Our VP, TJ Scherer, was recently quoted in an article from Captive.com spotlighting how captive domiciles count captives differently, which can influence how people and organizations view successful domiciles. Check out the full article here.

During the Captive Insurance Companies Association (CICA)‘s Annual Conference this year, Global Captive Podcast was on the scene interviewing captive leaders. Check out our VP, TJ Scherer’s interview here.

The Captive Insurance Companies Association (CICA) has announced that Mary Ellen Moriarty will become the new chair of CICA, and our Senior Vice President will take on the role of secretary/treasurer. You can find Captive International’s full article here.

The Captive Insurance Companies Association has announced that Mary Ellen Moriarty will become the new chair of CICA, and our Senior Vice President will take on the role of secretary/treasurer. You can find Captive Review’s full article here.

As Captive International and Spring share the same birthday (March 24th), here is a collaborative Q&A with our leadership team. Some of the topics discussed include the progression of the captive industry, market challenges and future opportunities.

As Captive Review celebrates its 25th birthday, they have released a list of the 25 most influential people in the captive space in the last 25 years. Our Managing Partner, Karin Landry was featured in their list for her expertise in risk management and alternative risk financing solutions. You can find the full article here.

As seen in the New England Employee Benefits Council (NEEBC)’s blog.

Paid Family and Medical Leave continues to evolve throughout New England and the country. While most of the activity has been at the state level, proposals have also been put forth federally. The programs passed by states vary in a number of ways, which leads to complexity for employers trying to navigate this landscape. Compliance concerns and complexities have also grown as the trend for remote work has continued, and employers that hire across the nation must comply with laws where employees work.

Massachusetts: Experience Over the Years

We have now completed our third year of the Massachusetts Paid Family and Medical (PFML) program! In those three years, the program has seen changes in contributions, benefits, claims experience, as well as changes to how it operates and coordinates with other benefits.

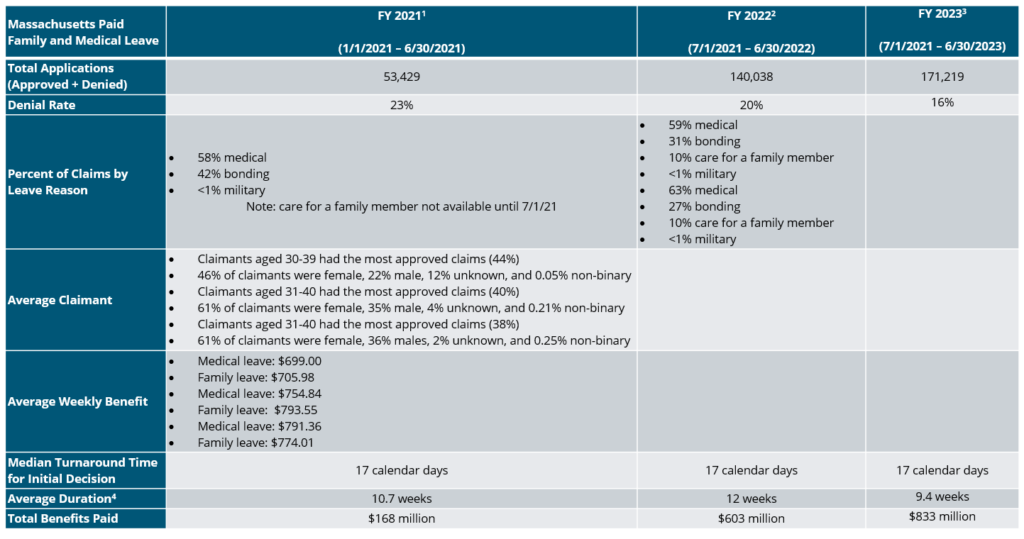

As shown in the summary below, the number of applications for the MA state PFML program has increased annually, as well as the number of approved claims. The most common reason for leave is own medical condition, while bonding with a new child is slightly lower in FY 2023 than FY 2022. Additional points of interest are shown below.

