In today’s diverse and dynamic workplace, fostering a culture of diversity, equity, and inclusion (DEI) is not just a moral imperative but also a strategic business necessity. One critical aspect of this commitment involves designing employee benefits packages that ensure fair and equitable treatment for all employees, regardless of age, gender, income, education, geography, or any other characteristics. In this article, we will explore how employers and HR teams can enhance their DEI efforts through inclusive employee benefits packages.

Conduct a Comprehensive DEI and Benefits Assessment

To create a benefits package that promotes DEI, it’s essential to start with a thorough assessment of your organization’s current practices and culture. You may want to consider:

- Benchmark current programs through surveys, focus groups, data collection, industry tech and other tools to evaluate current pain points and employee trends.

- Collect and analyze demographic data on age, gender, income, education, and other relevant characteristics to understand representation and disparities.

- Team up with subject matter experts like our actuaries, data analysts, or clinical pharmacy team to understand utilization and what is driving your claims costs, as this will give you a picture of the different demographics and health issues represented in your plans.

- Review existing health plan designs through different economic lenses based on your employees’ salary ranges, considering factors like coverage levels, deductibles, and co-pays.

Offer Flexible/Voluntary Benefits

One way to promote DEI in your benefits packages is by providing flexibility. Recognize that employees have different needs and circumstances. Consider offering a range of options to level the playing field, such as flexible work hours, remote/hybrid work opportunities, or voluntary benefits packages, allowing employees to select benefits that align with their individual requirements.

- Implement flexible work arrangements, such as flextime, earlier/later hours, or telecommuting, allowing employees to balance work and personal responsibilities.

- Introduce voluntary benefits such as disability insurance, hospital indemnity insurance, commuter benefits, etc. which allow employees to select benefits that fit their lifestyle and cater to their unique needs.

- Provide wellness days, caregiver leave or additional paid time off for employees to use as needed for personal reasons, including family responsibilities.

Address Healthcare Disparities

Healthcare benefits are a crucial part of any employee benefits package. To ensure equity, take steps to address healthcare disparities. Consider the following:

- Offer health insurance plans that include coverage for diverse healthcare needs, such as mental health services, transgender healthcare, and preventive care.

- Ensure that health plan networks include a wide range of healthcare providers to accommodate different geographic locations and healthcare preferences.

- Promote regular health check-ups and screenings through wellness programs, with a focus on educating employees about available resources.

Support Family and Caregiver Needs

Recognize that employees may have diverse family structures and caregiving responsibilities. To support DEI in your benefits package:

- Provide paid parental leave that covers all caregivers, including adoptive parents, and consider extending the leave duration for parents who give birth.

- Implement flexible scheduling options or remote work arrangements for employees caring for children, aging parents, or individuals with disabilities.

- If budget allows, consider stipends or other benefits related to childcare or eldercare services.

- Review current employee leave trends and industry patterns to identify what types of leave and support employees need most.

Encourage Financial Wellbeing

Financial wellness is a critical aspect of employee wellbeing. Consider these steps to enhance financial equity in your benefits:

- Offer retirement plans with automatic enrollment and contribution matching to promote retirement savings for all employees.

- Provide financial education and counseling services to help employees better manage their finances and plan for their future.

- Consider offering income protection benefits, such as short-term and long-term disability insurance, to safeguard employees against income loss due to an unexpected illness or injury.

- Provide student debt relief and education support resources to help employees of all backgrounds enhance their educational background without financial stress.

Promote Professional Development

To ensure DEI in career growth opportunities, invest in professional development benefits:

- Establish mentorship programs that match underrepresented employees with experienced mentors who can help guide their career growth.

- Offer tuition reimbursement or scholarships for further education or job-related certifications, with a focus on supporting employees from diverse backgrounds.

- Create leadership development programs that actively seek out and nurture talent from underrepresented groups, ensuring equitable access to advancement opportunities.

Raise Awareness and Foster Inclusivity

Create a culture of inclusivity by:

- Conduct regular DEI trainings/webinars for all employees to increase awareness of unconscious bias, microaggressions, and ways to promote inclusivity.

- Celebrate cultural and religious holidays and observances through inclusive events, workshops, or cultural competency training. Also, consider floating holidays that employees can use at their leisure to celebrate holidays meaningful to them.

- Establish a clear and confidential reporting system for employees to report discrimination, harassment, or bias incidents, with a commitment to investigating and addressing such concerns promptly.

Monitor and Adjust

Regularly review and assess the impact of your DEI-focused benefits initiatives. Solicit feedback from employees and adjust your benefits package as needed to address evolving needs and challenges.

- Continuously collect and analyze data on employee satisfaction, turnover, and the utilization of benefits to identify areas where adjustments may be necessary.

- Engage in regular dialogues with employee resource groups (ERGs) or diversity councils to gain insights and gather feedback on DEI initiatives.

- Stay informed about evolving legal and industry standards related to DEI in benefits and make necessary updates to your benefits package accordingly.

By conducting this recommended process, employers can proactively enhance DEI in their employee benefits packages, fostering a workplace culture that values diversity and promotes equitable access to opportunities and resources for all employees. Championing DEI efforts in benefits also often leads to greater outcomes in engagement, recruitment, and retention.

Introduction

With employers being challenged with attraction and retention, employee benefits and perks take center stage. Many organizations are aware of the importance of benchmarking when it comes to the competitiveness and performance of an employee benefits program, but are unsure about how to get started or what programs to compare.

