Captive Review has released a shortlist for their 2023 US Awards. Spring has been nominated and listed under the Top Actuarial Firm and Captive Consultant categories. You can access the full list here.

Current State

Costs, risk, regulations, and complexity have all contributed to a decrease in these employer-sponsored retiree benefits over the last few decades. When we combine today’s rising healthcare and benefits costs, economic instability, and an aging population, the result is a quandary for employers with retiree liabilities.

Organizations are looking for solutions to lessen and manage these liabilities. A 2022 MetLife study found that 85% of plan sponsors say their company’s post-retirement benefits received significant attention in 2022 from their corporate management because of the financial effects that their volatility and related risks place on their corporate balance sheet and income statement. In fact, the same study estimates that pension risk transfers represented between $50 and $52 billion in 2022. The study surveyed plan sponsors with one or more post-retirement medical and/or post-retirement life insurance plans for current or former employees. 78% of the survey’s plan sponsor respondents work for companies with $100 million or more in retiree medical and/or retiree life insurance plan obligations, putting serious strain on fiscal matters and causing a shift in priorities.

Solutions Available

Insurance companies like taking on pension risk for retirees, because payment amounts are known, as is the form of payment. In addition, the risk is somewhat short-term, related mostly to mortality. Accordingly, insurance companies quote on retiree liabilities with competitive prices, and several plan sponsors have settled some or all of their retiree liability.

Contrast this with terminated vested participants, who may have several decades until retirement. In this case, the benefit amount is dependent on several factors like age at retirement and form of payment elected. There is also substantial investment risk for plan sponsors. While these uncertainties are commonplace in pension plans, insurers build in substantial margin to compensate them for taking on these risks. This can be especially problematic for plan sponsors who have already settled much of their retiree liability, leaving only the less attractive liability to insurers on the books.

U.S. GAAP sets out stringent employer requirements when it comes to accounting for the accrual of estimated total retiree medical and other benefits; however, it does not force employers to fund these obligations. Employers are merely required to recognize them. Recognition nonetheless creates a liability without an offsetting asset.

The good news is that innovative funding mechanisms are available to assist with plan termination. One example is the SECURE Act 2.0, signed into law on December 29, 2022, which paves the way for overfunded pension plans – now defined as those that are at least 110% funded – to transfer up to 1.75% of plan assets to a program used to pay for retiree health and retiree life insurance benefits through 2032. Derisking and buy-out solutions continue to be prevalent as well, although they often come with a substantial margin for insurers. A retiree medical buyout leverages a customized group annuity issued by a highly rated insurance company to transfer the retiree benefit obligation from the corporate sponsor to the insurer. MetLife reports that 84% of surveyed planed sponsors are considering such a buyout for their retiree life insurance liabilities.

More and more plan sponsors are transferring or allocating excess pension assets from overfunded defined benefit pension plans to fund other retiree benefit obligations, such as retiree medical and life insurance. According to MetLife’s 2023 Post Retirement Benefits Poll report, 55% of plan sponsors surveyed have already transferred assets in this way.

Another tactic gaining traction as a viable funding solution for retiree benefits is captive insurance. Companies can rely on IRS Revenue Ruling 2014-15 to set up a captive that exclusively writes noncancellable accident and health insurance to cover retiree health benefits. With the coverage being life insurance, the captive’s reserves will receive life insurance tax treatment which thus allows the reserves to grow tax free. More importantly, the company is able to fund the retiree health benefits in a new captive without DOL approval since they do not fall under ERISA. This is the type of status-quo-challenging strategy that may prove critical for organizations grappling with defined benefit plan promises, given today’s difficult market conditions.

Case Study: Utilizing a Captive Insurance Arrangement to Manage Defined Benefit Pension Risk

Spring has worked closely with the pension risk transfer groups at insurance companies, who consistently price liabilities for settlement at 20% or higher than the US GAAP liability that plan sponsors recognize on their books for vested terminated participants. This is significantly higher than retirees, who can sometimes be priced at or even below the US GAAP liability.

