Spring has been awarded by Employee Benefits Advisor for this Rising Stars 2020 award! Check out the full article here.

Check out this article by Captive International, where they spotlight Spring’s experience with captives and how we approach captive and risk optimization.

Our Managing Partner, Karin Landry was in an interview with Captive.com in which she discussed the current state of captives and what we can expect to see in the future. Check out this Q&A Recap by Captive.com.

COVID-19 Update

In light of the global pandemic, the federal government’s Coronavirus Aid, Relief, and Economic Security (CARES) Act, which was passed in late March, has several provisions related to student loan debt that employers and employees should be aware of including:

1 – Payments on student loans will not be required through 9/30/2020.Nonpayment during this time will not yield any negative repercussions for the payer (such as a credit score hit), and interest will not accrue during the six months. This exception applies to direct and federal family education loans, but not private loans. In addition, borrowers who can afford to continue making minimum payments (or make additional payments), will have all of these payments apply toward principal during this period, allowing them to further benefit by paying off their student debt more quickly.

2 – If an employer would like to help an employee pay down their student loan debt as an added benefit during this difficult time, the employer can make a tax-free payment of up to $5,250 per employee during 2020.Prior to the CARES Act, employer payments were fully taxable to employees. Employers are hopeful that additional legislation will make these tax changes permanent.

In 2018, Americans held a whopping $1.5 trillion in student loan debt, beating both the national auto and credit card debt rates. This number has grown exponentially in recent years, having an impact on all employees but arguably hitting the millennial generation hardest. As a result, employees are deferring home purchases and retirement savings due to their student loan obligations. In turn, this creates a challenge for employers working to recruit these employees, who are experiencing financial challenges and not at optimal productivity or engagement.

Employers across the country are recognizing this crisis, and implementing solutions to mitigate its effects for employees. However, nothing is simple. In considering a student debt relief benefit, organizations need to think about:

- Strategic goal(s)

- Financial wellness

- Funding and taxability

- Administrative complexity

- Employee demographics

For employers with robust benefits programs in place, an integrated approach is continuing to become an increasingly popular way to take things to the next level, and for good reason. Although the concept is not new, and our team of experts has been developing solutions for years, certain aspects are getting employers’ attention.

Spring’s 2016 and 2018 employer surveys, led by Spring’s Senior Vice President Karen English, show that the core drivers to developing an integrated program are:

- Costs savings

- Simpler administration

- Upgraded employee experience

- Enhanced tracking capabilities

- Improved compliance

There’s a lot more impacting these areas than you might think, so let’s take a deeper dive.

Cost Savings:

Having an efficient benefits program with systems that speak to and work with each other can go a long way for your bottom line. Integration provides greater transparency into your workforce – absence management challenges, productivity, employee health – among other things. This knowledge is an opportunity to create a healthier, more present workforce.

If this sounds like qualitative “fluff”, it’s not. One healthcare client was able to save over $10M in direct and indirect costs through integration. These savings resulted from savings in the following areas:

- Workers’ compensation

- Disability

- Unplanned absence

- Vacation

- Other Leaves of Absence

Their program, done in tandem with captive insurance company funding, also yielded risk diversification and stability, as well as further savings of 10% of premiums.

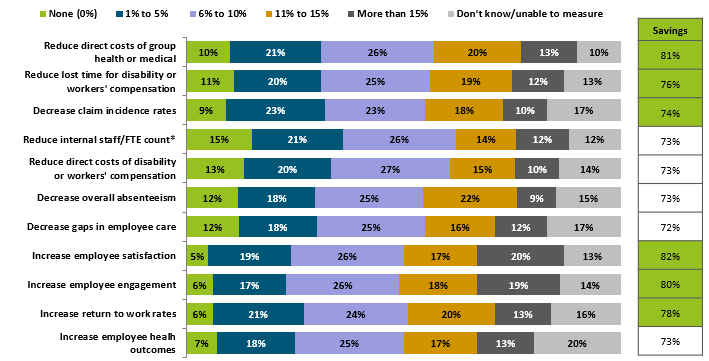

The graph below shows the average levels of employer savings achieved by implementing an integrated program, spanning a range of direct and indirect cost categories.

Simpler Administration:

All parties benefit from an integrated benefits system. An immeasurable amount of time and effort is saved from not having to go to different platforms for critical information. This will speed up the claims process.