Benchmarking can be conducted across a range of offerings, but recently time off programs have been a significant area of interest for employees and employers, especially around parental and family leave. If your organization is considering changes to your program – or just looking to verify your time off programs remain competitive – benchmarking is critical.

Getting Started

No matter which benefit you want to benchmark, including time off programs, it’s important to set the stage before the number crunching phase. Start with:

- Confirm benchmarking objectives: be sure to establish what you want to accomplish and why. Think about what problem you are trying to solve, or question you are trying to answer. What specific outcomes can be associated with the metrics you are trying to highlight? You might want your benchmarking to inform how your program is performing so you can make the case for additional resources, or how your program is structured, so you can explain how it could be more competitive for attraction and retention.

- Determine how you will gather data: the more focused you can be in your efforts, the more expediently you can get to the results. This starts with deciding which programs you are going to benchmark and metrics you are going to compare. You will also want to confirm whether you are interested in:

- Internal benchmarking, where the comparison is made against your own data over time

- External benchmarking, where metrics or practices of your company are compared to one or many other companies

- Both internal and external benchmarking

External benchmarking is perhaps the more talked about path, but both can provide real value and insights based on what you are trying to achieve.

Digging In

When it comes to paid time off, policies worth evaluating might include:

- Vacation/Paid Time Off (PTO) or Flexible Time Off

- Sick Leave as a standalone offering vs. included in PTO

- Other types of leave, such as:

- Personal Leave

- Bereavement Leave

- Mental Health Days

- Volunteer Days

- Sabbatical

- Military Leave

- Parental Leave (birthing and bonding)

- Family Care Leave

When conducting external benchmarking to compare your leave benefits with those of other companies, you might be interested in analyzing the following categories:

- Accrual vs. front loading

- Duration by leave type

- Eligibility by leave type

- Percentage of pay by leave type

- Contribution methodology (e.g., perhaps you have employees in states with Paid Family and Medical Leave (PFML) laws)

- Equity across workforce demographics, for example:

- Leave tracking systems

- Variations based on employee status, tenure, and employee type or classification

It may also make sense to filter your evaluation by parameters like company size, location, industry, etc., so that you have as clean of a comparison as possible.

On internal benchmarks, it’s important to understand what’s actually happening in your population. Utilization data may be your best source of “benchmarking” related to time off programs. Work to understand when employees are using time, establishing patterns of behavior among different employee classes. Use this data to defend maintaining the status quo or making changes.

There are many ways in which you can slice and dice benchmarking data related to time off programs, and you don’t have to do it all. Always go back to your established goals and then work backward to identify which data sets will inform those objectives.

Industry Standards

We are constantly fielding questions around the competitiveness of leave offerings, particularly related to parental leave and PTO/vacation days. Data in this area is varied, but below are some statistics that can give you a gauge of norms.

- 82% of companies offer vacation or PTO1

- 11% of companies offer unlimited PTO (more common for large employers and those in the Information Management/IT sector)1

- Large employers (1,000+) tend to offer more time off compared to smaller companies1

- 51% of employers offer paid parental leave2

- 46.5% of employers offer paid family care leave2

- 40% of employers offer mental health days2

- 92% of employers offer sick leave2

- 66% of employers offer “other leaves of absence” like personal, bereavement, jury duty, and/or military leave2

Number of Time Off Days Given Based on Years of Service1

| New Hire | 1-5 Years of Services | 6-9 Years of Services | 10+ Years of Services | |

| PTO Bank | 0-10 days | 11-15 days | 11-20 days | 20+ days |

| Sick | 1-5 days | 1-5 days | 1-5 days | 1-5 days |

| Vacation | 0-10 days | 6-10 days | 11-15 days | 16-20 days |

| Personal | 0-5 days | 1-5 days | 1-5 days | 1-5 days |

Get in Touch

If you’re interested in benchmarking your benefits programs such as leave offerings, or are wondering how your programs stack up, Spring’s subject matter experts would love to hear from you.

1 Alera Group Healthcare & Employee Benefits Benchmarking Survey, 2022

2 Spring Consulting Group’s 2022 Integrated Employer Survey

As a mark to the end of summer, The Disability Management Employer Coalition (DMEC) hosted their Annual Conference in the beautiful (and beachy) San Diego! The conference is in a different city every year, and it was refreshing being by the water this time. DMEC is one of the leading organizations in the absence and paid leave landscape; their conference brings together stakeholders from all across the industry to connect and discuss trends and best practices.

Here are some buzzworthy topics I wanted to share from the conference:

1) Mental Health Support

Although the demand for employer support for mental health and wellbeing services may not be as high as it was during the COVID-19 pandemic, it remained a hot button topic at this year’s conference. As mental health support solidifies its place in the benefits industry, employers are looking at innovative ways to stand out and cut costs. Some related presentations I found insightful include:

-The very first session of the conference, “A Mental Health Culture Shift: Addressing It from the Top Down,” brought together representatives from multiple health systems to discuss the importance of developing mental health resources that work for employees of all levels.

– In the presentation, “The Echo Pandemic: Mental Health, Lost Time, and Benefits Spend,” the speaker reviewed the ROI impact of preventative wellbeing solutions on benefits spend and workplace culture.

– In a one-of-a-kind presentation, a licensed psychologist reviewed “Regulated Psychedelics for Mental Health & What You Need to Know.” As psychedelic therapies are expected to be approved in 2023-2024 for PTSD treatment, this session reviewed how this will impact employers and their mental health offerings.

