We have all greeted our alarm clocks with disgust at times or been a bit overzealous with the snooze button, but what if your sleep pattern was so strained that every morning you and your alarm had a passive-aggressive standoff? How long could you tolerate that lack of sleep before your work or personal life was negatively impacted, and what, if anything, could help you find more rest to be the best version of yourself?

The National Safety Council (NSC) estimates that approximately 43% of workers are sleep-deprived, and that an overtired population is less productive, less present, and a potential safety risk. Organizations with safety sensitive positions or third shift workers have a greater risk, but all fatigued employees pose a greater risk to themselves and their employer than those that are well-rested.

Similar statistics from The Centers for Disease Control and Prevention indicate that many American adults (35%) get inadequate sleep (defined as under seven hours); and they indicate that lack of sleep is associated with increased risks for cardiovascular disease, obesity, diabetes, hypertension, depression, and all-cause mortality. Employee burnout is another phenomenon that is exacerbated if sleep issues exist.

As employers embrace the expansion of benefit offerings, sleep has entered the scene as a potential issue that needs addressing. Organizations are assessing how they can implement sleep education, tracking, and resolution for their employees with the goal of arriving at a more productive and healthier workforce. Employee benefit offerings surrounding sleep include some or all of the following features:

- Educational information related to sleep

- Mindfulness or stress reduction apps that might include reminders related to sleep habits such as your bedtime routine or your sleep environment

- Tracking of sleep patterns through wearable devices or apps with reporting to user; may or may not include suggestions for an enhanced sleep experience

- Supporting diagnosis and treatment of sleep disorders

- Remote monitoring of devices (e.g., CPAP machines)

Selecting the optimal solution for employees can be challenging, especially given that price points vary considerably, and employees are fatigued by all the available solutions. The best place to start is by examining the data available to you and try to assess if undiagnosed sleep disorders are a pain point within your organization. From there, consider how sleep support aligns with your overall wellness and well-being offering. Education around sleep is a strong entry point to talk about self-care and mindfulness without the stigma that surrounds conversations around behavioral health and substance abuse. Every one of us wants a better relationship with our alarm clock. Conveniently, many of the remedies for better sleep habits support better physical, emotional and psychological health as well. Given this, sleep tracking might just be the next big employee perk. Set your alarm, or you just might miss the trend.

Over the past five years, the outsourced vendor landscape has evolved related to the administration of the Americans with Disabilities Act (ADA). Carriers and third-party administrators (TPA) who previously supported employers with leave compliance at the federal and state levels (i.e. FMLA, MA PFML, CT PFL, etc.) are now proficient in ADA and will support employers with their compliance requirements.

Product offerings vary in the market, with some including support for leave as an accommodation exclusively and others providing support with all accommodations including leave. The assistance available from vendor partners also differs, with some supporting the entire process end-to-end, including coordination of the interactive process with supervisors and employees, while others support data collection but leave the interactive process to supervisors, employees, and HR. At this point, all carriers and TPAs agree that the ultimate decision on the accommodation rests exclusively with the employer, including evaluation of the potential hardship.

Employers with minimal accommodation requests likely do not need support from an external partner. For those employers, it is usually optimal to build some subject matter expertise internally within HR and funnel requests through that resource. At a high level that process should include the following steps:

- Identify the need for accommodation, facilitate intake/request

- Validate the need/disability, gather information

- Facilitate the interactive process

- Consider options

- Choose optimal accommodation in partnership with the employee

- Implement the accommodation (if applicable)

Although the supervisor is a critical part of the process, we typically recommend that supervisors do not independently manage the ADA process – especially if the volume of requests is small – as they may not understand the compliance requirements. In addition, they often only have a view into their business unit or team, making it impossible for them to understand how the broader organization would define a hardship under the ADA as compared to their team or business unit.

If the volume of accommodation requests is high or subject matter expertise does not exist in-house, leveraging your external provider may be a strong option. By co-sourcing the ADA solution, you can leverage the expertise of the external vendor but leave decision-making to your team, including HR, supervisor and employee. Key assessment of an ADA offering includes the following:

- Expertise of firm; skillset of those managing accommodations

- Offering; what is included in the fee

- Intake

- Certification

- Communications

- Interactive process

- Implementation of accommodation (i.e. order device, implement change, track ongoing needs until return to full time and full duty without accommodation)

- Add-on services (what additional support can they provide with additional fee?)

- Hand-offs between their team and HR, supervisors, etc.