The best integrated programs send notifications and communications, and offer automated triggers, case management and documentation. For managers, results are easier to explain. For employees, access is simpler and more approachable. At the corporate level, you can expect faster turnaround time and greater visibility.

Upgraded Employee Experience:

Employees do not typically understand the nuances surrounding absences, nor the various policies, plans, and processes involved. They simply need time away. By integrating absence to include occupational and non-occupational events, your employees will experience:

- Fewer points of contact

- Clearer processes to follow

- Faster turnaround times

- Improved information access

- Increase self-service options

- Decreased confusion

These benefits lead to an enhanced employee experience including higher engagement, both at the organization and with their health. As all HR professionals know, engagement is critical for recruiting, retention and overall performance. Whether at risk or not, all employees will appreciate a smarter, more robust benefits program and an employer that is looking out for their wellbeing.

Enhanced Tracking Capabilities:

To make sustainable improvements, it is imperative to track your integrated program and mine the data across all absences to investigate patterns and draw predictions. An integrated program allows for metrics across plans and policies with drill-down features such as:

- Occupational vs. non-occupational

- Paid vs. unpaid

- Job protected vs. non job protected

- Return-to-work vs. stay-at-work

- Sick, vacation, etc.

- Self vs. family

- Continuous vs. intermittent

- Diagnosis specific

With all these different facets captured uniformly, you have reporting that is comprehensive; supports workforce planning and budget; allows for strategic planning with HR as a business partner; and offers opportunities for prevention; so that your organization can be proactive instead of reactive. These kinds of insights allow employers to move into population health management.

Improved Compliance:

With the hub of intelligence that an integrated program offers, employers have a more reliable way of remaining compliant when it comes to things like the ADA, FMLA and ERISA, as well as any state-specific regulations and policies unique to the company. Automation will make leave requests and absence tracking much easier to manage, and accurate documentation will aid accountability for employers and employees alike.

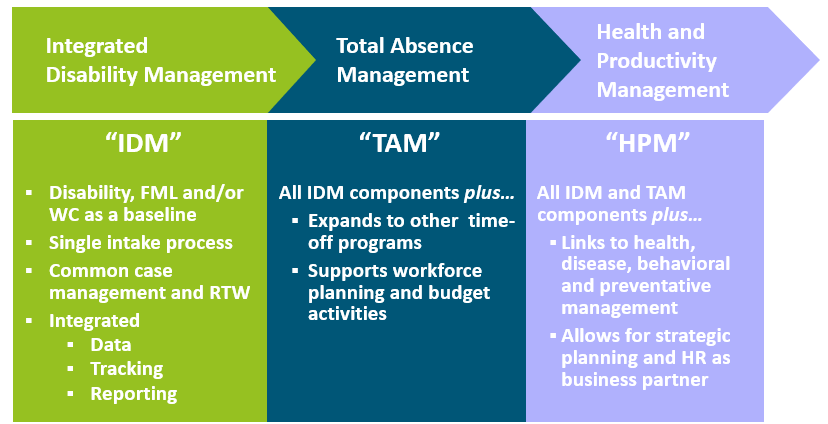

Ultimately, an integrated workers’ compensation and disability program can have significant positive impact on a company and its employees, especially for larger employers. We have seen great, quantifiable success with integrated programs from our clients. If you are thinking that this process seems too big a task to take on, don’t worry. Any company can start at any point along the continuum shown below, and gradually work their way to a model that facilitates population health management in the workforce.

Most Common Approach is Phased

and this is one of the many reasons I love my work. One component of my role is assisting organizations in managing their disability and leave programs, which includes being compliant with the American’s with Disabilities Act (ADA) and Amendments Act (ADAAA). The ADA has pained employers for years due to its regulatory complexity, and although they are making strides and building functional processes to address it, it can sometimes feel like two steps forward and one step back.

I recently conducted a training on the ADA for a large employer team of subject matter experts. After a challenging week of what felt like personal parental fails, I used an analogy that managing your ADA program is a lot like raising a pre-teen! Truth be told, that wasn’t in the script, but it was top of mind at the time and I knew that most of the audience could relate to both parental and ADA struggles.

If you still aren’t convinced of the overlap, I have outlined four challenges with the ADA (that I also experienced with my 12-year-old daughter).