2) Compliance Strategies

It seems like at every conference and event I attend, compliance is top of mind for employers across the nation. With shifting national, state, and local regulations, it can be difficult to stay compliant while satisfying a dispersed workforce. Here are some noteworthy sessions related to compliance:

– During my final session I was joined by industry experts to discuss “New Models for PFML: Education and Action.” We broke down various state programs, private versus state plans and considerations for PFML insurance policies under voluntary programs.

– Two compliance managers reviewed important cases when the DOL and EEOC disagreed with court decisions and how it eventually played out in their presentation, “Flip or Flop: When the Courts (and Regulations!) Disagree.”

– As mandatory paid sick and safe time (PSST) regulations continue to shift, presenters in the session “Time for a PTO Overhaul! Why the Legal Landscape Compels Us to Consider a Multi-bank Paid Time Off Structure,” discussed how to stay compliant while maintaining a single-bucket PTO approach.

3) Returning to the Office/WFH Approaches

As the worst of the pandemic echoes behind us, many employers are trying to revert to tradition and get people back in the office (or find some middle ground). Decisions made regarding this dynamic will lay the foundation for employee culture and how employers approach leave management. Below are some relevant presentations I wanted to highlight:

– Experts discussed “Transitional Return-to-Work Programs that Last,” this included the cost benefits of these programs and tactics to educate and motivate front-line managers.

– A representative from Headversity, provided tips and resources to help empower future generations of women leaders. This included addressing accommodations that support the work-life balance of female employees.

4) Leveraging Tech

Tech in the absence and disability space continues to evolve with the introduction of new innovations and tools that can help create efficiencies and drive best practices. Even building on existing tools and systems can help us better understand current patterns and trends. Here are some presentations I found most insightful:

– In an interactive session with DMEC’s CEO, Terri Rhodes, Spring’s Jackie Myers and me, the attendees engaged in DMEC Benchmarking Jeopardy, which spotlighted DMEC’s new benchmarking platform that Spring helped build, which will give users an easy and user-friendly way to compare and contrast absence management policies and procedures.

– My colleague Marcy Updike and I reviewed survey data that analyzed the monetary value of flexible time off programs and their potential impact on recruiting and retention during our session, “The Value of Workforce Flexibility: Impact & Tradeoffs.

– Representatives from three different absence software companies discussed “Key Considerations for Selecting & Implementing Software as a Solution.” They reviewed employee considerations for implementing absence software and tips for managing day-to-day operations.

As a regular attendee and partner of DMEC, I have to say this may have been my favorite destination to date! As we approach the end of summer, it was great enjoying a few days of sunny weather. Throughout the busy few days, the Spring team and I had a great time reconnecting with industry leaders and deepening our knowledge of innovations in the leave management space. We are excited to see what next year’s conference has in store for us!

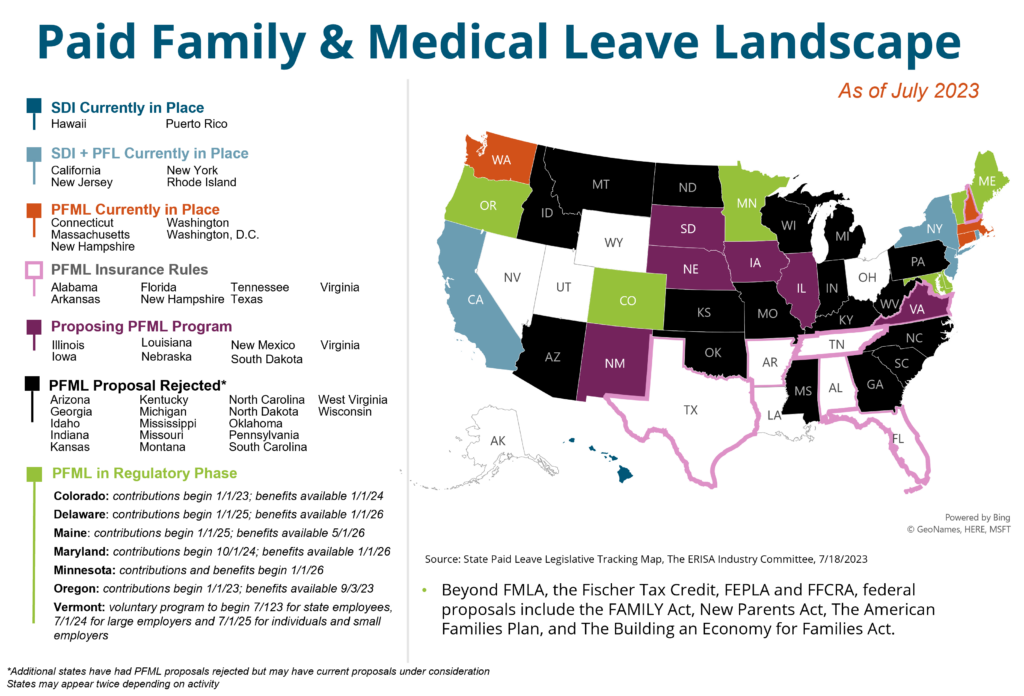

It has been 30 years since the Family and Medical Leave Act (FMLA) was passed at the federal level under former President Bill Clinton. FMLA grants eligible employees with unpaid, job-protected leave for qualifying family and medical reasons with continued employer-sponsored group health insurance coverage, if applicable. Since then, some adjustments to FMLA have been made, such as the inclusion of workers with a family member in the military and those in a legal, same-sex marriage. However, the evolution has been slow and limited; many believed or at least hoped that over time FMLA would evolve into a paid leave model, but over the last three decades, it is states that have taken initiative in establishing PFML programs for their workers.