Spring has developed solutions for clients to settle plan liabilities at very close to what plan sponsors currently recognize. This is a substantial savings to plan sponsors, and it allows the plan to be terminated sooner. Below we are bringing some of these concepts to life with a case study.

The Challenge:

A plan sponsor with a billion-dollar pension plan wanted to review risk management options for their plan, including how best to manage a large bulk annuity transaction. The organization had previously completed smaller transactions, including retiree annuity buy-outs as well as vested term lump sums. They were now looking to complete a much larger annuity transaction, but they wanted to better understand the full spectrum of options. A traditional annuity transaction would have been quite expensive given the conservative nature of how commercial carriers price deferred liabilities. While many factors impact the price of a transaction, the low interest rate environment, mortality risk charge, as well as conservative long-term investment options all contributed to a much higher transaction cost under a standard plan termination than the sponsor felt was reasonable.

The Process

Spring assessed various risk management options for the organization to consider, including an additional vested term lump sum window with a robust communication program to increase the take rate as well as a much larger bulk annuity transaction for the entire plan. The organization was interested in exploring an additional lump sum window, but first wanted to focus on how best to move forward with a cost-effective bulk annuity transaction. Rather than exploring these options with their plan actuary, the plan sponsor was also looking to work with an organization that could provide for a more objective and independent analysis without any conflicts of interest.

We reviewed options for a possible bulk annuity transaction with the organization which included both buy-in and buy-out strategies. We recommended exploring the use of a captive to improve the overall cost and participant security of the bulk annuity transaction. Using a captive can substantially lower the cost of the overall transaction, particularly for plans looking to transfer obligations for more than existing retirees only. A captive provided several benefits including:

- Lower cost of overall transaction

- Increased operating income

- Control over assets

- Risk diversification in the captive

- Improved participant security

The Results

This strategy yielded the following positive impacts:

- Over a 10% reduction in the one-time premium outlay for the transaction

- Participant security is enhanced because the captive provide an additional commitment to pay the benefits in addition to the fronting carrier.

Conclusion

Innovative tactics are available for organizations facing financial stress related to defined benefit plan liabilities, combined with the volatile market circumstances we’re seeing today. If your organization has pension plan liabilities and is looking for a strategy to mitigate this burden, you may want to evaluate the different options available to ultimately help you realize savings and enhance your risk management strength.

A Q&A from our Managing Partner, Karin Landry, our SVP, Prabal Lakhanpal, and Chief P&C Actuary, Peter Johnson was featured in Financier Worldwide Magazine’s August 2023 edition. It reviews current trends in captive insurance across benefits and Property and Casualty (P&C), and what we can expect in the industry moving forward. You can access the full Q&A here.

A summary of our webinar with the Northeast HR Association (NEHRA)

When it comes to health and productivity programs, the past several years have been a time for Benefits and HR professionals to test out a range of initiatives in response to pandemic and post-pandemic challenges, priorities, and employee expectations. Now, however, the market is in a different place and it is time to assess the impact of recent program offerings; does the reward outweigh the risk?

The Big Picture

Today’s economy is creating urgency around making sure benefits programs are properly managed. High inflation rates touch everything; the impact doesn’t stop at the grocery store or the gas pump, it extends to already high healthcare costs. In addition to the economic reality, we have seen an increase in healthcare utilization coming from new treatments and technologies available, further increasing costs. Relatively low unemployment may have shifted attraction and retention goals for some organizations, but a rise in layoffs is having tangible effects on the labor market at large which trickles down to employer strategies. It’s not just employers facing challenges, though, as healthcare services have become unaffordable for many and consumers/employees are also feeling the cost burden.

As a starting point, take a look at your data to answer questions like:

- What does your population look like in terms of demographics and health trends?

- What are your employees selecting for benefits?

- What is driving your costs?

- How might you segment your population?

- Are you accounting for future population shifts and resulting needs (e.g., company growth)?

You should then be able to assess whether or not your benefits align with your population as well as your corporate objectives. When determining true return on investment (ROI), it’s important to consider both human and financial perspectives.

Now that we have established a bird’s eye view of the risk versus reward equation, let’s drill down into key plan components that factor in.

