Over the past five years, the outsourced vendor landscape has evolved related to the administration of the Americans with Disabilities Act (ADA). Carriers and third-party administrators (TPA) who previously supported employers with leave compliance at the federal and state levels (i.e. FMLA, MA PFML, CT PFL, etc.) are now proficient in ADA and will support employers with their compliance requirements.

Product offerings vary in the market, with some including support for leave as an accommodation exclusively and others providing support with all accommodations including leave. The assistance available from vendor partners also differs, with some supporting the entire process end-to-end, including coordination of the interactive process with supervisors and employees, while others support data collection but leave the interactive process to supervisors, employees, and HR. At this point, all carriers and TPAs agree that the ultimate decision on the accommodation rests exclusively with the employer, including evaluation of the potential hardship.

Employers with minimal accommodation requests likely do not need support from an external partner. For those employers, it is usually optimal to build some subject matter expertise internally within HR and funnel requests through that resource. At a high level that process should include the following steps:

- Identify the need for accommodation, facilitate intake/request

- Validate the need/disability, gather information

- Facilitate the interactive process

- Consider options

- Choose optimal accommodation in partnership with the employee

- Implement the accommodation (if applicable)

Although the supervisor is a critical part of the process, we typically recommend that supervisors do not independently manage the ADA process – especially if the volume of requests is small – as they may not understand the compliance requirements. In addition, they often only have a view into their business unit or team, making it impossible for them to understand how the broader organization would define a hardship under the ADA as compared to their team or business unit.

If the volume of accommodation requests is high or subject matter expertise does not exist in-house, leveraging your external provider may be a strong option. By co-sourcing the ADA solution, you can leverage the expertise of the external vendor but leave decision-making to your team, including HR, supervisor and employee. Key assessment of an ADA offering includes the following:

- Expertise of firm; skillset of those managing accommodations

- Offering; what is included in the fee

- Intake

- Certification

- Communications

- Interactive process

- Implementation of accommodation (i.e. order device, implement change, track ongoing needs until return to full time and full duty without accommodation)

- Add-on services (what additional support can they provide with additional fee?)

- Hand-offs between their team and HR, supervisors, etc.

- Training available both at transition and on-demand; most will not participate in training until it directly impacts them

Regardless of the partner selected, employers can never fully outsource the accommodation process. Although it often feels like a burden, returning accommodated employees to the workplace is in the best interest of everyone. The ADA does not require that employers remove essential job functions, but it does ensure that disabled employees who are able to perform the essential functions of their job with an accommodation receive those legally required accommodations.

If you need support with your accommodation process and compliance with ADA, free resources are available through the Job Accommodation Network (askjan.org) or feel free to reach out to our team for guidance.

As seen in the New England Employee Benefits Council (NEEBC)’s blog.

Paid Family and Medical Leave continues to evolve throughout New England and the country. While most of the activity has been at the state level, proposals have also been put forth federally. The programs passed by states vary in a number of ways, which leads to complexity for employers trying to navigate this landscape. Compliance concerns and complexities have also grown as the trend for remote work has continued, and employers that hire across the nation must comply with laws where employees work.

Massachusetts: Experience Over the Years

We have now completed our third year of the Massachusetts Paid Family and Medical (PFML) program! In those three years, the program has seen changes in contributions, benefits, claims experience, as well as changes to how it operates and coordinates with other benefits.