Starting with California in 2004, 11 states and Washington, D.C. now have some type of established PFML program, with several other states including Maryland, Colorado, and, most recently, Minnesota, in the regulatory phase where a law has passed but benefits are not yet available. Plans vary by percentage of wage replacement, maximum weekly benefits, the contribution split between employer and employee, benefit duration, and other factors. The newest trend in PFML law, however, relates to PFML as an insured product.

PFML Insurance Rules

Recently, states including Virginia, Tennessee, Florida, and Alabama have passed legislation related to a voluntary PFML insurance product, as opposed to the more traditional, mandatory PFML programs that we had been seeing in previous years. With this new model, state laws create a new line of family leave insurance that may be written as an amendment or rider to a group disability income insurance policy, or as a separate group insurance policy purchased by an employer.1 Employers may offer the product for their employees without obligation to do so, in a setup similar to other voluntary benefits like short-term disability or vision insurance. In this way, it is purchased through an employer but at the individual’s expense and discretion and a third party insurance carrier is used to carry out the program.

As an example, under the Tennessee Paid Family Leave Insurance Act, a new line of insurance called paid family leave (PFL) insurance has been established. It can be offered as a rider or included in a policy for short-term disability, life insurance, or as a standalone PFL policy. Qualifying reasons for a leave of absence include the birth or adoption of a child, placement of a child for foster care, care for a family member with a serious health condition, and reasons related to a family member’s active military duty. The insurance is purchased through an employer arrangement, but unlike the voluntary program launched this year in New Hampshire, there are no tax incentives for employers who offer the PFL product.

Preliminary Results

PFML as an insurance product is a new concept that we expect to evolve over time.

Take-up by employers will likely vary on their size, culture, geographic spread, and most importantly their current benefit offerings. Some employers may appreciate the model law as a guide to providing a new benefit for employees, or a competitive benefit to what is offered in other states so that equity could be achieved across locations. Others could feel it is too costly for them to offer, or they may already have equivalent benefits in place. Whatever the case, employees are becoming increasingly aware of these laws, and employers need to be ready to explain why they are or are not supporting them.

At the state level, it may be an intermediary step to the establishment of a mandatory PFML program, or it may be a way of offering some benefit without the budgetary and resource constraints required to build out a more traditional plan.

This new wave of PFML laws is just getting started, however, and our team will be closely monitoring utilization and legislative developments. In the meantime, check out our absence management services here or get in touch with our team if you have questions about the direction of PFML.

1 (2023). Absence Advisory June 2023. Aflac

A summary of our webinar with the Northeast HR Association (NEHRA)

When it comes to health and productivity programs, the past several years have been a time for Benefits and HR professionals to test out a range of initiatives in response to pandemic and post-pandemic challenges, priorities, and employee expectations. Now, however, the market is in a different place and it is time to assess the impact of recent program offerings; does the reward outweigh the risk?

The Big Picture

Today’s economy is creating urgency around making sure benefits programs are properly managed. High inflation rates touch everything; the impact doesn’t stop at the grocery store or the gas pump, it extends to already high healthcare costs. In addition to the economic reality, we have seen an increase in healthcare utilization coming from new treatments and technologies available, further increasing costs. Relatively low unemployment may have shifted attraction and retention goals for some organizations, but a rise in layoffs is having tangible effects on the labor market at large which trickles down to employer strategies. It’s not just employers facing challenges, though, as healthcare services have become unaffordable for many and consumers/employees are also feeling the cost burden.

As a starting point, take a look at your data to answer questions like:

- What does your population look like in terms of demographics and health trends?

- What are your employees selecting for benefits?

- What is driving your costs?

- How might you segment your population?

- Are you accounting for future population shifts and resulting needs (e.g., company growth)?

You should then be able to assess whether or not your benefits align with your population as well as your corporate objectives. When determining true return on investment (ROI), it’s important to consider both human and financial perspectives.

Now that we have established a bird’s eye view of the risk versus reward equation, let’s drill down into key plan components that factor in.

1. Risk Management

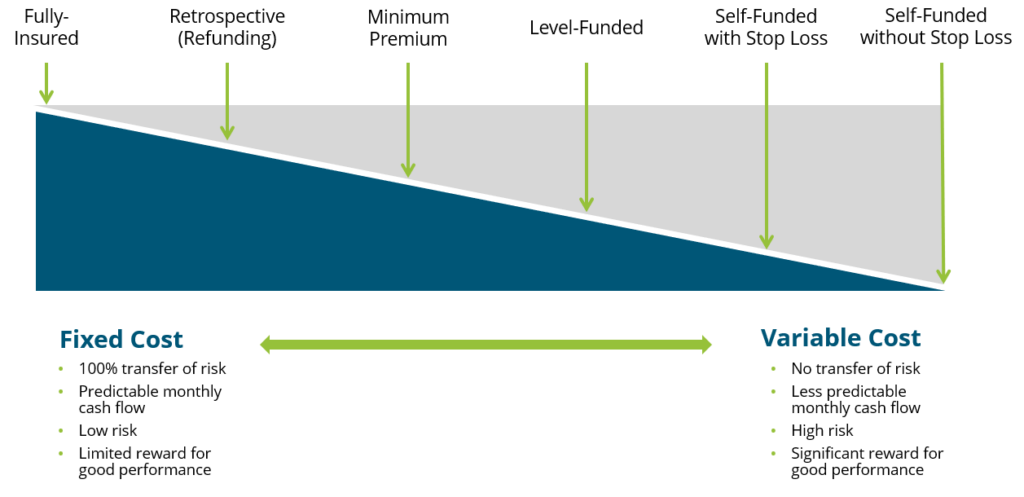

There are a range of risks to consider within your benefits strategy. There is the risk of buying insurance, and the allocation of funds. There is the risk to your employees of undertaking a high cost treatment, if necessary, which may not be feasible for lower wage workers.