- Training available both at transition and on-demand; most will not participate in training until it directly impacts them

Regardless of the partner selected, employers can never fully outsource the accommodation process. Although it often feels like a burden, returning accommodated employees to the workplace is in the best interest of everyone. The ADA does not require that employers remove essential job functions, but it does ensure that disabled employees who are able to perform the essential functions of their job with an accommodation receive those legally required accommodations.

If you need support with your accommodation process and compliance with ADA, free resources are available through the Job Accommodation Network (askjan.org) or feel free to reach out to our team for guidance.

As seen in the New England Employee Benefits Council (NEEBC)’s blog.

Paid Family and Medical Leave continues to evolve throughout New England and the country. While most of the activity has been at the state level, proposals have also been put forth federally. The programs passed by states vary in a number of ways, which leads to complexity for employers trying to navigate this landscape. Compliance concerns and complexities have also grown as the trend for remote work has continued, and employers that hire across the nation must comply with laws where employees work.

Massachusetts: Experience Over the Years

We have now completed our third year of the Massachusetts Paid Family and Medical (PFML) program! In those three years, the program has seen changes in contributions, benefits, claims experience, as well as changes to how it operates and coordinates with other benefits.

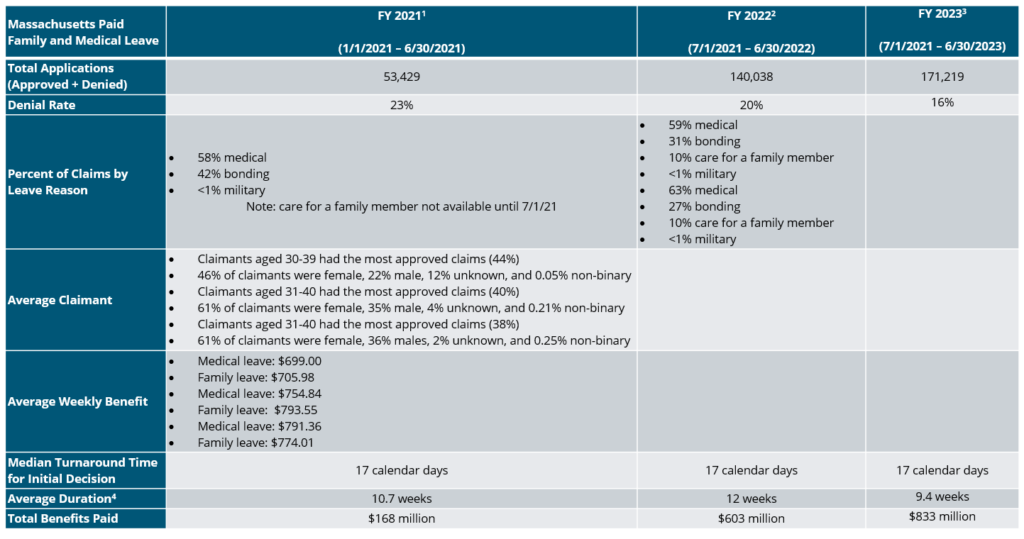

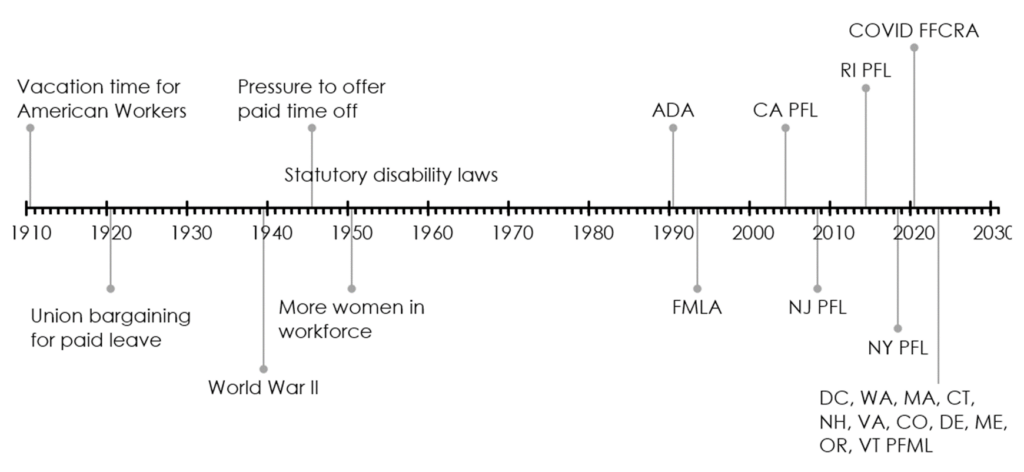

As shown in the summary below, the number of applications for the MA state PFML program has increased annually, as well as the number of approved claims. The most common reason for leave is own medical condition, while bonding with a new child is slightly lower in FY 2023 than FY 2022. Additional points of interest are shown below.