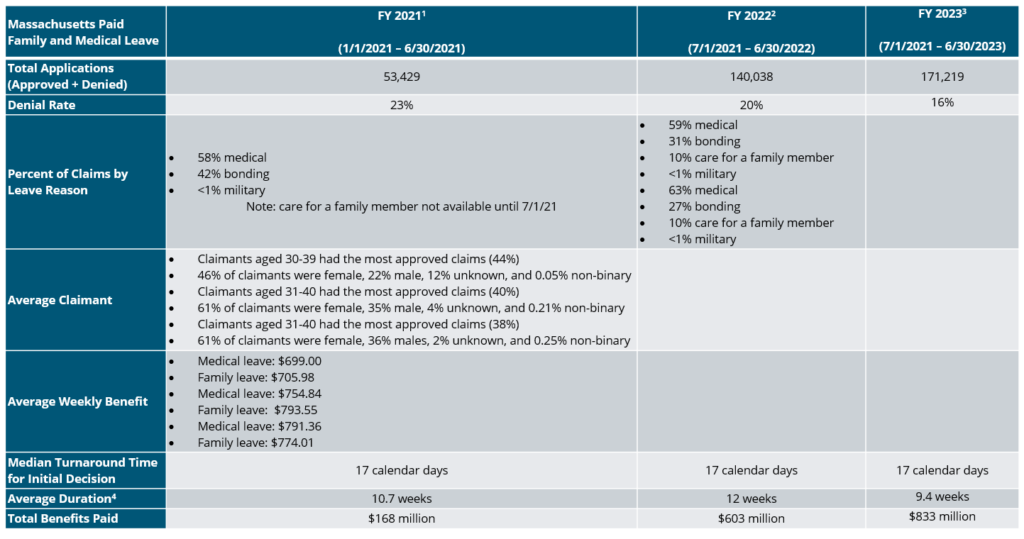

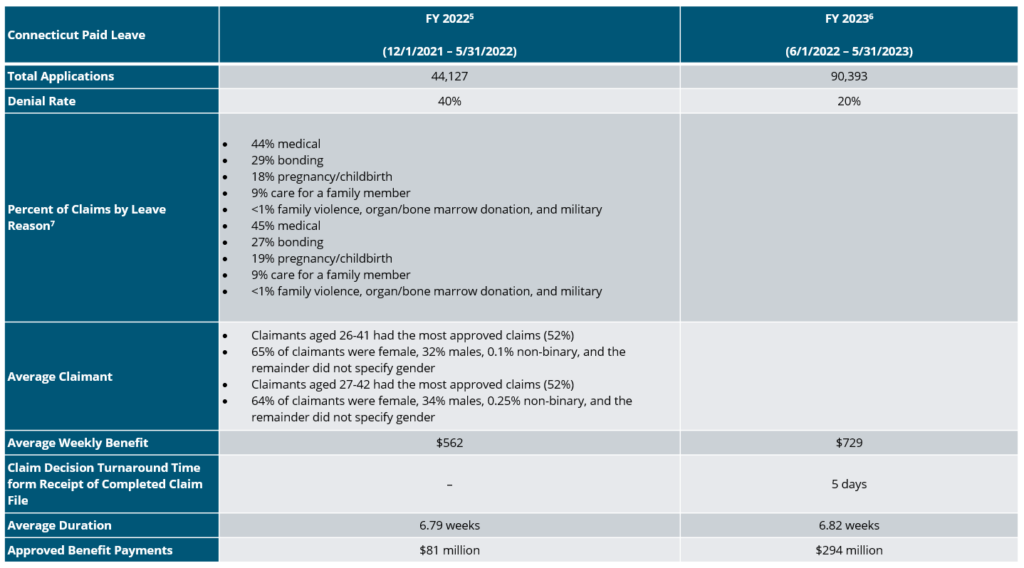

As shown in the summary below, the number of applications for the MA state PFML program has increased annually, as well as the number of approved claims. The most common reason for leave is own medical condition, while bonding with a new child is slightly lower in FY 2023 than FY 2022. Additional points of interest are shown below.

MA PFML Increases as of 1/1/24

The MA PFML weekly maximum benefit amount and contribution rate increased effective January 1, 2024. The maximum weekly benefit is now $1,149.90, which is an increase of about $20 from the 2023 weekly maximum. For any employees who may have leave that runs from 2023 into 2024, the weekly benefit will be based on the beginning of the benefit year.

The total contribution is increasing from 0.63% to 0.88%, for employers with 25 or more covered individuals. The medical leave contribution will be 0.70%, with employers funding 0.42% and employees responsible for up to 0.28%. The family leave contribution will be 0.18%, with employers able to collect the total contribution from employees. Employers with less than 25 employees are not required to submit the employer portion of premium, so the effective total contribution rate is 0.46%.

The financial earnings requirement was also updated in 2024. Employees must have earned at least $6,300 and 30 times the PFML benefit amount during the last 4 completed calendar quarters to be considered eligible for MA PFML.

Additional Changes to MA PFML

Effective November 1, 2023, employees taking Paid Family and Medical Leave (PFML) in Massachusetts have the option to “top off” PFML benefits with available accrued paid leave (e.g., PTO, etc.) so the employee can receive up to 100% of their regular wages. This was not previously allowed for employers providing PFML through the state plan, however, was an option employers could allow through a private plan. The Department amended its FAQs in December clarifying employers can apply the terms of their company policies to the top up option.