MA PFML Increases as of 1/1/24

The MA PFML weekly maximum benefit amount and contribution rate increased effective January 1, 2024. The maximum weekly benefit is now $1,149.90, which is an increase of about $20 from the 2023 weekly maximum. For any employees who may have leave that runs from 2023 into 2024, the weekly benefit will be based on the beginning of the benefit year.

The total contribution is increasing from 0.63% to 0.88%, for employers with 25 or more covered individuals. The medical leave contribution will be 0.70%, with employers funding 0.42% and employees responsible for up to 0.28%. The family leave contribution will be 0.18%, with employers able to collect the total contribution from employees. Employers with less than 25 employees are not required to submit the employer portion of premium, so the effective total contribution rate is 0.46%.

The financial earnings requirement was also updated in 2024. Employees must have earned at least $6,300 and 30 times the PFML benefit amount during the last 4 completed calendar quarters to be considered eligible for MA PFML.

Additional Changes to MA PFML

Effective November 1, 2023, employees taking Paid Family and Medical Leave (PFML) in Massachusetts have the option to “top off” PFML benefits with available accrued paid leave (e.g., PTO, etc.) so the employee can receive up to 100% of their regular wages. This was not previously allowed for employers providing PFML through the state plan, however, was an option employers could allow through a private plan. The Department amended its FAQs in December clarifying employers can apply the terms of their company policies to the top up option.

Connecticut: A Year in Review

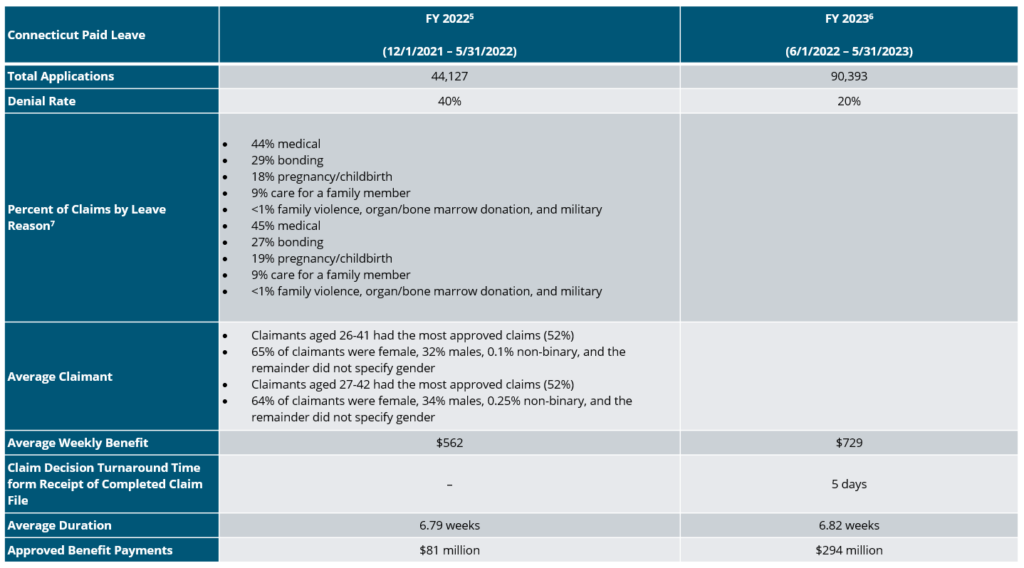

Connecticut has now had PFML benefits available for 2 years. The program continues to grow, as shown in the summary below.

Based on the experience in the state in 2022 and 2023, Connecticut is not making any major changes to the program in 2024. The contribution rate will remain at 0.5% up to the social security wage contribution cap, which is increasing to $168,600 in 2024 ($160,200 in 2023). In addition, the CT minimum wage increases to $15.69 per hour in 2024, which correlates to an increase of about $40 for the maximum weekly benefit, now $941.90.

Connecticut’s Key Differences

The CT PFML program has some key differences when compared to MA PFML, such as the availability of leave for organ and bone marrow donation, as well as leave related to family violence. Differences in benefit amounts, leave duration, and eligibility conditions make it not directly comparable to MA PFML experience.

Rhode Island: Changes for 2024

Rhode Island established the first statutory disability program in the country in 1942, known as Rhode Island Temporary Disability Insurance (TDI). In 2014, they became the third state to offer family leave benefits through temporary caregiver insurance (TCI). The state does not allow private plans, making the model slightly different than other PFML programs in the region.