When it comes to benefits funding, the following graphic illustrates the spectrum of options available, where the risk taken by the employer increases as you move toward the right.

While a fully insured plan largely frees the organization of risk, there is typically a lot of overhead and administrative costs involved and less governance when it comes to claims management. Overall, though, we encourage our clients to consider this spectrum and determine where they fit in related to risk appetite, budget and resources, specific health trend, and more.

2. Financial Management

Related but separate from risk management comes the financial management of your benefits program(s). There are three key activities that fall within this bucket:

- Program Strategy

- Account for long-term costs and variability

- Cost Projections and Rate Setting

- Provide budget updates

- Adjust for economic changes

- Includes premium equivalent rate projections and employee contribution rate setting

- Plan Governance

- Establish framework

- Ensure sufficient reporting and monitoring cadence

- Account for actual versus expected, large claims reporting, key cost drivers, retiree medical valuations, etc.

The insights gleaned from the financial management arm should be embedded into your overall benefits and risk management strategy, rather than live in a silo.

3. Pharmacy

Pharmacy has been top of mind for employers, understandably so given the rapid rise in prescription drug costs, which now constitute anywhere from 20-25% of total healthcare spend in the U.S. Specialty medications account for 50% or more of pharmacy spend even though only about 2% of the population is using them. Brand and generic drug costs are also rising at rates we have not seen in the past, perhaps in correlation with inflation. Suffice it to say, employers are struggling to mitigate their own costs as well as the costs for their employees. So, what can be done?

Within the pharmacy benefits landscape, two areas have been getting a lot of attention: weight loss drugs and biosimilars.

Weight Loss Drugs

Chances are you’ve heard about a new wave of “Hollywood diet” drugs. There has been an enormous amount of marketing going on around these new weight loss drugs, especially in the realm of social media and influencers. All of the buzz has also gotten the attention of employers, who are asking us questions surrounding coverage, costs, and pros and cons.

To provide some background, of the four weight loss drugs taking center stage, only two have indications for weight loss, while the other two are being used off-label. Weight loss drugs are not new, but these varieties are showing results we haven’t seen before, and their arrival on the market is timely, as about 42% of the population is either overweight or obese.

From a health and productivity standpoint, we know that obesity increases a person’s risk of developing a chronic condition, which leads to higher healthcare costs. But we also know that there are financial and non-financial reasons to foster a happy and healthy workforce. Can and should weight loss drugs be an answer for employers?

These new drugs are retailing for about $1,300 a month, so we need to consider annual costs and the longevity of how long an employee will need to stay on the medication. For employers considering them to their plan, we recommend it being one piece of a comprehensive strategy that also includes wellness initiatives and/or a commitment from those prescribed the drug. In addition, you must build strong monitoring protocols to judge effectiveness and impact on overall plan costs and utilization.

The inclusion of weight loss drug coverage in a health plan will make sense for some employer groups, and not others. We recently talked with an employer client who saw enough value in even a 10% reduction in body weight to convince them to cover the drug. However, any decisions need to be based, once again, off of population data and corporate objectives. This is a new and evolving sector, so your strategy should remain fluid as we see developments.

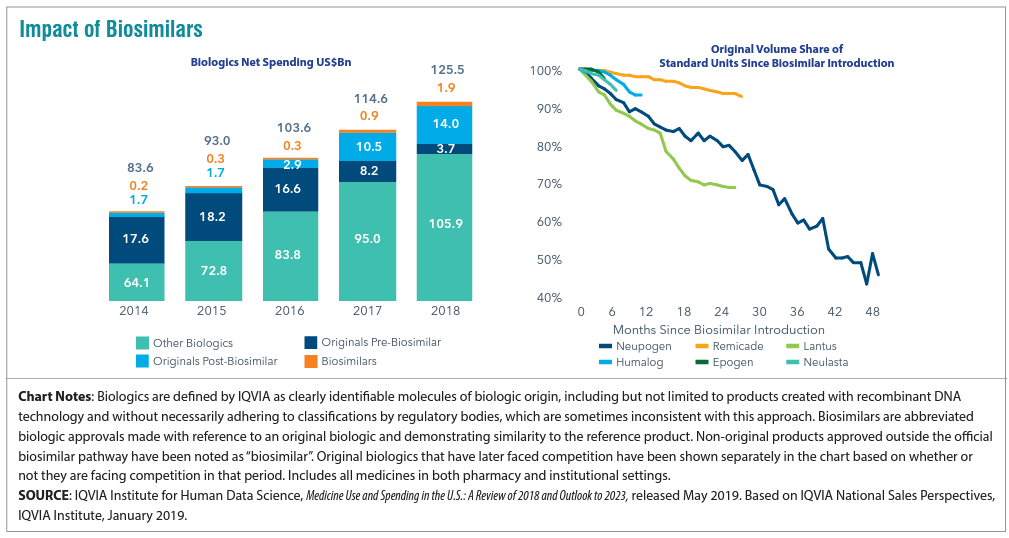

Biosimilars

Biosimilars are non-generic alternatives to those specialized medications that are very targeted in how they work and on what conditions they combat. There has been a lot of anticipation surrounding biosimilars as a solution to the specialty drug cost crisis. At the beginning of the year, a biosimilar of Humira, the number one drug dispensed in the U.S. which is used to treat inflammatory conditions, entered the market as the first biosimilar. While there has been some impact, to date it has not been the silver bullet we were hoping for. We can see below that biosimilar adoption rates are all over the map depending upon the condition for which it’s being utilized.