1) Everything must be managed on a case-by-case basis

Organizations must have a prescribed process to identify and manage ADA cases to ensure potential accommodations do not slip through the cracks. However, the regulation is clear in that every case must be reviewed based on its own merit. Employers must consider every request, examine what is needed, and consider solutions that will satisfy the employee’s needs without causing undue hardship to the organization. Key elements of any job must be considered, such as location, essential functions, organizational structure, hardship potential, duration and the like. A simple yes or no is rarely enough. There are often conditions that must be met, including the potential for extensive negotiation, and any decision may be accompanied by resistance from different parties.

At home I also take into consideration things like location, duration, hardship to the family unit and every request must be reviewed on its own merits. Just like with your ADA requests, a yes is always met with delight, but a no will always cause additional work and difficult discussions. That said, that doesn’t mean that you can routinely go the “yes” route just because it’s the path of least resistance.

2) There is a constant demand for “things”

Regardless of whether the request is for Instagram or a sit-stand desk, the requests just keep rolling in! Giving a simple “no” just isn’t going to work. You must engage with your employee (or child) by asking questions, digging into the details, justifying your rationale and following documented policies and regulations (or family rules). Why do they need what they are asking for? Examine both sides of the argument.

With accommodation requests, a simple “yes” is rarely the optimal solution. The key is to really understand what is needed versus what is requested, as there are often gaps in between. The dialogue and documentation need to support what the employee can do and what will ensure they are able to do the essential functions of their job with or without accommodations. Simply approving their request for something may not actually yield a successful solution. Instead as the employer you need to fi nd an accommodation that suits not only the employee but as many stakeholders as appropriate. I recently worked with a client surrounding parking accommodations which were on the rise and extremely challenging given their various office locations and distances to sites. It highlighted how a simple “yes” doesn’t always work. Instead great care needs to be taken with each request and each potential accommodation.

With my daughter it started with an iPod and grew to the iPhone, which has now turned into social media requests. Just saying yes doesn’t work for me – I need to dig in and see what I can provide her that might satisfy her need to fi t in without creating an undue hardship for me. And if I do say yes, you can bet there is going to be a social meeting agreement (similar to an accommodation agreement) to hold us both accountable!

3) Your voice is drowned out by others

Employees requesting an accommodation typically have resources to work with at an organization. They may be working with a disability or workers’ compensation partner, their supervisor, HR, benefits and even occupational health resources. All those voices become noise in the ADA process. Even with the best of intentions, those sources put pressure on the situation that may drown out the voice of the accommodation team. Some parties may be encouraging return to work too aggressively or not aggressively enough. Silence from those resources may be perceived as lack of support the same way that vocalization may be viewed as intimidating. How do you fi nd the right balance?

The key is to manage expectations within the ADA process and bring the stakeholders together by giving them a seat at the table. The interactive process is a very critical part of accommodation reviews; it cannot be avoided in a compliant process. Instead of dreading that part of the process, try to embrace it. Use it to get to the best solution for the employee and the stakeholders and then make a firm decision on what can be implemented.

All parents understand that our children aren’t always listening to us even though we may think every word we utter is critical and wisdom-filled (just like a strong HR professional). Further, what they hear from us may differ from what they hear from their friends, friends’ parents, teachers, or even your spouse. But regardless of the frustration or eyerolls, the ultimate decision related to our children rests with us. They may try to change our minds or tell us all the reasons why other opinions should be valued, but we determine the best solution and do our best to implement it at home.

4) Everything must be managed on a case-by-case basis

An organization cannot be compliant with the ADA, or appropriately manage absence, unless they are dedicated to developing an accommodation program and following through with clear processes and documentation. With that said, it is a long game – a marathon, not as print. Most employees and supervisors will not be singing your praises immediately. At first, they will feel like you are making it “too easy” for employees, or “rewarding” employees who are abusing the system. At the same time employees may think you are “asking too many questions” or “forcing them to pay more money to get paperwork completed.” On any given day all those things may be true, but you are also working to provide a compliant work environment that accommodates employees fairly. You want a solution that returns employees to productive work, processes that are in good faith and interactive and a way that documents what steps were taken and what was agreed to. All of those are beneficial to your organization and to the individual as well.

