Alternative Risk Financing & Captives

Overview

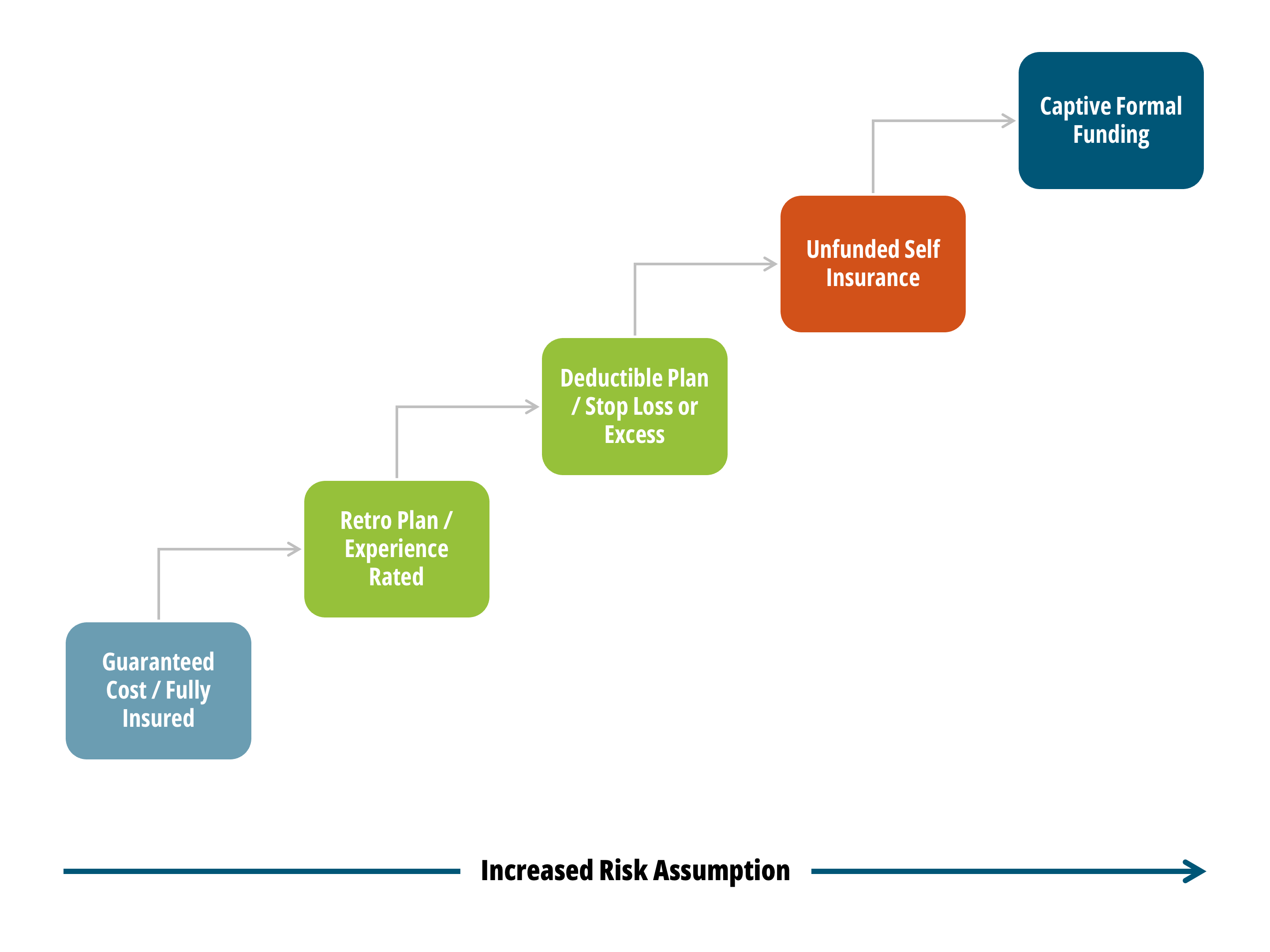

As we continue to face rising healthcare and other insurance costs, many organizations are looking for non-traditional methods to assist in financing their employee benefits and property & casualty insurance programs. There are a range of alternative risk funding solutions available, which offer different ways to retain, finance, and manage risk. For decades, sophisticated, forward-thinking organizations have embraced alternative risk funding techniques to enhance the value and efficiencies of their insurance programs.