MA PFML Increases as of 1/1/24

The MA PFML weekly maximum benefit amount and contribution rate increased effective January 1, 2024. The maximum weekly benefit is now $1,149.90, which is an increase of about $20 from the 2023 weekly maximum. For any employees who may have leave that runs from 2023 into 2024, the weekly benefit will be based on the beginning of the benefit year.

The total contribution is increasing from 0.63% to 0.88%, for employers with 25 or more covered individuals. The medical leave contribution will be 0.70%, with employers funding 0.42% and employees responsible for up to 0.28%. The family leave contribution will be 0.18%, with employers able to collect the total contribution from employees. Employers with less than 25 employees are not required to submit the employer portion of premium, so the effective total contribution rate is 0.46%.

The financial earnings requirement was also updated in 2024. Employees must have earned at least $6,300 and 30 times the PFML benefit amount during the last 4 completed calendar quarters to be considered eligible for MA PFML.

Additional Changes to MA PFML

Effective November 1, 2023, employees taking Paid Family and Medical Leave (PFML) in Massachusetts have the option to “top off” PFML benefits with available accrued paid leave (e.g., PTO, etc.) so the employee can receive up to 100% of their regular wages. This was not previously allowed for employers providing PFML through the state plan, however, was an option employers could allow through a private plan. The Department amended its FAQs in December clarifying employers can apply the terms of their company policies to the top up option.

Connecticut: A Year in Review

Connecticut has now had PFML benefits available for 2 years. The program continues to grow, as shown in the summary below.

Based on the experience in the state in 2022 and 2023, Connecticut is not making any major changes to the program in 2024. The contribution rate will remain at 0.5% up to the social security wage contribution cap, which is increasing to $168,600 in 2024 ($160,200 in 2023). In addition, the CT minimum wage increases to $15.69 per hour in 2024, which correlates to an increase of about $40 for the maximum weekly benefit, now $941.90.

Connecticut’s Key Differences

The CT PFML program has some key differences when compared to MA PFML, such as the availability of leave for organ and bone marrow donation, as well as leave related to family violence. Differences in benefit amounts, leave duration, and eligibility conditions make it not directly comparable to MA PFML experience.

Rhode Island: Changes for 2024

Rhode Island established the first statutory disability program in the country in 1942, known as Rhode Island Temporary Disability Insurance (TDI). In 2014, they became the third state to offer family leave benefits through temporary caregiver insurance (TCI). The state does not allow private plans, making the model slightly different than other PFML programs in the region.

On January 1, 2024, a few updates to TDI and TCI became effective. The state’s taxable wage base increased to $87,000 in 2024, up from $84,000 in 2023. The contribution rate in 2024 is 1.2%, which is an increase of 0.1% from the previous two years. The maximum weekly benefit is $1,043, not including the dependency allowance8, and the minimum weekly benefit is $130.

The financial eligibility conditions claimants must meet increased. Employees must have paid contributions of at least $16,800 in the base period or meet the alternative conditions wherein they earned at least $2,800 in one of the base period quarters and base period taxable wages equal at least $5,600.

Rhode Island provides data on a weekly basis, which can be found on the State of Rhode Island Department of Labor and Training’s website.

New Hampshire: The First Year for the First Voluntary Program

New Hampshire began paying benefits for the first Voluntary PFML Plan in the nation on January 1, 2023. New Hampshire employers can purchase coverage for 6 or 12 weeks through the state’s insurance carrier, MetLife, at any time. Employers may purchase coverage through other carriers, however the 50% Business Enterprise Tax (BET) Tax Credit will not apply. Individuals who are not covered by a NH PFML plan or equivalent plan may purchase individual plan coverage for 6 weeks. Individuals may only enroll during the open enrollment period, which is December 1, 2023, through January 29, 2024, for the 2024 plan year.

Premium amounts are determined through the underwriting and enrollment process but may not exceed $5 per week for individuals. No limit applies to employer premium.

The maximum weekly benefit for NH PFML is 60% of the Social Security wage cap ($168,600). Therefore, the maximum weekly benefit is $1,945.38 in 2024, an increase from $1,848.46 in 2023.

The state has not yet published 2023 claim data.

Other New England Updates

In addition to Massachusetts, Connecticut, Rhode Island, and New Hampshire, Vermont and Maine have evolving PFML programs.