I was recently working with a client that learned the hard way about documentation. They had a healthcare resource that was given an accommodation around not performing CPR as it was not viewed as an essential function. This employee was transitioned to a new role where CPR was required but the knowledge of her accommodation and lack of ability to perform this function was missed during transition. Unfortunately, this placed an unanticipated strain on the organization, which could have been avoided with greater documentation. Instead, the involved parties were working to solve the immediate need without thinking about the long-term impact on the employee or the organization.

As you focus on return to work and accommodations, try to aim for incremental change toward the most successful program possible, keeping the long-term vision in your view. Start with your policies and procedures, ensuring they reflect the type of program your organization needs. Consider them as living documents that will require revisions as your accommodation program matures. Build an efficient process around those policies, doing your best to move toward that pre-defined,

distant goal post.

At home, incremental change is necessary as well. Do I want a clean room, laundry done, dishes finished and homework perfect? Yes. But I will settle for incremental change toward a successful and productive member of society. This may mean taking things one step (or chore) at a time or placing more focus on the achievements compared to the gaps.

So next time my daughter tells me I am “annoying” and “all the other kids have Instagram” and “I don’t know what it’s like,” I will remind myself that on any given day those things may be true, but I’m trying to raise a healthy, happy kid and building this foundation is necessary to create long-term success. Right now, it’s hard for me to see the goal post but I know it’s there.

Regulation around the ADA is complex, like my pre-teen, but it’s important to remember that it is built on the core premise of avoiding discrimination and pushing employers to do what is right. It sometimes forces a difficult dialogue between employers and employees, but the goal is optimal for both parties.

The Current State of ‘Employer vs. Insurance RFPs

Employers today often find themselves undertaking a Request for Proposal (RFP). RFPs are an important tool that allow for greater insight into the market. RFPs are used as a mechanism by employers to test the market competitiveness of their insurance programs and collect market intelligence regarding new offerings. The bidding process aids accountability and provides market information on emerging risk management techniques, regulatory changes and recent trends. However, RFPs are a time consuming and an arduous task that require inputs from multiple stakeholders, who often have competing priorities.

Captive insurance companies provide an alternate solution for employers who are looking to escape the rut of undertaking an RFP every few years. Captives provide greater transparency and control to employers over their insurance programs and eliminate the often costly and time-consuming need to bid programs to ensure competitiveness. Captives allow organizations to have a clear understanding of their experience and thereby eliminate the arbitrariness of rate hikes by the incumbent carriers. An RFP can also be an expensive exercise both in terms of tangible and intangible resources. In monetary terms, there are the fees for advisors/brokers/consultants. Additionally, time and effort required by your team are also important factors to consider while evaluating the true cost of an RFP.

A bidding exercise is often seen as an opportunity to hit reset on an existing plan and evaluate if the program continues to meet the everchanging needs of an organization. In a dynamic and ever-changing business environment, waiting for an opportunity to bid the program to reevaluate its effectiveness and appropriateness for the organization can result in repairable loss. Businesses need to be able to constantly evolve and change to meet the needs of the market or risk losing its competitive edge.

Captives provide a clear line of sight to the working of the program, thereby allowing for customization in an almost real time basis. A captive framework leads to additional reports and information which further facilitate tweaks and adjustments that benefit an organizations insurance program.

A captive insurance company allows a company to gain true transparency and control of not only their loss exposure, but also the expense structure required to support their programs. This transparency promotes a sense of partnership between the employer and the insurance carrier. Employers with captives have often commented on the change in the relationship dynamic between the two entities, viewing the carrier as a partner than as a market option can have long term benefits.

Organizations that use captives are able to ascertain the need for a change or adjustment in rates without input from the market. Captives rid insurance transactions of opaqueness and thereby results in an open and honest conversations among all stakeholders – insurance carriers, brokers and internal organizational stakeholders.

An integral part of most insurance arrangements is the broker. Broker arrangements can, at times, create a degree of obscurity. Since brokers are usually commissions-based, decreasing premiums or making changes may sometimes not be in the broker’s best interest. This could potentially add another degree of complication and difficulty to the decision-making process. In a captive setting commissions paid to brokers are clearly visible. This clarity of fees generally leads to a clearly defined scope of work for the broker/consultant/advisor. Allowing employers to derive more value from their service providers.

Many organizations may feel pressure compelled to bid frequently, to continually create competitive pressures and achieve better rates. This approach can create an abrasive relationship between the organization, the broker and the insurance carriers. Insurance carriers are looking for long term partners and often may choose to not bid aggressively in cases involving organizations who have a reputation of constantly looking to bid, as this can be disruptive for all parties involved.