For employers, what’s important is vigilance in understanding where your Pharmacy Benefit manager (PBM) has positioned biosimilars as far as coverage is concerned. We have found that PBMs are placing biosimilars typically at the same parity with the reference, or brand name product. In this case both Humira and its biosimilar would be considered tier 3 medications, which does not yield the anticipated savings. Why is this? Well, there may be additional rebates available to employers and health plans if they continue to use the reference product.

This is a complicated space that continues to change at a rapid pace. Overall, though, if biosimilars are working the way we want them to, we need to figure out a way for all stakeholders to embrace them as a lower cost alternative instead of being locked into brand name drug prices. In some cases, the drugs are life-changing, so we do want to cover them but in a more sustainable way. We work with clients to ensure they are informed of and ready for these advancements and nuances.

4. Targeted Point Solutions

The term “point solutions” now represents a large umbrella of tools, however it typically references programs that target specific diagnoses such as diabetes, oncology, and hypertension. In recent years there has been significantly more interest in point solutions from our employer clients, and, especially with multiple solutions running at a time, these can be a slow leak on spend. Now is a good time to take a step back to answer that risk versus reward question for point solutions.

The best place to start in assessing point solutions whose reward outweighs the risk is data analytics. Try to use any data you are getting from your health plan, internal teams, or the industry to benchmark your spend. In areas where your spend is high relative to benchmarks, do a deep dive for potential solutions that can help. Some pitfalls in this area include:

- The more point solutions you implement, the harder they become to monitor and manage

- Point solutions embedded in your health plan may seem like a no-brainer, but they usually yield very low take-up rates

- Overlap between different point solutions/benefits programs can cause confusion for all stakeholders

- Focusing purely on dollar ROI may not be the play; listen to your gut about what is right for your workforce and understand the qualitative advantages around camaraderie and culture to be gained

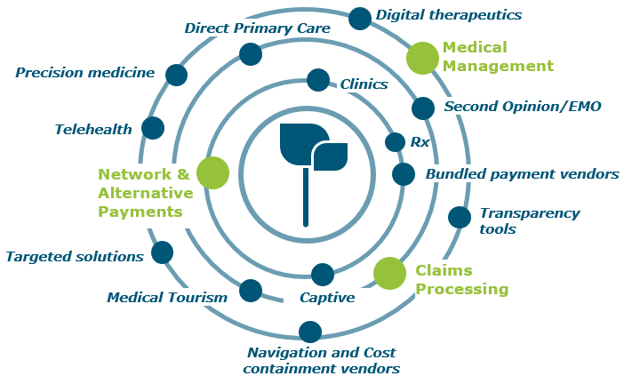

5. Absence Management

Absence management is highly correlated with your health plan performance, since the vast majority of your high cost claims will also include a leave of absence, so there are both plan costs and productivity rates at play here.

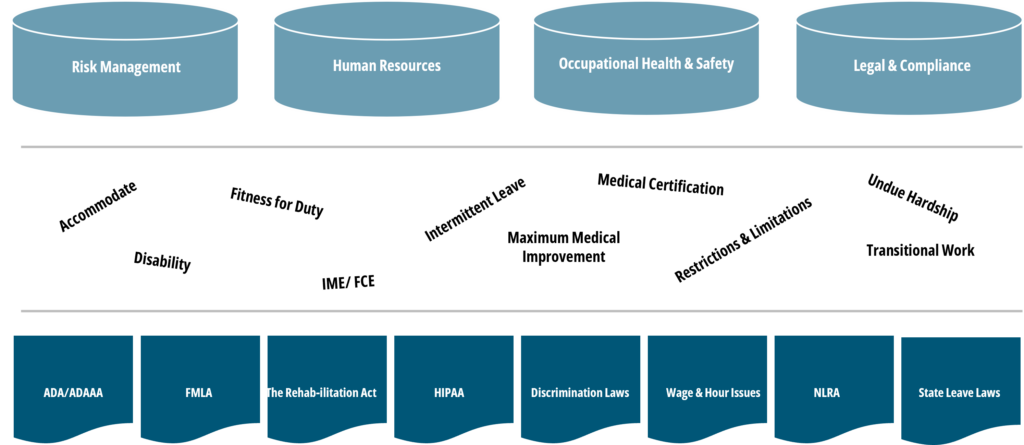

Making absence programs more challenging is the volume of stakeholders involved and laws with which you need to comply (as seen below).

Further, when we talk about absence management, we account for a wide range of benefits including short- and long-term disability, statutory disability, workers’ compensation, FMLA, ADA state paid family and medical leave (PFML), and others.

With absence, different than with medical plans, your company’s managers and supervisors are directly involved when it comes to plan design, governance, staff training, etc., so it is an area where you typically need to look inward to drive change.

When it comes to the risk/reward balance of an absence management program, employers can make sure corporate programs are set up the way they want, for example, promoting the right attraction and retention strategy. Remember that the more generous your programs are, the more they will cost and the higher the risk you take on. If shifting some responsibility to an outsourced partner, be sure you still have monitoring protocols in place.