Vermont launched their voluntary Family and Medical Leave Insurance (FMLI) program in 2023. Beginning on July 1, 2023, state employees were covered under the program. Other private and public employers with 2 or more employees can access the program on July 1, 2024, and small employers with one employee and individuals can purchase coverage for benefits beginning on July 1, 2025. Similar to New Hampshire, Vermont will offer 6 weeks of benefits at 60% of the Social Security wage cap. Cost will vary.

Maine officially created their Paid Family and Medical Leave program through the budget signed on July 11, 2023. Rulemaking will launch in 2024, with contributions beginning January 1, 2025, and benefits becoming available on May 1, 2026.

Are You Up to Speed?

Outside the region, California, Colorado, Delaware, Hawaii, Maryland, Minnesota, New Jersey, New York, Oregon, Washington, and the District of Columbia, as well as Puerto Rico, have mandatory paid family and medical leave and/or statutory disability insurance programs either in place or launching in upcoming years. As the PFML landscape continues to evolve at the local, state and federal level, policies need to be monitored on an ongoing basis.

PFML requirements are based on an employee’s work location. Employers should ensure they are compliant with the requirements of each individual leave program where they have employees working, and are aware of the differences by state. If any of your employees are subject to state PFML, you should review plans, policies, and processes to confirm they align with any legislative changes. To do so, the following checklist can be helpful:

- Register in any new states where employees work, if required

- Review your contribution strategy and ensure contributions are being collected

- Update employee notices and benefit documentation

- Consider private plans where available and in accordance with your corporate philosophy

- Ensure company sponsored leave programs coordinate with PFML to the extent possible

- Monitor changes in legislation that may impact compliance

If you need assistance ensuring PFML compliance or to assess the optimal plan set up for your organization, visit our Spring Consulting Group Paid Family and Medical Leave dashboard for additional information.

Paid Family and Medical Leave continues to evolve throughout the country. While most of the activity has been at the state level, proposals have also been put forth federally. The programs passed by states vary in terms of covered workers, benefits paid, leave duration, funding, private plan availability and coordination with other leave programs. Variety across states leads to complexity for employers trying to navigate this landscape. Compliance concerns have also grown as the trend for remote work has continued, and as employers that hire across the nation must comply with laws where employees work.

A summary of changes to benefits and contributions in 2024 is below for each state program. Additional information can be found on Spring Consulting Group’s Paid Family and Medical Leave dashboard.

California

California’s Statutory Disability Insurance (SDI) law went into effect in 1946. In 2004, Paid Family Leave (PFL) requirements were added to the law, making it the first state to create a paid family leave program. In 2024, CA is increasing the contribution rate from 0.9% to 1.1%, which is fully paid by employees. Additionally, the SDI taxable wage maximum is eliminated, meaning all employee wages are subject to the SDI contribution requirement. This change does not apply to voluntary plans. The maximum weekly benefit will remain at $1,620.

Colorado

The Colorado Family and Medical Leave Insurance Program (FAMLI) officially begins paying benefits on January 1, 2024, after 1 year of collecting contributions. The contribution rate will remain at 0.9% of wages, however, Social Security wage limit is increasing to $168,600. Employees are responsible for up to 50% of the total contribution. In 2024, the maximum weekly benefit is $1,100.

Connecticut

The state began collecting contributions on January 1, 2021 and benefits became available one year later in 2022. Based on the experience in the state in 2022 and 2023, Connecticut is not making any major changes to the program in 2024. The contribution rate will remain at 0.5% up to the Social Security wage contribution cap, which is increasing to $168,600 in 2024 ($160,200 in 2023). In addition, the CT minimum wage increases to $15.69 per hour in 2024, which correlates to an increase of about $40 for the maximum weekly benefit, now $941.90.

Delaware

The Delaware Paid Family and Medical Leave Insurance program was signed into law on May 11, 2022. The state has been developing rules and regulations prior to contributions beginning on January 1, 2025 and benefits become available on January 1, 2026.

The state was the first to provide an opportunity for employers with comparable leave programs to opt-out of the Delaware Paid Leave and grandfather their employer plan for up to five years. Employers had to submit applications by January 1, 2024. Additionally, employers who are interested in applying for private plans under Delaware PFML will be able to do so beginning in September of 2024.

Hawaii

Hawaii enacted the Temporary Disability Insurance (TDI) law in 1969 and remains the last state (other than Puerto Rico) to not add paid family leave provisions to their statutory disability program.

In 2024, the maximum weekly benefit will increase by $33 to $798. The total contribution rate will vary by employer, however, employers can collect up to 0.5% of the maximum weekly wage base from employees, which equates to $6.87 per week. The maximum weekly wage base in 2024 is $1,374.78.