Case Study

Spring recently undertook an analysis for an organization whose incumbent broker initially quoted a 25% rate increase on the employee benefit program. When threatened with the possibility of an RFP, the incumbent carrier revised their quote to reflect a 10% increase in premium. The organization was disillusioned with the insurance carrier and decided to undertake an RFP – which resulted in an alternate carrier quoting a net decrease in premiums of about 15% along with a multi-year rate guarantee.

While a 15% rate reduction is a seemingly positive result, the process and effort required to get there was expensive, time consuming and left the HR team feeling beholden to the wishes of the insurance carriers and the broker.

The employer requested Spring undertake an independent review of the information presented to them by their broker and insurance carriers. Spring’s analysis revealed that the organization had a much better loss experience than indicated in the rates provided. The organization is currently considering its options for the upcoming year, including potentially utilizing a captive to underwrite their employee benefit risks .This exercise could have been avoided if the employer was using a captive to insure its risks. At the time of the initial rate increase (of 10%)the employer along with their broker would have been able to quickly ascertain that the rate hike was unnecessary and could have been addressed with a quick discussion with the insurance carrier. Which could have saved the organization valuable time, effort and cost of disruption.

To conclude, companies that are financially sound and have a reasonably predictable insurance risk, are ideal candidates to evaluate the possibility of using a captive. If you are an employer looking for a long-term solutions should consider a captive. Captives provide the benefits of an RFP without disrupting a company’s day to day activities. It also helps bridge the gap of obscurity and trust between your company and your insurance carriers.

To see if a captive solution is right for your company, a captive feasibility study is the logical first step. The study identifies the organization’s goals and objectives, reviews the current state of programs, analyzes the data, and then estimates potential captive savings for each line of coverage. The study determines the most effective program design for the organization, including potential advantages or disadvantages of this alternate funding mechanism.

Our 2017 Employer Leave Management Survey, conducted with DMEC, was spotlighted in an article by SHRM. Check out the full insights here.

The term voluntary benefits was coined long ago when employers fully funded (or significantly subsidized) core benefits and voluntary benefits were an add-on, paid for by the employee through payroll deductions. As the landscape changed, core benefits evolved to be partially funded by employers and partially funded through payroll deductions. As a result, many benefits became voluntary.

For today’s employees, it’s not as simple as core and voluntary; it’s about choice. Employees need to balance what limited disposable income they have for all benefits, regardless of what they are labeled. Even still, the concept of core and voluntary resonates with employers as an industry norm, so it’s important to identify ways to avoid common pitfalls of voluntary program implementation:

- Think holistically

- Don’t forget about ERISA

- Consider enrollment options as a critical component in overall design

- Remember that education is key

- Help employees get the most from their plan

1) Holistically About Voluntary Benefits

Many employers think offering voluntary benefits is like checking a box – something that can be done quickly and without much deliberation. However, programs without thoughtful preparation are rarely successful in terms of education, enrollment and satisfaction. Voluntary benefits should be considered an integral part of the overall benefits package. A strong offering should take into account various factors, including but not limited to:

Current population:

Although a one-size-fits-all approach does not and should not exist, employee demographics can help you pinpoint which products would be most sensible for your collective audience. Generally speaking, those that are starting out in their careers have different priorities than those nearing retirement, and employees falling somewhere in the middle of the spectrum will have their own set of benefits needs as well. For example, accident insurance is more popular for families than for singles or empty nesters, while student loan repayment is more relevant for those in their 20’s and 30’s than for older employees.

Current benefit offering:

When considered in tandem, voluntary benefits can serve to protect employees and reduce their risk or perceived risk for various physical or financial troubles. For example, introducing a high deductible health plan offering complementary voluntary products (i.e. hospital indemnity, critical illness, accident insurance) can help decrease the financial burden on employees.

2) Don’t Forget About ERISA Considerations for Voluntary Benefits

Voluntary benefit programs may or may not be subject to the Employee Retirement Income Security Act of 1974(ERISA), depending on how they are structured and supported by the employer. ERISA provides important protections but can also pose constraints for employers and employees. Assuming you do not want your voluntary programs to be covered under ERISA, you must be careful to manage enrollment and administration separately from your core benefit programs. If you would like your voluntary plans to be subject to ERISA, then coordinating administration and enrollment will not be problematic; however, understand the potential impacts. ERISA compliance and your potential fiduciary duties should never be an afterthought.