Connecticut: A Year in Review

Connecticut has now had PFML benefits available for 2 years. The program continues to grow, as shown in the summary below.

Based on the experience in the state in 2022 and 2023, Connecticut is not making any major changes to the program in 2024. The contribution rate will remain at 0.5% up to the social security wage contribution cap, which is increasing to $168,600 in 2024 ($160,200 in 2023). In addition, the CT minimum wage increases to $15.69 per hour in 2024, which correlates to an increase of about $40 for the maximum weekly benefit, now $941.90.

Connecticut’s Key Differences

The CT PFML program has some key differences when compared to MA PFML, such as the availability of leave for organ and bone marrow donation, as well as leave related to family violence. Differences in benefit amounts, leave duration, and eligibility conditions make it not directly comparable to MA PFML experience.

Rhode Island: Changes for 2024

Rhode Island established the first statutory disability program in the country in 1942, known as Rhode Island Temporary Disability Insurance (TDI). In 2014, they became the third state to offer family leave benefits through temporary caregiver insurance (TCI). The state does not allow private plans, making the model slightly different than other PFML programs in the region.

On January 1, 2024, a few updates to TDI and TCI became effective. The state’s taxable wage base increased to $87,000 in 2024, up from $84,000 in 2023. The contribution rate in 2024 is 1.2%, which is an increase of 0.1% from the previous two years. The maximum weekly benefit is $1,043, not including the dependency allowance8, and the minimum weekly benefit is $130.

The financial eligibility conditions claimants must meet increased. Employees must have paid contributions of at least $16,800 in the base period or meet the alternative conditions wherein they earned at least $2,800 in one of the base period quarters and base period taxable wages equal at least $5,600.

Rhode Island provides data on a weekly basis, which can be found on the State of Rhode Island Department of Labor and Training’s website.

New Hampshire: The First Year for the First Voluntary Program

New Hampshire began paying benefits for the first Voluntary PFML Plan in the nation on January 1, 2023. New Hampshire employers can purchase coverage for 6 or 12 weeks through the state’s insurance carrier, MetLife, at any time. Employers may purchase coverage through other carriers, however the 50% Business Enterprise Tax (BET) Tax Credit will not apply. Individuals who are not covered by a NH PFML plan or equivalent plan may purchase individual plan coverage for 6 weeks. Individuals may only enroll during the open enrollment period, which is December 1, 2023, through January 29, 2024, for the 2024 plan year.

Premium amounts are determined through the underwriting and enrollment process but may not exceed $5 per week for individuals. No limit applies to employer premium.

The maximum weekly benefit for NH PFML is 60% of the Social Security wage cap ($168,600). Therefore, the maximum weekly benefit is $1,945.38 in 2024, an increase from $1,848.46 in 2023.

The state has not yet published 2023 claim data.

Other New England Updates

In addition to Massachusetts, Connecticut, Rhode Island, and New Hampshire, Vermont and Maine have evolving PFML programs.

Vermont launched their voluntary Family and Medical Leave Insurance (FMLI) program in 2023. Beginning on July 1, 2023, state employees were covered under the program. Other private and public employers with 2 or more employees can access the program on July 1, 2024, and small employers with one employee and individuals can purchase coverage for benefits beginning on July 1, 2025. Similar to New Hampshire, Vermont will offer 6 weeks of benefits at 60% of the Social Security wage cap. Cost will vary.

Maine officially created their Paid Family and Medical Leave program through the budget signed on July 11, 2023. Rulemaking will launch in 2024, with contributions beginning January 1, 2025, and benefits becoming available on May 1, 2026.

Are You Up to Speed?

Outside the region, California, Colorado, Delaware, Hawaii, Maryland, Minnesota, New Jersey, New York, Oregon, Washington, and the District of Columbia, as well as Puerto Rico, have mandatory paid family and medical leave and/or statutory disability insurance programs either in place or launching in upcoming years. As the PFML landscape continues to evolve at the local, state and federal level, policies need to be monitored on an ongoing basis.

PFML requirements are based on an employee’s work location. Employers should ensure they are compliant with the requirements of each individual leave program where they have employees working, and are aware of the differences by state. If any of your employees are subject to state PFML, you should review plans, policies, and processes to confirm they align with any legislative changes. To do so, the following checklist can be helpful:

- Register in any new states where employees work, if required

- Review your contribution strategy and ensure contributions are being collected

- Update employee notices and benefit documentation

- Consider private plans where available and in accordance with your corporate philosophy

- Ensure company sponsored leave programs coordinate with PFML to the extent possible

- Monitor changes in legislation that may impact compliance

If you need assistance ensuring PFML compliance or to assess the optimal plan set up for your organization, visit our Spring Consulting Group Paid Family and Medical Leave dashboard for additional information.