Maine

Maine officially created their Paid Family and Medical Leave program through the budget signed on July 11, 2023. Rulemaking will launch in 2024, with contributions beginning January 1, 2025, and benefits becoming available on May 1, 2026.

Maryland

Maryland will begin collecting contributions on October 1, 2024, and begin paying benefits on January 1, 2026. The total contribution rate will be 0.90%. Employers can collect up to 0.45% from employees and are responsible for funding at least 0.45%. However, employers with less than 15 employees are not required to contribute the employer portion of the premium. Additionally, employers interested in applying for a private plan will be able to do so this fall.

Massachusetts

Massachusetts Paid Family and Medical Leave (PFML) began paying benefits for medical leave, bonding, and military reasons on January 1, 2021 after collecting contributions for 15 months. Leave to care for a family member began on July 1, 2021. After three years of experience, Massachusetts will be increasing the weekly maximum benefit amount and the contribution rate, effective January 1, 2024.

The maximum weekly benefit is now $1,149.90, which is an increase of about $20 from the 2023 weekly maximum. For any employees who may have leave that runs from 2023 into 2024, the weekly benefit will be based on the beginning of the benefit year.

The total contribution is increasing from 0.63% to 0.88%, for employers with 25 or more covered individuals. The medical leave contribution will be 0.70%, with employers funding 0.42% and employees responsible for up to 0.28%. The family leave contribution will be 0.18%, with employers able to collect the total contribution from employees. Employers with less than 25 employees are not required to submit the employer portion of premium, so the effective total contribution rate is 0.46%.

The financial earnings requirement was also updated in 2024. Employees must have earned at least $6,300 and 30 times the PFML benefit amount during the last 4 completed calendar quarters to be considered eligible for MA PFML.

Minnesota

Minnesota is working to develop the rules for PFML. Contributions and benefits are set to begin at the same time on January 1, 2026, which would mean they are one of the only states to not pre-fund a PFML program in recent years. The contribution rate will be 0.7%, with employers funding at least 50%. Beginning in 2024, most employers will be required to submit a report detailing quarterly wages and hours worked for each employee.

New Hampshire

New Hampshire began paying benefits for the first Voluntary PFML Plan in the nation on January 1, 2023. New Hampshire employers can purchase coverage for six or 12 weeks through the state’s insurance carrier, MetLife, at any time. Employers may purchase coverage through other carriers; however the 50% Business Enterprise Tax (BET) Tax Credit will not apply. Individuals who are not covered by a NH PFML plan or equivalent plan may purchase individual plan coverage for six weeks. Individuals may only enroll during the open enrollment period, which is December 1, 2023, through January 29, 2024, for the 2024 plan year.

Premium amounts are determined through the underwriting and enrollment processbut may not exceed $5 per week for individuals. No limit applies to employer premiums.

The maximum weekly benefit for NH PFML is 60% of the Social Security wage cap ($168,600). The maximum weekly benefit is, therefore, $1,945.38 in 2024, an increase from $1,848.46 in 2023.

New Jersey

New Jersey was the third state to create a statutory disability insurance program when the Temporary Disability Benefits (TDB) law went into effect in 1948. In 2008, the state added Family Leave Insurance (FLI).

In 2024, the contribution rate and maximum weekly benefit will increase. The contribution rate will be 0.09%, up from 0.06% in 2023. The taxable wage base for employees will be $161,400. FLI is fully funded by employees. For TDI, employers pay a specific rate between 0.10% and 0.75%, up to the taxable wage base for employers of $42,300. Like in 2023, employees will not contribute towards TDI in 2024.

Earnings requirements have also increased. To qualify for NJ TDB and FLI in 2024, employees must have worked 20 weeks earning at least $283 per week or have earned $14,200 in the base year.

New York

New York Disability Benefits Law (DBL) went into effect in 1949. Paid Family Leave (PFL) was later introduced in 2018. In 2024 the contribution will decrease to 0.373%, from 0.455% in 2023. The rate will apply to wages up to the state average weekly wage of $1,718.15, and is fully funded by employee contributions. The maximum weekly benefit is also increasing to $1,151.16.

Oregon

Oregon benefits began paying on September 3, 2023, after collecting contributions for about 8 months, since the beginning of 2023. Effective January 1, 2024, the contribution rate will increase to 1%, up to the social security taxable wage maximum of $168,600. Employers can collect up to 60% of the total premium from employees. The maximum weekly benefit will remain at $1,523.63 and the minimum weekly benefit will be $63.49.