Risk Financing Continuum

Captive Insurance – What & Why

Captive insurance companies are insurance subsidiaries that provide funding vehicles for their parents’ risks. Captives can be established in a variety of forms – as wholly owned subsidiaries or non-owned programs, depending on the size of an organization. There are now over 7,000 captive insurers worldwide. Approximately 90% of Fortune 500 companies employ of some type of captive insurance company arrangement.

Captives are a powerful tool to help organizations rethink their insurance programs. The list of captive advantages continues to grow, and can make significant organizational impacts such as:

- Potential short and long-term cost savings, including the ability to capture investment return and recoup profits that are currently going to insurance carriers

- Customized insurance programs (employee benefits designs and property & casualty), including enhanced coverage unavailable in the commercial markets

- Enterprise risk financing applications

- Potential financial efficiencies

- Improved data management and reduction in claims costs

- Reduced frictional costs (i.e. administrative)

- Management of a central risk pool

- Facilitates benefit parity across the globe

- Greater visibility into insurance spend and impacts

Our Captive Services

We specialize in the following, for organizations of all sizes and industries:

Captive Feasibility

- Determine appropriate coverages for consideration

- Identify preferred domiciles

- Define structure, including financial arrangements and service requirements

- Develop loss projections and financial pro formas

- Facilitate go, no-go decisions

Captive Program Modeling:

- Confirm preferred domicile, coverages and parameters

- Develop program structure, including financial arrangements and service requirements

- Access/coordinate tax opinions

- Complete loss projections including scenario modeling and pro forma financials

Captive Implementation:

- Meet with domicile insurance commissioner to discuss filing

- Develop program submission to captive domicile insurance commissioner

- Submit captive application

- Draft policies and procedures

- Arrange for excess coverage through RFP process (access commercial market)

- Finalize partnership arrangements

Ongoing Captive Administration and Actuarial Support:

- Develop policy forms, necessary filings, service standards and procedures

- Issue policies and provide ongoing administration

- Conduct actuarial reviews of reserves, liabilities and perform certifications

- Develop premium, loss and expense allocation

- Review existing programs and identify areas for expansion- create business plans and financial models to support expansion

- Continually monitor the program success against the initial and changing objectives

Other Alternative Risk Financing Options

For a range of reasons, some organizations find that a captive insurance solution is not the right fit, but are still interested in models other than a traditional, fully-insured structure. We help clients evaluate the universe of options to identify the optimal solution for their organization, which might turn out to be:

- Risk Retention Groups (RRGs)

- Professional Employer Organization (PEO)

- Defined Contribution Plan (ICHRA, HRA, HSA, FSA)

- Multi Employer Welfare Association (MEWA)

- Voluntary Employee Beneficiary Association (VEBA) and Trusts

Regardless of the particular model, self-insurance yields the following advantages for organizations that choose this path:

- Gain a complete and transparent understanding of the various pieces involved in insurance transaction – claims, admin fees, taxes, reinsurance, and insurance company profits

- Eliminate insurance company profits, to a large extent

- Better understand underlying organizational risk to more proactively management claims costs through interventions such as disease management solutions

- Control the administrative aspect of your programs and decrease administrative fees

- Improve cash flow management

- Yield long-term cost savings

From setting overall strategy, to analyzing your data to understand the best fit, all the way through to implementation, we are here to ensure your insurance programs are maximized and tailored to your needs.

Why Spring

Spring is a leader in developing innovative and intelligent alternative risk funding strategies that lower costs, improve management control, enhance coverage, increase program design flexibility and help establish financial stability for our clients.

There is no other firm out there that is as dedicated and flexible with providing you with the right solution from development through implementation. Our thought leadership in this space has not gone unnoticed. We have been named Actuarial firm of the year by Captive Review on several occasions; our Managing Partner, Karin Landry, was most recently named #5 on Captive Review’s Power 50 list; in 2020 and 2021, our team was recognized for leading actuarial and feasibility study expertise.

Our captive consultants have helped innovate captive funding of employee benefits, from the beginning. We have since helped many other organizations through the Department of Labor (DOL) process. Our strategies have incorporated group life and AD&D insurance, long term disability, retiree medical benefits, pensions, workers’ compensation, medical stop loss, and other liability risks. We have worked with captives that have been domiciled both domestically and offshore.