The Problem

In the insurance, healthcare and benefits world, we have been helping clients challenged by things like inflation, hardened insurance markets, rising healthcare and prescription drug costs, remote and hybrid work, and other trends that continue to ebb and flow. On top of these dynamics, many consumers and organizations are beginning to open their eyes to the crisis that is long-term care in the U.S. The issues in this area became alarmingly obvious in the wake of the pandemic, and has continued to remain a top concern over the last several years. State Medicaid programs pick up significant long-term care costs and they are looking for ways to minimize these expenses.

Multiple studies show that 70% of Americans over the age of 65 will need Long-Term Care (LTC) at some point in their life, with the average duration being 3 to 4 years. The cost of an LTC stay is even more unaffordable than other components of healthcare in the U.S., with 2021 national annual averages as follows:

- In-home care: $62K

- Assisted living: $54K

- Private nursing home: $108K

Long-Term Care insurance (LTCi) exists to prepare and provide a cushion for LTC needs. With the LTC costs and expected use of the LTCi policy, individual LTC is expensive. Forbes reported that the average LTCi cost for a male age 60 looking to purchase an LTC pool of $165,000 of coverage costs $1,200 a year. When we weave these factors into the aging population shift we’re experiencing, where the number of Americans aged 65 or older is expected to increase by 47% by 20501, we can see a huge problem on the not-so-distant horizon. Over the last 2 decades, the challenging environment has caused many LTCi carriers to exit the market, making coverage and pricing even more of an uphill battle.

Legislative Developments Driving New Entrants and Programs

Like with Paid Family and Medical Leave (PFML), states are starting to take things into their own hands regarding an LTCi funding solution, recognizing the dire situation for their constituents and the extensive drain LTC puts on publicly-funded programs like Medicare and Medicaid.

The State of Washington was the trendsetter in this area, passing its WA Cares program in 2022, key points of which include:

- A 0.58% payroll tax from employees unless they have private long-term care coverage

- No income cap

- Collection began in July 2023

- A lifetime maximum benefit of $36,500 (adjusted annually for inflation)

- Benefits only eligible for WA residents receiving services in the state

- Recipients must need assistance with three or more activities of daily living (ADLs), such as eating, bathing, dressing, etc.

- Benefits will become available for those eligible in July 2026

- Companies may opt to pay the tax for employees

While Washington may be the first, many other states have LTC legislation on their docket. In 2019, California created a Long Term Care Insurance Task Force to explore the feasibility of developing and implementing a competent statewide insurance program for LTC services and support. To date, the Task Force has made the following recommendations for a more flexible program of that in WA:

- An opt-out provision with a lower tax option if a policy is purchased before the program is enacted

- Reduced contributions if a policy is purchased after program enactment

- Beneficiaries need assistance with at least two ADLs

- Option for employee and employer contributions

- Payroll tax up to 2% with no income cap

The state of the California legislation is still in flux and it is uncertain when it will go into effect. In addition, some sort of LTCi plan is being or has been considered in over 10 other states including Connecticut, Colorado, North Carolina, Georgia, and Oregon. Legislation has been proposed in New York, Massachusetts, Pennsylvania, Minnesota, and Michigan, in addition to the two programs highlighted above.

While the maximum benefit payout (in the case of WA) will not be sufficient for most LTC needs, it is a step in the right direction, necessitating conversation and planning, and reducing some of the state’s burden. We do believe this trend will gain steam and momentum in the coming years. While some may be tempted to “wait and see,” we saw in Washington that many didn’t have time to secure a different option prior to the legal deadline and so were responsible for the tax. For this reason, we strongly advise our clients and their employees to review their LTC options now, while options still exist.

While state LTCi programs such as WA Cares revolve around an employee or employer tax, there is still administrative and compliance burden on employers to withhold, report, and submit those taxes. For these and other reasons, it may behoove employers to explore other options for employees either through a voluntary program or one partially sponsored by the employer.