Puerto Rico

Puerto Rico launched their Non-Occupational Temporary Disability Insurance program, El Seguro por Incapacidad No Ocupacional Temporal (SINOT), in 1968. No paid family leave benefits have been added to date. In 2024, the maximum weekly benefit will remain at $113 ($55 maximum for agricultural workers) and the minimum weekly benefit will remain at $12. No change to the 0.6% contribution rate (up to $9,000 of earnings) has been announced for 2024. Employers may deduct up to 0.3% from employees.

Vermont

Vermont launched their voluntary Family and Medical Leave Insurance (FMLI) program in 2023. Beginning on July 1, 2023, state employees were covered under the program. Other private and public employers with 2 or more employees can access the program on July 1, 2024, and small employers with one employee and individuals can purchase coverage for benefits beginning on July 1, 2025. Similarly to New Hampshire, Vermont will offer 6 weeks of benefits at 60% of the Social Security wage cap. Cost will vary.

Rhode Island

Rhode Island established the first statutory disability program in the country in 1942, known as Rhode Island Temporary Disability Insurance (TDI). In 2014, they became the third state to offer family leave benefits through temporary caregiver insurance (TCI). The state does not allow private plans, making the model slightly different than other PFML programs in the region.

On January 1, 2024, a few updates to TDI and TCI became effective. The state’s taxable wage base increased to $87,000 from $84,000 in 2023. The contribution rate in 2024 is 1.2%, which is an increase of 0.1% from the previous two years. The maximum weekly benefit is $1,043, not including the dependency allowance1, and the minimum weekly benefit is $130.

The financial eligibility conditions claimants must meet increased so that employees must have paid at least $16,800 in the base period or meet the alternative conditions wherein they earned at least $2,800 in one of the base period quarters and base period taxable wages equal at least $5,600.

Washington

Washington began paying on January 1, 2020, after collecting contributions for a year. Effective January 1, 2024, the PFML contribution rate will decrease to 0.74% of an employee’s wage, up to the Social Security taxable wage maximum of $168,600. Employers must fund at least 28.57% and employees will contribute up to 71.43%. The maximum weekly benefit will increase to $1,456 per week.

Washington, D.C.

D.C. Paid Leave benefits began on July 1, 2020, and they had collected contributions since July 1, 2019. Effective October 1, 2023, the District released an updated Notice to Employees, which included an increased maximum weekly benefit, from $1,049 previously, to $1,118. No change has been announced to the 0.26% contribution rate, which is fully employer-funded.

What’s Next?

As the PFML landscape continues to evolve at the local, state, and federal levels, policies need to be monitored on an ongoing basis.

If you need assistance ensuring PFML compliance or to assess the optimal plan set up for your organization, Spring’s consultants are happy to help.

All information is subject to change.

1 Dependency allowance provides the greater of $10 or 7% of the benefit rate for up to 5 dependents

In a recent article published by Yahoo Finance, Reliance Matrix was ranked as the most popular absence management provider according to Spring’s annual 2023 benchmarking survey. Check out the full article here.

In a recent article published by BusinessWire, Reliance Matrix was ranked as the most popular absence management provider according to Spring’s annual 2023 benchmarking survey. Check out the full article here.

Title:

Consultant

Joined Spring:

I joined Spring in July 2017, shortly after I graduated from college.

Hometown:

I was born in Maine but grew up in Stockton, NJ. It’s a really small town and my elementary school only had about 60 people in it total.

At Work Responsibilities:

I work on our Absence Management Team and primarily help clients with their absence policies, as well as health and Rx plans. I also spend a lot of my time monitoring the paid leave landscape and updating our clients on legislative developments that may impact their leave programs throughout the country.

Outside of Work Hobbies/Interests:

I recently moved back to NJ and spend a lot of my time with my family and dogs, reading, and exploring my new neighborhood.

Fun Fact:

I spent a semester studying abroad in Cape Town, South Africa!

Describe Spring in 3 Words:

Dedicated, Invested, and Fun

Favorite book (or one you’ve recently read):

I just finished All The Light You Cannot See. I don’t think I can pick an overall favorite book.

Pets:

My family dog Scout (Chocolate Lab) and my “nephew” Alan (Red Lab) but I consider them mine 😊

After operational difficulties posed by the pandemic settled, a large, global hospitality organization wanted to refocus on employee health and productivity, with operational efficiency and risk management in mind. With an emphasis on the employee experience, the client engaged Spring to conduct a review of their workers’ compensation, disability and leave of absence plans, policies and processes with the goal of understanding how they compare to industry best practices and how insourced, outsourced, or cosourced models could yield improvements.

