in order to continue his work next year with the energy and effectiveness which it ought to have.” Countries like Germany, Sweden, and others were no strangers to this idea, and set forth on setting global standards regarding minimum levels of vacation. Today, the U.S. is one of only six countries in the world – and the only industrialized nation – without a national paid leave policy. So, what gives?

At least on paper, Americans seem to prefer work over vacation. You may be laughing or rolling your eyes, but it is a fact that significant time off goes unused at the end of the year (people choose to lose it rather than use it). In some cases, this may be the result of a corporate culture that, while they may document PTO programs, do not actually encourage the use of that time. If you’re expected to work while on vacation, you may not feel it worthwhile to take said vacation.

PTO

Over the years additional policies popped up to fill some of these gaps, such as leave related to COVID-19, sick leave, disability, parental leave, and family leave. Many organizations arrived at a PTO program in which an allocated number of days account for different types of leave which vary by employer, but might include vacation, bereavement, sick and personal leave. While this creates efficiency and reduces unscheduled absences, this design (perhaps inadvertently) encourages working while sick, as employees do not want to use days within their bucket when they have a cold, since those same days could be used on a tropical vacation or, on a less happy note, in the case of a personal or family emergency. This flaw went from acceptable to unacceptable in light of the pandemic, and turned some organizations off of PTO and on to FTO.

FTO

Flexible Time Off (FTO) allows for ultimate flexibility in the volume of “vacation” time taken. With the expectation that employees do their jobs, meet deadlines and achieve their individual and corporate goals, time for rest is scheduled at the discretion of managers. FTO however is not to be confused with unlimited vacation days. While a nice idea, some challenges exist around FTO, including:

- FTO plans are unlikely to meet the needs for vacation plans and sick/safe plans, and are not recommended to fulfill all of these requirements given federal and state law complexities

- Performance management and manager training is critical with this design

- Be careful about creating guidelines around the number of acceptable days off, because it can quickly morph into a PTO plan with wage liability

- Participation in FTO plans for non-exempt employees is not recommended as it will result in payroll obstacles and litigation susceptibility

Given these factors, however, FTO plans can be a powerful organizational tool. If you’re considering FTO, I recommend first answering the following questions:

- Which population should be considered for FTO?

- What approach will ensure managers are managing workload instead of time off?

- What scheduling and approval processes will be implemented?

- How will you ensure employees have the opportunity to leverage their FTO?

- Are you accounting for sick/safe requirements through another policy/program?

- How will you answer to the stigma that FTO is designed to decrease utilization and save you (the employer) from PTO liability?

The Big Reveal

FTO can bring a lot to the table for an organization: it is unlikely to result in more time off (than before), it is financially savvy, a good recruiting tool, and relatively easy to implement. On the flip side, however, I noted some real challenges. In the end, and if you read this article for the clickbait title, my investigative answer is no: FTO is not the new PTO. It should however be considered as one tool within the absence management toolbox, and assessed according to your individual employer needs and priorities.