Solutions in the Market

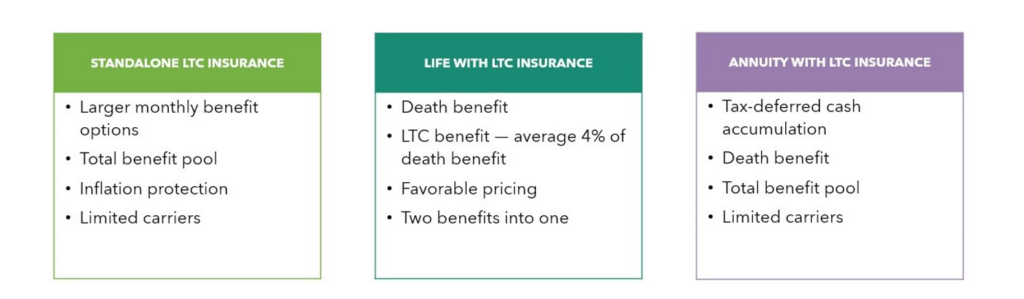

Luckily, long-term care insurance products have evolved from standalone LTC insurance to a hybrid program including life and LTC, or life and chronic illness riders. We also expect to see annuities becoming a bigger option in the future. Traditional medical insurance and long-term disability (LTD) typically will not cover much of anything related to LTC. More prevalent options include the following:

These solutions can be structured for groups (employer-paid or voluntary), executive carve-outs, or for individuals. Underwriting can come in the following formats: guaranteed issue, modified, or full.

Takeaways

For employers, LTC needs and insurance should be one piece of your reward and risk management strategy. We encourage companies to look at the LTCi realm and support employees where they can. A captive insurance model may provide a unique and cost-effective funding strategy. For individuals who already have an LTCi plan, you may want to consider “layering up” to ensure adequate coverage. Take a look at your duration limits, inflation riders, and other components. Regardless of your current position, a statutory LTC program could be coming to your state, and it’s best to be proactive in this area. Your broker/consultant should be equipped to help you navigate this complex landscape and provide solutions that make sense for your organization and its employees.

1 https://www.prb.org/resources/fact-sheet-aging-in-the-united-states/

Paid Family and Medical Leave continues to evolve throughout the country. While most of the activity has been at the state level, proposals have also been put forth federally. The programs passed by states vary in terms of covered workers, benefits paid, leave duration, funding, private plan availability and coordination with other leave programs. Variety across states leads to complexity for employers trying to navigate this landscape. Compliance concerns have also grown as the trend for remote work has continued, and as employers that hire across the nation must comply with laws where employees work.

A summary of changes to benefits and contributions in 2024 is below for each state program. Additional information can be found on Spring Consulting Group’s Paid Family and Medical Leave dashboard.

California

California’s Statutory Disability Insurance (SDI) law went into effect in 1946. In 2004, Paid Family Leave (PFL) requirements were added to the law, making it the first state to create a paid family leave program. In 2024, CA is increasing the contribution rate from 0.9% to 1.1%, which is fully paid by employees. Additionally, the SDI taxable wage maximum is eliminated, meaning all employee wages are subject to the SDI contribution requirement. This change does not apply to voluntary plans. The maximum weekly benefit will remain at $1,620.

Colorado

The Colorado Family and Medical Leave Insurance Program (FAMLI) officially begins paying benefits on January 1, 2024, after 1 year of collecting contributions. The contribution rate will remain at 0.9% of wages, however, Social Security wage limit is increasing to $168,600. Employees are responsible for up to 50% of the total contribution. In 2024, the maximum weekly benefit is $1,100.

Connecticut

The state began collecting contributions on January 1, 2021 and benefits became available one year later in 2022. Based on the experience in the state in 2022 and 2023, Connecticut is not making any major changes to the program in 2024. The contribution rate will remain at 0.5% up to the Social Security wage contribution cap, which is increasing to $168,600 in 2024 ($160,200 in 2023). In addition, the CT minimum wage increases to $15.69 per hour in 2024, which correlates to an increase of about $40 for the maximum weekly benefit, now $941.90.

Delaware

The Delaware Paid Family and Medical Leave Insurance program was signed into law on May 11, 2022. The state has been developing rules and regulations prior to contributions beginning on January 1, 2025 and benefits become available on January 1, 2026.

The state was the first to provide an opportunity for employers with comparable leave programs to opt-out of the Delaware Paid Leave and grandfather their employer plan for up to five years. Employers had to submit applications by January 1, 2024. Additionally, employers who are interested in applying for private plans under Delaware PFML will be able to do so beginning in September of 2024.