3) Consider Enrollment Options as a Critical Component in Overall Design

Our research affirms that employees better understand the offering

and have higher enrollment when they participate in group meetings or individual meetings. In addition, vendor partners are often willing to offer more competitive pricing and waive enrollment requirements if they can meet with employees directly or send them some type of material in the mail.

While some employers welcome the “free” education and enrollment, others are concerned about aggressive selling or having employees using work hours to meet with potential vendors. If you think of voluntary benefits as part of your holistic offering, then leveraging work hours will be less of an apprehension when voluntary is an element of your complete attraction and retention tool.

The key is to think about the enrollment process as an essential design component of your voluntary program. Ensure that decisions surrounding enrollment fi t with the overall program strategy and make sense for your population. Providing comprehensive enrollment with core and voluntary may be a best practice for your group. This allows employees to make coordinated decisions regarding their contributions and programs. It also enables you to offer complementary plans for optimal plan selection. While that structure works for some, other employers feel employees have too many decisions to make during annual enrollment and prefer to stagger voluntary enrollment to allow more time for thoughtful decision making. There’s no right or wrong answer – each company and population is different.

4) Remember that Education is Important

Decision support tools have continued to evolve, providing employees with strong advocacy for traditional plans and voluntary benefits alike. Although voluntary benefits are designed to be less complex and easier to understand, for some employees the language is new. Summarizing the program(s) and sharing scenarios to help employees understand the products is often the best way to introduce a new plan.

Regardless of who funds the program, as the employer it is important that you educate your employees on the available offering. Employees should not elect a benefit they do not understand and employers should not offer benefits that are not valued by employees, or that employers themselves cannot explain effectively. Every dollar spent on voluntary benefits is money your employees are not spending on other necessities like monthly bills, student debt, groceries, emergency savings, or even401k contributions; make sure they are knowledgeable about what they are buying and ensure that it’s a competitive product in the market.

Education can be facilitated in many ways including traditional employee meetings, brochures, benefit fairs, and onsite sessions with vendors. At Spring we have also assisted clients with quick videos that provide the highlights of a program and generate interest. These videos have been well received and employees are able to retain the information from a creative video more easily than a detailed presentation. Videos are also shareable and can be viewed by family members who may be a critical part of the decision-making process.

5) Help Employees Make the Most of the Plan

After you have implemented a voluntary program and educated your membership it’s important that you continue to monitor the program and assist your employees in optimization. Sometimes employees forget about the benefits they have available to them and continue to make monthly contributions to plans but they neglect to fi le claims because they don’t remember what they have elected. A few simple actions can help your employees make the most of the plan:

- Send a quarterly newsletter to all employees, or just those enrolled in voluntary benefits. This will give you the opportunity to remind them of the program benefits. It can also help facilitate changes (i.e. enrolling spouses, children) and provide an opportunity to as questions.

- Partner with your vendors. For example, if you have a purchase program in place, they often run specials and send postcard reminders. Take advantage of those specials! Perhaps you could run a joint wellness campaign linked to specials on health equipment. Ask if they would be willing to raffle off something like a treadmill or vacation to align with your wellness strategy.

- Remind your employees to file claims. Even if you cannot leverage actual data, you can send a reminder at the midpoint of every year for wellness visits with a link to the claim form. For example, most critical illness and accident plans offer a wellness rider – find out how many employees use that benefit and try to increase that percentage.

- Ensure the program remains competitive from a pricing and design standpoint. Employees should feel assured that the benefit they’re purchasing through their employer remains is top tier.

Taking the above factors into account will help you establish a voluntary benefit offering that is accessible and relevant to your employees and that is well worth the effort on your part. Today’s workforce has come to expect more than just the basics when it comes to benefits, and voluntary products allow you to diversify your benefits package, keeping you competitive with market standards without any significant cost increase.

However, it is not enough merely to offer voluntary products and services – they need to be the right ones for your population, they need to be communicated effectively, they need to be readily understood, they need to account for regulations like ERISA, they need to be fully utilized and they need to be rolled out in a way that makes sense for your organization. By covering these bases you’ll be able to avoid the most common pitfalls and successfully offer a valued voluntary benefits programs.