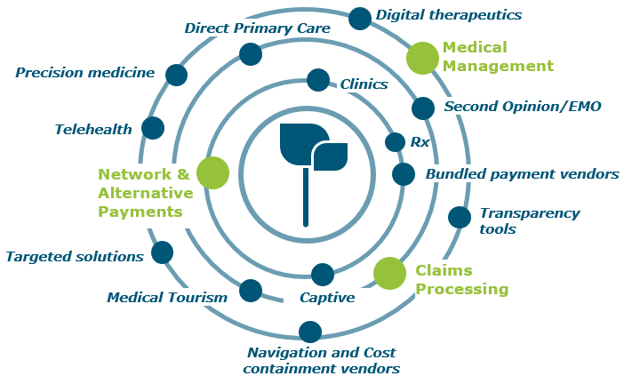

1. Risk Management

There are a range of risks to consider within your benefits strategy. There is the risk of buying insurance, and the allocation of funds. There is the risk to your employees of undertaking a high cost treatment, if necessary, which may not be feasible for lower wage workers.

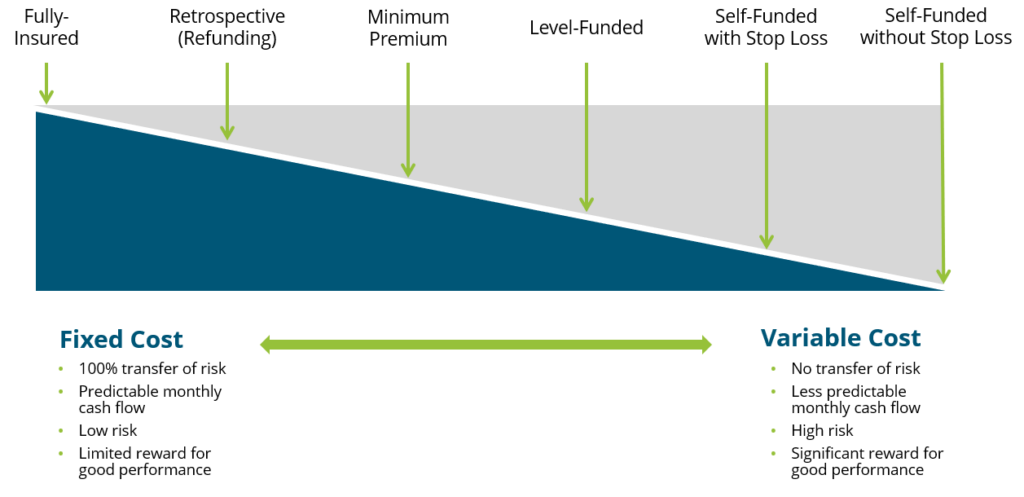

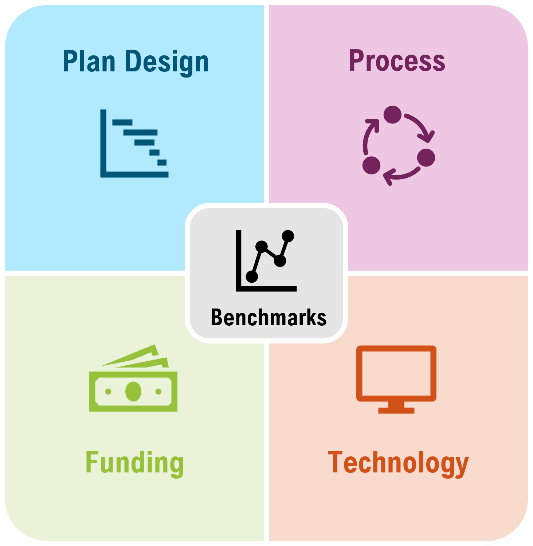

When it comes to benefits funding, the following graphic illustrates the spectrum of options available, where the risk taken by the employer increases as you move toward the right.

While a fully insured plan largely frees the organization of risk, there is typically a lot of overhead and administrative costs involved and less governance when it comes to claims management. Overall, though, we encourage our clients to consider this spectrum and determine where they fit in related to risk appetite, budget and resources, specific health trend, and more.