Hawaii

Hawaii enacted the Temporary Disability Insurance (TDI) law in 1969 and remains the last state (other than Puerto Rico) to not add paid family leave provisions to their statutory disability program.

In 2024, the maximum weekly benefit will increase by $33 to $798. The total contribution rate will vary by employer, however, employers can collect up to 0.5% of the maximum weekly wage base from employees, which equates to $6.87 per week. The maximum weekly wage base in 2024 is $1,374.78.

Maine

Maine officially created their Paid Family and Medical Leave program through the budget signed on July 11, 2023. Rulemaking will launch in 2024, with contributions beginning January 1, 2025, and benefits becoming available on May 1, 2026.

Maryland

Maryland will begin collecting contributions on October 1, 2024, and begin paying benefits on January 1, 2026. The total contribution rate will be 0.90%. Employers can collect up to 0.45% from employees and are responsible for funding at least 0.45%. However, employers with less than 15 employees are not required to contribute the employer portion of the premium. Additionally, employers interested in applying for a private plan will be able to do so this fall.

Massachusetts

Massachusetts Paid Family and Medical Leave (PFML) began paying benefits for medical leave, bonding, and military reasons on January 1, 2021 after collecting contributions for 15 months. Leave to care for a family member began on July 1, 2021. After three years of experience, Massachusetts will be increasing the weekly maximum benefit amount and the contribution rate, effective January 1, 2024.

The maximum weekly benefit is now $1,149.90, which is an increase of about $20 from the 2023 weekly maximum. For any employees who may have leave that runs from 2023 into 2024, the weekly benefit will be based on the beginning of the benefit year.

The total contribution is increasing from 0.63% to 0.88%, for employers with 25 or more covered individuals. The medical leave contribution will be 0.70%, with employers funding 0.42% and employees responsible for up to 0.28%. The family leave contribution will be 0.18%, with employers able to collect the total contribution from employees. Employers with less than 25 employees are not required to submit the employer portion of premium, so the effective total contribution rate is 0.46%.

The financial earnings requirement was also updated in 2024. Employees must have earned at least $6,300 and 30 times the PFML benefit amount during the last 4 completed calendar quarters to be considered eligible for MA PFML.

Minnesota

Minnesota is working to develop the rules for PFML. Contributions and benefits are set to begin at the same time on January 1, 2026, which would mean they are one of the only states to not pre-fund a PFML program in recent years. The contribution rate will be 0.7%, with employers funding at least 50%. Beginning in 2024, most employers will be required to submit a report detailing quarterly wages and hours worked for each employee.

New Hampshire

New Hampshire began paying benefits for the first Voluntary PFML Plan in the nation on January 1, 2023. New Hampshire employers can purchase coverage for six or 12 weeks through the state’s insurance carrier, MetLife, at any time. Employers may purchase coverage through other carriers; however the 50% Business Enterprise Tax (BET) Tax Credit will not apply. Individuals who are not covered by a NH PFML plan or equivalent plan may purchase individual plan coverage for six weeks. Individuals may only enroll during the open enrollment period, which is December 1, 2023, through January 29, 2024, for the 2024 plan year.

Premium amounts are determined through the underwriting and enrollment processbut may not exceed $5 per week for individuals. No limit applies to employer premiums.

The maximum weekly benefit for NH PFML is 60% of the Social Security wage cap ($168,600). The maximum weekly benefit is, therefore, $1,945.38 in 2024, an increase from $1,848.46 in 2023.

New Jersey

New Jersey was the third state to create a statutory disability insurance program when the Temporary Disability Benefits (TDB) law went into effect in 1948. In 2008, the state added Family Leave Insurance (FLI).

In 2024, the contribution rate and maximum weekly benefit will increase. The contribution rate will be 0.09%, up from 0.06% in 2023. The taxable wage base for employees will be $161,400. FLI is fully funded by employees. For TDI, employers pay a specific rate between 0.10% and 0.75%, up to the taxable wage base for employers of $42,300. Like in 2023, employees will not contribute towards TDI in 2024.

Earnings requirements have also increased. To qualify for NJ TDB and FLI in 2024, employees must have worked 20 weeks earning at least $283 per week or have earned $14,200 in the base year.

New York

New York Disability Benefits Law (DBL) went into effect in 1949. Paid Family Leave (PFL) was later introduced in 2018. In 2024 the contribution will decrease to 0.373%, from 0.455% in 2023. The rate will apply to wages up to the state average weekly wage of $1,718.15, and is fully funded by employee contributions. The maximum weekly benefit is also increasing to $1,151.16.