Closing Thoughts

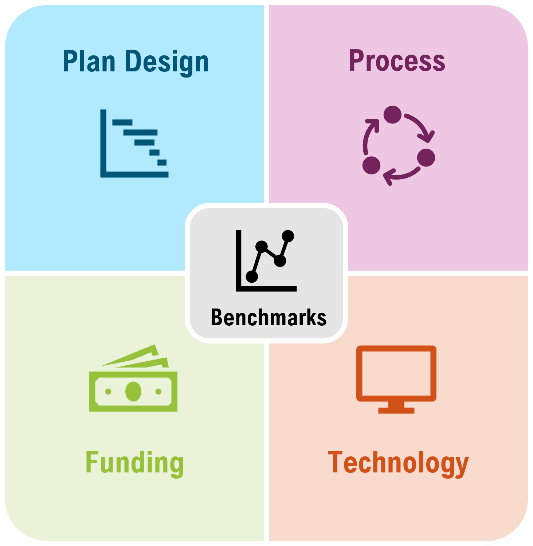

Across these five areas and more, we encourage you to get familiar with your organization’s plan and demographic data. Depending on your size, the level and depth of data available might be different, but there is always some data available, such as industry standards and benchmarks. Whether you are focused on weight loss drug strategy, funding, or point solutions, you can take those data-driven insights and apply them across these four pillars to determine your best practice.

If you are having trouble getting started, or could use specific guidance surrounding the topics mentioned, please get in touch with our team.

Q: How would you describe the current state of tech in the absence management space?

A: To preface the discussion, I want to quickly illustrate the current state of paid family and medical leave (PFML) regulations. Although eligible employees may quality for the Family and Medical Leave Act (FMLA), the Americans with Disabilities Act (ADA), or other national policies, there is no national PFML program. Instead, many states, municipalities, and cities have developed their own plans. This is positive, but means employers have more and varied regulations to keep up with while managing and integrating internal policies. For this and other reasons, many employers are turning to Leave of Absence (LOA) software to help track employee leave. In layman’s terms, it is software that helps employers manage and track employee absences including sick leave, vacation time, federal holidays, jury duty, etc. Outside of LOA software and services, we are seeing components of absence recording in payroll services, benefits administration programs, time tracking software, HRIS modules etc.

Q: How do employers feel about these developments?

A: We’ve seen many employers embrace these technologies. As an impartial entity, at Spring we provide employers with all options when it comes to Leave of Absence (LOA) software, benefits administration programs and other technology options, including taking a look at internal processes for opportunities to streamline. Our surveys indicate that employees tend to favor newer LOA programs as opposed to traditional, more manual practices. Having a system in place mitigates the stress of trying to figure out what to do and where to go for information about leave options available, or to request a leave. These programs also allow employers to track patterns in utilization of different leave types and critical metrics surrounding return to work and leave duration. In this way, absence management technology can have an indirect impact on employee productivity and morale.

Q: What are some of the limitations/pitfalls to tech in absence management?

A: Although it may seem like we are in the prime of technological innovation, with new devices and tools popping up everywhere, macro advancements are slow to develop. Many LOA systems offer similar services when it comes to recording/managing leave, but the main benefits come from tracking and data analytics. With that being said, leave technologies may not be worth the monetary investment for smaller companies with fewer leaves to manage. Another concern relates to privacy and security, as many of these programs require sensitive company and employee information, but this is no more true for absence management technology than it is for any other digital tool that houses sensitive information We haven’t seen a large-scale breach in this space yet, but it remains a concern for some employers. Lastly, our employer clients have seen the most success with these types of technologies when they have the bandwidth to assign a point person or point team, as appropriate, so that there are in-house experts on the tool that can not only maintain the system and answer questions, but can also be looking for process improvements.

Q: What should employers do if they are considering implementing more tech within their absence programs?

A: I would recommend employers first review their current policies and pinpoint areas for improvement. Some do this through employee benefits surveys, one-on-one interviews, benchmarking, market research, etc. Absence management software ranges drastically and it is essential that employers understand exactly what they are looking for in a tool, before reviewing available options. It is important to first compile any pertinent data related to leaves of absence and a clear line of sight into your different leave benefits and how they interact. Once you have conducted this landscape/needs assessment, we recommend working with a consultant like Spring to conduct a Request for Proposal (RFP) for technology partners, market research to give you a detailed overview of solutions, benchmarking to understand what similar employers are utilizing, and/or surveys to determine the priorities of your employees and stakeholders.

Q: What can we expect to see in the coming months/years?

A: The pandemic completely flipped leave approaches and tools upside down. Many companies have shifted to hybrid and remote models, with a more dispersed workforce than ever. Those offices that have implemented a return-to-office (in-person) policy are seeing an influx of accommodations requests because employees are reluctant to return. Complexities and market shifts like these are what made LOA software the norm among many larger employers, and it remains a viable solution in the post-pandemic world as well. It is difficult to predict macro-economic and social changes, but I predict current LOA technologies will continue to improve and gain traction. I expect we will see more employers reevaluating their absence programs to stay competitive and attract talented workers, and having an employee-friendly system in place is part of that equation.

Although AI, ChatGPT and other groundbreaking technologies are dominating global headlines, the absence management space has remained mostly untouched. But who knows? Maybe one day we will have absence software that can predict our sick days before we even take them. Stay tuned for more food for thought!

Background

In 2018 the State of Hawaii Legislature passed a bill, Session Law Act 109, directing the Legislative Reference Bureau (LRB) to conduct an analysis to determine the impacts of establishing a state paid family leave (PFL) program. Stakeholders considered in the impact analysis included industry, consumers, employees, employers, and caregivers. The goal of Act 109 was to create a potential framework for the development of a PFL program that would offer paid leave for workers who need to care for a family member. The bill allowed the LRB to contract with a consultant for completion of the impact study, and after a formal Request for Proposal (RFP) process, Spring was selected to partner with the State of Hawaii on this initiative.