2. Financial Management

Related but separate from risk management comes the financial management of your benefits program(s). There are three key activities that fall within this bucket:

- Program Strategy

- Account for long-term costs and variability

- Cost Projections and Rate Setting

- Provide budget updates

- Adjust for economic changes

- Includes premium equivalent rate projections and employee contribution rate setting

- Plan Governance

- Establish framework

- Ensure sufficient reporting and monitoring cadence

- Account for actual versus expected, large claims reporting, key cost drivers, retiree medical valuations, etc.

The insights gleaned from the financial management arm should be embedded into your overall benefits and risk management strategy, rather than live in a silo.

3. Pharmacy

Pharmacy has been top of mind for employers, understandably so given the rapid rise in prescription drug costs, which now constitute anywhere from 20-25% of total healthcare spend in the U.S. Specialty medications account for 50% or more of pharmacy spend even though only about 2% of the population is using them. Brand and generic drug costs are also rising at rates we have not seen in the past, perhaps in correlation with inflation. Suffice it to say, employers are struggling to mitigate their own costs as well as the costs for their employees. So, what can be done?

Within the pharmacy benefits landscape, two areas have been getting a lot of attention: weight loss drugs and biosimilars.

Weight Loss Drugs

Chances are you’ve heard about a new wave of “Hollywood diet” drugs. There has been an enormous amount of marketing going on around these new weight loss drugs, especially in the realm of social media and influencers. All of the buzz has also gotten the attention of employers, who are asking us questions surrounding coverage, costs, and pros and cons.

To provide some background, of the four weight loss drugs taking center stage, only two have indications for weight loss, while the other two are being used off-label. Weight loss drugs are not new, but these varieties are showing results we haven’t seen before, and their arrival on the market is timely, as about 42% of the population is either overweight or obese.

From a health and productivity standpoint, we know that obesity increases a person’s risk of developing a chronic condition, which leads to higher healthcare costs. But we also know that there are financial and non-financial reasons to foster a happy and healthy workforce. Can and should weight loss drugs be an answer for employers?

These new drugs are retailing for about $1,300 a month, so we need to consider annual costs and the longevity of how long an employee will need to stay on the medication. For employers considering them to their plan, we recommend it being one piece of a comprehensive strategy that also includes wellness initiatives and/or a commitment from those prescribed the drug. In addition, you must build strong monitoring protocols to judge effectiveness and impact on overall plan costs and utilization.

The inclusion of weight loss drug coverage in a health plan will make sense for some employer groups, and not others. We recently talked with an employer client who saw enough value in even a 10% reduction in body weight to convince them to cover the drug. However, any decisions need to be based, once again, off of population data and corporate objectives. This is a new and evolving sector, so your strategy should remain fluid as we see developments.