Spring’s Work

After thorough research and analysis, we proposed a shift from the decentralized, separate, and insourced disability and LOA model to a centralized, integrated, and outsourced approach across WC, FMLA/LOA, ADA, RTW and STD/LTD. Our holistic model incorporates:

- Minimal disruption by utilizing existing STD/LTD vendor for disability & LOA management and recommendations to optimize this partnership and establish linkages with WC vendor

- LTD and STD continue to be funded through the captive

- Client team hiring plan/staffing model

- ADA claim management software

- Training for HR, managers, and vendors to align on both process and culture

- Best practices for intake, claim, submission, and customer service journey points

- Case management, claims administration, RTW and accommodation management

- Ongoing absence status and reporting/metrics

- Technology and administration partners to meet needs

- System integration with payroll, HRIS, and other systems

By outsourcing, the client can achieve its goals of:

- Increasing operational efficiency

- Improving employee health and productivity

- Applying the right resources at the right time

- Reducing administrative burden for client team

- Mitigating risk by transferring the responsibility for day-today absence tracking, management and compliance to a third party

The Results

Spring is working to implement the solution to yield the following quantitative and qualitative success factors:

Qualitative

- Decreases colleague and manager confusion and better the employee experience

- Positions HR in an advocacy role; enhance the ability to inform and remind employees of benefits and resources they have available to them to help during a time of need

- Increase employee satisfaction regarding applying for days off

- Better communication and integration between benefits and risk management teams

Quantitative

- Decreases claims costs that flow through to client’s captive (and number of claims, or incidence), leading to higher savings

- Due to formalized processes and reporting

- Reduces benefit payout amount

- Enhances productivity due to fewer lost workdays (lessen duration of leaves) and stronger RTW

- Due to early intervention, strong policy provisions, RTW and accommodation philosophy and tight benefit coordination

- Lowers replacement costs when colleagues are out

- Avoids legal claims and lawsuits

- Anticipates close to $10M of direct savings over a 5-year period and a conservative ROI projection (savings minus expenses): $1.2M

Have questions about how to build or improve your absence management program to see tangible results like these? Check out our website or get in touch today.

While paid family and medical leave (PFML) remains in the state regulatory spotlight, much of the workforce is not covered by these laws or has leave needs outside of what is available. At the height of COVID-19, the American Journal of Emergency Medicine reported a 25%-33% increase in reported domestic violence cases. According to WHO, mental health issues rose 25% in 2020. These issues did not disappear even though the pandemic dust has settled.

Cutting-edge employers are leveraging ancillary types of paid leave as support tools for employees. They are thinking beyond traditional offerings and facilitating easier navigation so that when an employee experiences a hardship, understanding work leave options does not add to their mental burden. I had the pleasure of presenting on this topic at the 2023 Disability Management Employer Coalition (DMEC) Compliance Conference, and I wanted to share key insights.

Paid Leve Evolution

In October of 2023:

- 10 states and Washington D.C. currently require employers provide paid family and medical leave (PFML) benefits, in addition to Hawaii which requires only statutory disability benefits be provided

- 2 states have passed voluntary PFML laws with 6 more creating PFML insurance rules which allows employers to purchase insured PFML if they are interested

- 5 states are in the regulatory phase of PFML, where benefits are not yet available

- 32 states do not have PFML benefit laws (excluding Washington D.C., Hawaii which has a statutory disability benefit, and the states that fall solely into the “PFML insurance rules” category, as that does not constitute a state law)