Oregon

Oregon benefits began paying on September 3, 2023, after collecting contributions for about 8 months, since the beginning of 2023. Effective January 1, 2024, the contribution rate will increase to 1%, up to the social security taxable wage maximum of $168,600. Employers can collect up to 60% of the total premium from employees. The maximum weekly benefit will remain at $1,523.63 and the minimum weekly benefit will be $63.49.

Puerto Rico

Puerto Rico launched their Non-Occupational Temporary Disability Insurance program, El Seguro por Incapacidad No Ocupacional Temporal (SINOT), in 1968. No paid family leave benefits have been added to date. In 2024, the maximum weekly benefit will remain at $113 ($55 maximum for agricultural workers) and the minimum weekly benefit will remain at $12. No change to the 0.6% contribution rate (up to $9,000 of earnings) has been announced for 2024. Employers may deduct up to 0.3% from employees.

Vermont

Vermont launched their voluntary Family and Medical Leave Insurance (FMLI) program in 2023. Beginning on July 1, 2023, state employees were covered under the program. Other private and public employers with 2 or more employees can access the program on July 1, 2024, and small employers with one employee and individuals can purchase coverage for benefits beginning on July 1, 2025. Similarly to New Hampshire, Vermont will offer 6 weeks of benefits at 60% of the Social Security wage cap. Cost will vary.

Rhode Island

Rhode Island established the first statutory disability program in the country in 1942, known as Rhode Island Temporary Disability Insurance (TDI). In 2014, they became the third state to offer family leave benefits through temporary caregiver insurance (TCI). The state does not allow private plans, making the model slightly different than other PFML programs in the region.

On January 1, 2024, a few updates to TDI and TCI became effective. The state’s taxable wage base increased to $87,000 from $84,000 in 2023. The contribution rate in 2024 is 1.2%, which is an increase of 0.1% from the previous two years. The maximum weekly benefit is $1,043, not including the dependency allowance1, and the minimum weekly benefit is $130.

The financial eligibility conditions claimants must meet increased so that employees must have paid at least $16,800 in the base period or meet the alternative conditions wherein they earned at least $2,800 in one of the base period quarters and base period taxable wages equal at least $5,600.

Washington

Washington began paying on January 1, 2020, after collecting contributions for a year. Effective January 1, 2024, the PFML contribution rate will decrease to 0.74% of an employee’s wage, up to the Social Security taxable wage maximum of $168,600. Employers must fund at least 28.57% and employees will contribute up to 71.43%. The maximum weekly benefit will increase to $1,456 per week.

Washington, D.C.

D.C. Paid Leave benefits began on July 1, 2020, and they had collected contributions since July 1, 2019. Effective October 1, 2023, the District released an updated Notice to Employees, which included an increased maximum weekly benefit, from $1,049 previously, to $1,118. No change has been announced to the 0.26% contribution rate, which is fully employer-funded.

What’s Next?

As the PFML landscape continues to evolve at the local, state, and federal levels, policies need to be monitored on an ongoing basis.

If you need assistance ensuring PFML compliance or to assess the optimal plan set up for your organization, Spring’s consultants are happy to help.

All information is subject to change.

1 Dependency allowance provides the greater of $10 or 7% of the benefit rate for up to 5 dependents

Within the employee benefit market, the term point solution has become watered down and leveraged for all add-on programs that complement a core benefit offering. Unfortunately, this has led many benefit professionals to feel like point solutions do not add value. The truth is that some point solutions add immense value while others fall short, but the challenge is the answer is different for each employer.

Employers must consider their healthcare and employee benefit spend, including but not limited to potential incentives; corporate culture and goals related to employee engagement, health and productivity; capability and service guarantees with core providers; and anticipated utilization of core and point solutions to evaluate their offerings and where point solutions may make sense.

Assess Current Offerings

The first step in considering point solutions is to evaluate your current offering(s). Catalog your current partners, what services they perform, what you are paying them, and when your contract renews. In addition, summarize any performance guarantees or return on investment metrics as well as standard reporting that is provided and at what frequency.

For most employers, this exercise in gathering data related to your offerings will shine a spotlight on a few critical areas:

- Where does overlap exist?

- How much spend is tied to “optional” programs?

- How much data is readily available?

- Are there programs demonstrating value?

- Are there contractual limitations to change?