On January 1, 2024, a few updates to TDI and TCI became effective. The state’s taxable wage base increased to $87,000 in 2024, up from $84,000 in 2023. The contribution rate in 2024 is 1.2%, which is an increase of 0.1% from the previous two years. The maximum weekly benefit is $1,043, not including the dependency allowance8, and the minimum weekly benefit is $130.

The financial eligibility conditions claimants must meet increased. Employees must have paid contributions of at least $16,800 in the base period or meet the alternative conditions wherein they earned at least $2,800 in one of the base period quarters and base period taxable wages equal at least $5,600.

Rhode Island provides data on a weekly basis, which can be found on the State of Rhode Island Department of Labor and Training’s website.

New Hampshire: The First Year for the First Voluntary Program

New Hampshire began paying benefits for the first Voluntary PFML Plan in the nation on January 1, 2023. New Hampshire employers can purchase coverage for 6 or 12 weeks through the state’s insurance carrier, MetLife, at any time. Employers may purchase coverage through other carriers, however the 50% Business Enterprise Tax (BET) Tax Credit will not apply. Individuals who are not covered by a NH PFML plan or equivalent plan may purchase individual plan coverage for 6 weeks. Individuals may only enroll during the open enrollment period, which is December 1, 2023, through January 29, 2024, for the 2024 plan year.

Premium amounts are determined through the underwriting and enrollment process but may not exceed $5 per week for individuals. No limit applies to employer premium.

The maximum weekly benefit for NH PFML is 60% of the Social Security wage cap ($168,600). Therefore, the maximum weekly benefit is $1,945.38 in 2024, an increase from $1,848.46 in 2023.

The state has not yet published 2023 claim data.

Other New England Updates

In addition to Massachusetts, Connecticut, Rhode Island, and New Hampshire, Vermont and Maine have evolving PFML programs.

Vermont launched their voluntary Family and Medical Leave Insurance (FMLI) program in 2023. Beginning on July 1, 2023, state employees were covered under the program. Other private and public employers with 2 or more employees can access the program on July 1, 2024, and small employers with one employee and individuals can purchase coverage for benefits beginning on July 1, 2025. Similar to New Hampshire, Vermont will offer 6 weeks of benefits at 60% of the Social Security wage cap. Cost will vary.

Maine officially created their Paid Family and Medical Leave program through the budget signed on July 11, 2023. Rulemaking will launch in 2024, with contributions beginning January 1, 2025, and benefits becoming available on May 1, 2026.

Are You Up to Speed?

Outside the region, California, Colorado, Delaware, Hawaii, Maryland, Minnesota, New Jersey, New York, Oregon, Washington, and the District of Columbia, as well as Puerto Rico, have mandatory paid family and medical leave and/or statutory disability insurance programs either in place or launching in upcoming years. As the PFML landscape continues to evolve at the local, state and federal level, policies need to be monitored on an ongoing basis.

PFML requirements are based on an employee’s work location. Employers should ensure they are compliant with the requirements of each individual leave program where they have employees working, and are aware of the differences by state. If any of your employees are subject to state PFML, you should review plans, policies, and processes to confirm they align with any legislative changes. To do so, the following checklist can be helpful:

- Register in any new states where employees work, if required

- Review your contribution strategy and ensure contributions are being collected

- Update employee notices and benefit documentation

- Consider private plans where available and in accordance with your corporate philosophy

- Ensure company sponsored leave programs coordinate with PFML to the extent possible

- Monitor changes in legislation that may impact compliance

If you need assistance ensuring PFML compliance or to assess the optimal plan set up for your organization, visit our Spring Consulting Group Paid Family and Medical Leave dashboard for additional information.

In a recent article published by Yahoo Finance, Reliance Matrix was ranked as the most popular absence management provider according to Spring’s annual 2023 benchmarking survey. Check out the full article here.

In a recent article published by BusinessWire, Reliance Matrix was ranked as the most popular absence management provider according to Spring’s annual 2023 benchmarking survey. Check out the full article here.