Biosimilars

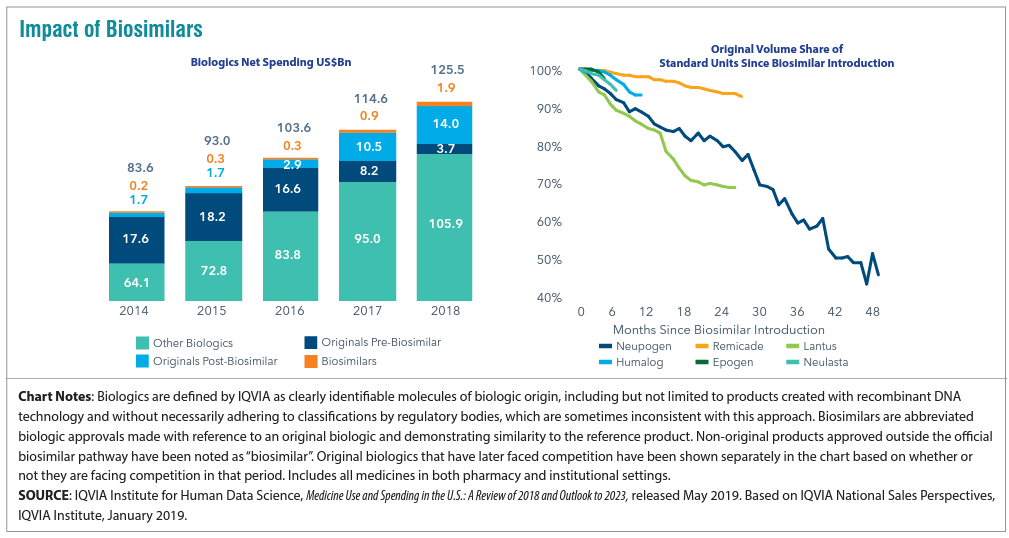

Biosimilars are non-generic alternatives to those specialized medications that are very targeted in how they work and on what conditions they combat. There has been a lot of anticipation surrounding biosimilars as a solution to the specialty drug cost crisis. At the beginning of the year, a biosimilar of Humira, the number one drug dispensed in the U.S. which is used to treat inflammatory conditions, entered the market as the first biosimilar. While there has been some impact, to date it has not been the silver bullet we were hoping for. We can see below that biosimilar adoption rates are all over the map depending upon the condition for which it’s being utilized.

For employers, what’s important is vigilance in understanding where your Pharmacy Benefit manager (PBM) has positioned biosimilars as far as coverage is concerned. We have found that PBMs are placing biosimilars typically at the same parity with the reference, or brand name product. In this case both Humira and its biosimilar would be considered tier 3 medications, which does not yield the anticipated savings. Why is this? Well, there may be additional rebates available to employers and health plans if they continue to use the reference product.

This is a complicated space that continues to change at a rapid pace. Overall, though, if biosimilars are working the way we want them to, we need to figure out a way for all stakeholders to embrace them as a lower cost alternative instead of being locked into brand name drug prices. In some cases, the drugs are life-changing, so we do want to cover them but in a more sustainable way. We work with clients to ensure they are informed of and ready for these advancements and nuances.

4. Targeted Point Solutions

The term “point solutions” now represents a large umbrella of tools, however it typically references programs that target specific diagnoses such as diabetes, oncology, and hypertension. In recent years there has been significantly more interest in point solutions from our employer clients, and, especially with multiple solutions running at a time, these can be a slow leak on spend. Now is a good time to take a step back to answer that risk versus reward question for point solutions.

The best place to start in assessing point solutions whose reward outweighs the risk is data analytics. Try to use any data you are getting from your health plan, internal teams, or the industry to benchmark your spend. In areas where your spend is high relative to benchmarks, do a deep dive for potential solutions that can help. Some pitfalls in this area include:

- The more point solutions you implement, the harder they become to monitor and manage

- Point solutions embedded in your health plan may seem like a no-brainer, but they usually yield very low take-up rates

- Overlap between different point solutions/benefits programs can cause confusion for all stakeholders

- Focusing purely on dollar ROI may not be the play; listen to your gut about what is right for your workforce and understand the qualitative advantages around camaraderie and culture to be gained

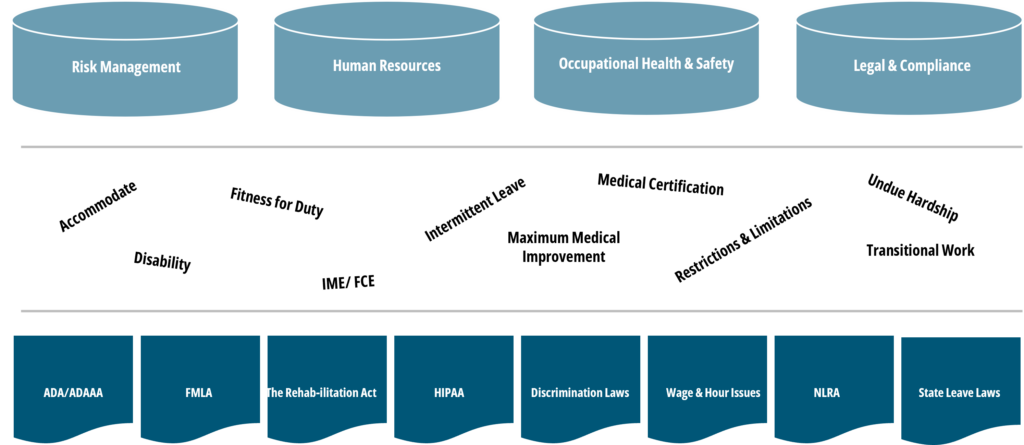

5. Absence Management

Absence management is highly correlated with your health plan performance, since the vast majority of your high cost claims will also include a leave of absence, so there are both plan costs and productivity rates at play here.