The Challenge

The objectives of the impact study were to:

- Conduct an objective and unbiased study analyzing and comparing existing models of PFL programs in other states

- Model the impacts of adopting similar methods of PFL programs in Hawaii, including the projection of costs and other quantifiable effects of each model

- Examine objectively the compliance and enforcement options for a PFL program in Hawaii and make recommendations for additional staffing and support needs

At the time, six states plus D.C. had a paid leave program for family and/or medical reasons in place, and part of our evaluation was not only a cross-model comparison of existing plans, but also a provision of the PFML landscape overall, including states with pending or rejected legislation. Both qualitative and qualitative factors needed to be assessed, including required operational activities, outreach and education approaches, state administration models, headcount modeling, IT infrastructure development, and projected startup costs. Integration with Hawaii’s existing State Temporary Disability Insurance (TDI) program was also explored.

Spring’s Work

Through Spring’s three-phased approach, the impact study covered a wide range of areas in detail that were critical in deciding on the development of a PFL plan in Hawaii. Starting with a deep dive into existing state PFL programs which included California, Massachusetts, New Jersey, New York, Rhode Island, Washington D.C., and Washington as seen below.

Plan Structure:

- Plan model

- Rating method

- Plan design including benefit amount, wage replacement ratio, maximum benefit, length of leave, employer eligibility, employee eligibility, qualifying events, covered relationships, job protection, and interaction with TDI program funding

Funding:

- Taxable wage base for funding

- Contributions to funding

- Updated costs

Administration:

- Administrative structure

- Claims management

- Ongoing monitoring

Implementation Timeline

- Rollout sufficient to gain industry and employer support

- Education and communications strategy

- Protocol for contributions and pre-funding

Within this evaluation, factors like gender equity, hiring practices, speed of benefit payments, ease of making applications or claims, financial sustainability, data collection capabilities, and compliance monitoring capabilities were also assessed. To arrive at these impact answers, Spring’s actuaries developed an actuarial impact model that utilizes actual PFL claim and other industry data to project claim incidence rates, duration of benefits, average benefit payments, expected costs and funding rates under existing state models and Hawaii’s current TDI structure.

The Results

Spring’s comprehensive impact study for the State of Hawaii’s Legislative Reference Bureau is available for public viewing here. Our team presented it in person to various legislators. While the State has not moved forward with a PFL program to date, we continue to keep the dialogue open and all parties are pleased with the framework set out in this project, as it was an imperative piece of due diligence on behalf of the State.

Employees have a whole host of responsibilities outside of work, and compassionate and strategic employers understand this and act accordingly. Below is our checklist of considerations for an employee benefits program that is family-friendly, enabling work-life balance and lessening the need to choose between job and familial needs, ultimately helping solve for some of HR’s biggest challenges: recruitment, retention, absenteeism, mental health and productivity.

| Get familiar with your population and demographics o Does your workforce trend younger, older, or a balanced mix? o Are there cultural, regional, or gender-based considerations at play? o Do your claims demonstrate specific health issues among employees or dependents? o Are most of your employees remote, hybrid or on-site? o Does the nature of employees’ work or work schedule present any concerns (e.g., physical labor, night shifts, healthcare staff susceptible to illness)? |

| Evaluate family-oriented provisions that are already in place via your health plan, corporate policies, voluntary benefits, or wellness programs o Where are there gaps or room for improvement? o Have you accounted for nontraditional families in a way that aligns with diversity, equity, and inclusion (DEI) goals? o What benefits do you provide compared to similar companies with whom you are competing with for talent? |

| Armed with this information, consider a broad range of benefits or perks: o Paid parental leave (for mothers and fathers), including for adoption o Take it a step further by designing a plan that offers insurance coverage and/or assistance related to fertility treatments, adoption, surrogacy, and post-partum needs o Paid family leave / caregiver leave, for employees to care for aging parents, sick children, partners recovering from surgery, and more o Bereavement leave, so that workers have space to grieve and spend time with loved ones during a time of need o Flextime or alternative work schedules, for daycare pickup, doctors’ appointments, sporting events, and the like o Childcare assistance, such as an on-site facility or a stipend o Eldercare assistance, which could include financial and/or counselling and navigational help o Financial wellness benefits, for traditional use cases like retirement but extending to consider things like tuition, student debt and long-term care planning o Long-term care insurance, or related financial/educational resources, especially as states begin to consider statutory long-term care programs o Paid Time Off (PTO) – in many cases this represents a set number of days that can be used for various reasons, including the fun (vacation) and the not-so-fun o Enhanced mental health benefits or resources beyond standard EAP benefits for all members of the family o Pet insurance or “pawternity” leave – while it may seem offbeat, most pet owners consider their pets to be family members |

| Identify which family-focused benefits are most appropriate and feasible for your population, and fit with your company culture |

| Determine your budget or how desired benefits could be funded (e.g., fully funded by employer, fully funded by employee, or some combination) and contribution methods |

| Understand how different leave types and benefits would integrate with current offerings or if adjustments will be needed (e.g., phasing out sick banks for a more flexible paid time off policy) |

| Ensure compliance and cohesion with national, state and local policies surrounding family leave (FMLA, state Paid Family and Medical Leave, parental leave policies, etc.) |

| If appropriate, conduct a Request for Proposal (RFP) for any vendor-provided products or services |

| Consider engaging a consultant like Spring to guide you through this checklist! |