- Still much of the workforce is not covered by these laws

- Check out our whitepaper for a more detailed landscape of state PFML policies

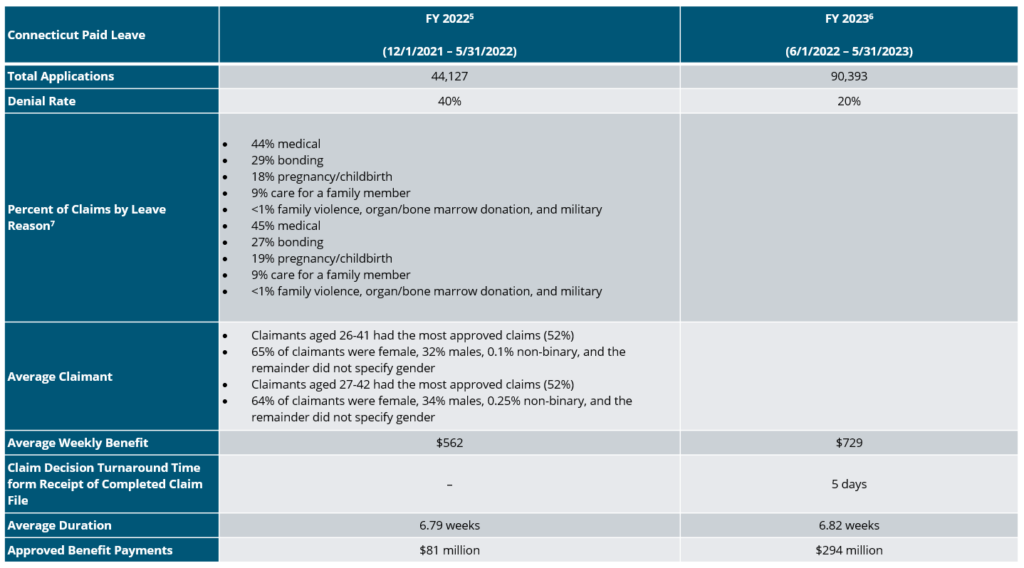

It has been a long road to get to this patchworked state, however. The push for time off dates back to 1910 when President Taft proposed that every American worker needed two to three months of vacation a year. U.S. legislators did not agree, so unions were left to bargain for paid vacation from the 1920s through the 1940s.

During World War II, when employers were scrambling for talent, the offer of paid vacation rose as a way to increase compensation due to wage controls that were in place at the time. Statutory paid disability laws began passing in 1942, with laws in RI, CA, NJ and NY in place by 1949.

On the federal level, very little progress was made until the mid-20th century, when women increasingly entered the workforce and thus the focus then expanded beyond paid vacation time to broader family-related leaves. From there, as illustrated below, we have seen an array of paid and unpaid leave laws pass at both the state and federal levels, with the onus for paid leave largely falling to state legislation due to a lack of movement on the federal stage.

Current Leave Landscape & Employer Tactics

Here is a high-level snapshot of leave options available today.

Mandatory

Federal

- Family and Medical Leave Act (FMLA)

- American’s Disability Act (ADA/ADAAA)

- Uniformed Services and Employment and Reemployment Rights Act (USERRA)

State

- Paid family leave (PFL)

- Paid family and medical leave (PFML)

- Statutory Disability Insurance (SDI)

- Workers’ Compensation (WC)

- Paid Sick Leave (PSL)

Local

- Sick leave laws

- Apply federal, state, and local entitlements

Voluntary

Offered at employer’s discretion

Examples Include:

- Paid leave in a state that does not offer PFL or PFML

- Personal leave

- Bereavement leave

- Vacation, sick or PTO beyond mandates

It’s important to note that of the above leaves, some are fully paid, some are partially paid, and some are unpaid. Job protection in the event of an absence from work may or may not be granted, depending on the situation and policy at play. This landscape leaves significant gaps, which many employers are looking to close with ancillary options.

Employers generally recognize the value of leave benefits, in that they serve to:

- Support employees

- Retain talent

- Recruit talent

- Combat productivity losses, often related to personal and family health problems (being “present” does not always mean being productive)

There is now a movement to expand upon traditional fundamentals in this area to better address widespread issues. Specifically, we have seen an uptick in (a sample list):

- Bereavement leave

- Domestic violence support

- Mental health support

- Personal leave

- Wellness days

- Compassionate leave

- Sabbatical leave

- Time Off in Lieu of Working Overtime (TOIL)

- Humanitarian leave

Even the most generous of programs, however, can fall short if careful thought is not given to communication strategies around offerings available, employee education surrounding leave eligibility and protocols, and population needs.

Compliance Considerations

The greater the volume of leave types on the table, the more complex compliance becomes. As such, employers should have processes in place regarding:

- Determining which leave laws and policies may apply to an employee’s request (federal, state, local) and run leaves concurrently when applicable

- Training managers involved in the employer’s leave policies

- Administering leave policies in a consistent and non-discriminatory manner

- Ensuring engaging in the interactive process to determine reasonable accommodations under the ADA which includes leave as an accommodation

- Continuing group health insurance benefits during employee leave

- Allowing for an equal amount of paid time off for parental leave policies for both caregivers

- Using language in policies that is gender neutral

- Ensuring adherence to reporting and tracking requirements

Looking Ahead

As veterans in the integrated disability and absence management space, we cannot see the future, but we can offer informed predictions about what’s to come. We anticipate state activity will continue to push employers to expand their leave offerings. Flexibility and work-life balance will remain in the spotlight, and employees will be working toward being more informed about their leave rights, so compliance will continue to take precedence. Operationally, we expect that more HR and benefits teams will turn to outsourcing to mitigate staffing issues, and will look to fully integrate leave benefits into a single system to reduce administrative burden, streamline processes, and increase reporting capabilities.

If you are interested in benchmarking your leave programs, integrating benefits, or better understanding best practices in this area, Spring would love to hear from you.