Making absence programs more challenging is the volume of stakeholders involved and laws with which you need to comply (as seen below).

Further, when we talk about absence management, we account for a wide range of benefits including short- and long-term disability, statutory disability, workers’ compensation, FMLA, ADA state paid family and medical leave (PFML), and others.

With absence, different than with medical plans, your company’s managers and supervisors are directly involved when it comes to plan design, governance, staff training, etc., so it is an area where you typically need to look inward to drive change.

When it comes to the risk/reward balance of an absence management program, employers can make sure corporate programs are set up the way they want, for example, promoting the right attraction and retention strategy. Remember that the more generous your programs are, the more they will cost and the higher the risk you take on. If shifting some responsibility to an outsourced partner, be sure you still have monitoring protocols in place.

Closing Thoughts

Across these five areas and more, we encourage you to get familiar with your organization’s plan and demographic data. Depending on your size, the level and depth of data available might be different, but there is always some data available, such as industry standards and benchmarks. Whether you are focused on weight loss drug strategy, funding, or point solutions, you can take those data-driven insights and apply them across these four pillars to determine your best practice.

If you are having trouble getting started, or could use specific guidance surrounding the topics mentioned, please get in touch with our team.

Background

In 2018 the State of Hawaii Legislature passed a bill, Session Law Act 109, directing the Legislative Reference Bureau (LRB) to conduct an analysis to determine the impacts of establishing a state paid family leave (PFL) program. Stakeholders considered in the impact analysis included industry, consumers, employees, employers, and caregivers. The goal of Act 109 was to create a potential framework for the development of a PFL program that would offer paid leave for workers who need to care for a family member. The bill allowed the LRB to contract with a consultant for completion of the impact study, and after a formal Request for Proposal (RFP) process, Spring was selected to partner with the State of Hawaii on this initiative.

The Challenge

The objectives of the impact study were to:

- Conduct an objective and unbiased study analyzing and comparing existing models of PFL programs in other states

- Model the impacts of adopting similar methods of PFL programs in Hawaii, including the projection of costs and other quantifiable effects of each model

- Examine objectively the compliance and enforcement options for a PFL program in Hawaii and make recommendations for additional staffing and support needs

At the time, six states plus D.C. had a paid leave program for family and/or medical reasons in place, and part of our evaluation was not only a cross-model comparison of existing plans, but also a provision of the PFML landscape overall, including states with pending or rejected legislation. Both qualitative and qualitative factors needed to be assessed, including required operational activities, outreach and education approaches, state administration models, headcount modeling, IT infrastructure development, and projected startup costs. Integration with Hawaii’s existing State Temporary Disability Insurance (TDI) program was also explored.

Spring’s Work

Through Spring’s three-phased approach, the impact study covered a wide range of areas in detail that were critical in deciding on the development of a PFL plan in Hawaii. Starting with a deep dive into existing state PFL programs which included California, Massachusetts, New Jersey, New York, Rhode Island, Washington D.C., and Washington as seen below.

Plan Structure:

- Plan model

- Rating method

- Plan design including benefit amount, wage replacement ratio, maximum benefit, length of leave, employer eligibility, employee eligibility, qualifying events, covered relationships, job protection, and interaction with TDI program funding

Funding:

- Taxable wage base for funding

- Contributions to funding

- Updated costs

Administration:

- Administrative structure

- Claims management

- Ongoing monitoring

Implementation Timeline

- Rollout sufficient to gain industry and employer support

- Education and communications strategy

- Protocol for contributions and pre-funding

Within this evaluation, factors like gender equity, hiring practices, speed of benefit payments, ease of making applications or claims, financial sustainability, data collection capabilities, and compliance monitoring capabilities were also assessed. To arrive at these impact answers, Spring’s actuaries developed an actuarial impact model that utilizes actual PFL claim and other industry data to project claim incidence rates, duration of benefits, average benefit payments, expected costs and funding rates under existing state models and Hawaii’s current TDI structure.

The Results

Spring’s comprehensive impact study for the State of Hawaii’s Legislative Reference Bureau is available for public viewing here. Our team presented it in person to various legislators. While the State has not moved forward with a PFL program to date, we continue to keep the dialogue open and all parties are pleased with the framework set out in this project, as it was an imperative piece of due diligence on behalf of the State.

Our Senior Vice President, Prabal Lakahpal, and Senior Consulting Actuary, Nick Frongillo have been listed in Captive International’s Forty under 40. The list is comprised of up-in-coming talent that is helping shape the future of captive insurance. You can access the complete list here.

Title:

Senior Consulting Actuary

Joined Spring:

I joined Spring in April 2019, around a year before the pandemic.

Hometown:

I was born in Maryland and grew up in both Maryland and California.

At Work Responsibilities:

As a Senior Consulting Actuary at Spring, I provide employers with customized solutions that manage costs and improve performance of employee benefit programs. Some of the most common programs I am involved with include retirement, life, and disability plans.

Outside of Work Hobbies/Interests:

Lately, I am enjoying running, hiking, and yoga.

Fun Fact:

I am a multi-state backgammon champion (Massachusetts and Connecticut)!

Favorite Part of Spring:

I genuinely enjoy the work we do. Every day, I get to work with bright professionals and industry pioneers to make a difference for our clients.

Favorite Food:

Sushi.

Favorite Place Visited:

Anywhere with a lighthouse, but especially the North Carolina coastline. I have seen about 200 lighthouses, and I look forward to seeing more!

Spring Consulting Group has announced they have hired three new actuaries to support their Employee Benefits and Property & Casualty (P&C) Actuarial offerings.

As Spring’s Senior Vice President & Chief Actuary, Steven Keshner, is set to retire soon, the organization has appointed Ron Williams as Chief Actuary. In this role, Ron will lead Spring’s Employee Benefits Actuarial team, including providing strategic oversight and contributing to new business development.

Ron brings over 30 years of insurance experience across financial solutions, capital and risk management, and employee benefits. Prior to joining Spring, Ron was a Managing Director leading the Health and Benefits Risk Analytics Practice at KPMG and also held leadership roles at Willis Towers Watson, Lincoln Financial Group, and The Hartford.

Ron is also an adjunct professor of Corporate Finance within the Actuarial Science Program at the University of Connecticut, a Fellow of the Society of Actuaries, and a Member of the American Academy of Actuaries

Spring also hired MIT graduate, Andrew Stuntz as an Actuarial Analyst on the P&C team to support projects related to pricing, reserving, and captive feasibility studies. Prior to Spring, Stuntz worked on transit pricing and fare technology projects for the Massachusetts Bay Transportation Authority (MBTA) and on analysis of environmental regulations for NERA Economic Consulting. Stuntz will work on the P&C actuarial team led by Peter Johnson, Chief P&C Actuary.

Spring also recently welcomed Aaron Houtari as an Actuarial Analyst. Houtari holds two bachelor’s degrees in economics and applied Mathematics, and was Co-President of the Actuarial Club at Hillsdale College.

Houtari has held multiple finance and actuarial positions at AXA Advisors, JPMorgan, and Allen Bailey & Associates.

Commenting on these developments, Spring’s Managing Partner, Karin Landry, stated “I am thrilled about all the new additions to Spring. I know this will enhance the breadth of our actuarial services and ensure our clients continue receiving the same excellence, attention to detail, and consultative knowledge that our actuaries are known for!”

Landry also announced plans to continue expanding Spring’s actuarial resources this year in both the employee benefits and P&C space.

In a recent article published by Captive Intelligence, our Chief Property and Casualty (P&C) Actuary, Peter Johnson, reviews current trends in the P&C industry and how risk optimization can help cut costs and increase coverages. Check out the full article here.