In order to address these questions and come to any conclusions regarding your point solutions, this assessment needs to run in tandem to a market analysis.

Understand the Market

It is important to understand the plethora of solutions available in the market. The most efficient way to gather this intelligence is to talk with your current health plan and broker/consultant. We help many clients, including edHEALTH, on mapping out and understanding the universe of options in the realm of point solutions and then creating a targeted strategy based on tailored benchmarks. But don’t stop there. Find other resources that can educate you on options, perhaps another advisor or an industry conference. These conversations do not require a deep dive (yet) into each solution. Instead, they should provide enough for you to think about what’s possible as you compare and contrast what you have versus what you anticipate needing in the future.

Identify Pain Points

The most valuable point solutions work to solve a pain point that your core health offering cannot address as well as serve as a targeted comprehensive solution. This is why solutions around specific diagnoses have evolved (e.g., musculoskeletal, cancer, fertility, hypertension, etc.) and for engaged claimants often provide better experiences, more favorable outcomes and even potential cost savings.

Consider your pain points both qualitatively and quantitatively. Look at data from employees to understand what is not working well for them in the process. Then look at the data from your health plan and understand where you are above their benchmark in spend by major diagnostic category, or have any outliers in the data. For example, our client edHEALTH, a captive for educational institutions, recently began offering a new diabetes management program, which was implemented based on their member schools’ input and supporting data.

Bringing it all Together

Once you have assessed your current offering, gotten a better understanding of what is available in the market, and identified your pain points, it’s time to compare and contrast those three areas of review and arrive at your desired future state.

Start where program overlaps exist and see if you can simply remove programs without employees experiencing a loss in coverage/benefit. In some instances, those overlapping programs may be provided free of charge from your vendor but still may cause confusion among your employees or be absorbing credits that could be used for other programs. In addition, vendors may be willing to negotiate removal of those services, freeing up funds for other programs.

After you have explored overlapping programs, consider programs that are currently offered but do not seem to align with your pain points. It’s possible that a point solution is working so well and achieving the desired impact that it is positively impacting spend. If so, this is a point solution you want to continue. Your vendor partner should be able to demonstrate via data how the point solution is working, what employees/claimants are being impacted and how to continue these favorable results. If the vendor partner cannot prove successful data for your population, be skeptical; it may still be a value-add program, but some cynicism is helpful in this very complicated review of point solutions.

Once you have reviewed overlapping programs and those that do not align with your pain points, you should review all other point solutions against market offerings. Ensure your solutions are keeping pace with the market both in pricing as well as service offering and performance standards. For programs involving considerable spend, a request for proposal (RFP) may be necessary,. For programs with minimal spend, a few calls with competitors may provide enough insight to determine if an RFP is necessary. If your solutions are not competitive, do not have appropriate performance standards, or have not demonstrated their value, you should consider replacing them or, at a minimum, renegotiate with strong performance or return on investment parameters.

This review must be data driven, but it will often involve both art and science. Sometimes a program may be a worthy partnership for your culture even if cost savings may not materialize. Only you and your team will be able to make that decision, but just because the decision is not solely routed in cost savings doesn’t mean you shouldn’t track utilization, engagement and return on investment. Those may be even more critical for programs that will need to be defended in the future. Many HR and benefits professionals are feeling point solution fatigue, and are asking questions around impact, risk, and reward. If you could use assistance conducting a point solution audit, or would like advice on best practices in this area, please get in touch with the Spring team.

In a recent article published by Yahoo Finance, Reliance Matrix was ranked as the most popular absence management provider according to Spring’s annual 2023 benchmarking survey. Check out the full article here.

In a recent article published by BusinessWire, Reliance Matrix was ranked as the most popular absence management provider according to Spring’s annual 2023 benchmarking survey. Check out the full article here.

As we enter 2024 in an interesting economic and workforce environment, benefits professionals are once again looking to get creative with their offerings and ensure that they align with cultural and corporate objectives as well as budget.

There is one benefit in particular that, while not new, has been gaining traction over the last few years and we expect continued momentum and adoption in 2024: lifestyle spending accounts.

What is a Lifestyle Spending Account?

A lifestyle spending account (LSA) represents a range of flexible benefits accounts that employers can offer to employees as funds toward eligible expenses related to health, wellness, and personal needs and interests. The employer defines what an LSA can be used for, with many companies including pet care or services, travel, leisure activities, and home improvement within their list of qualifying expenses. In this way, they cover a much broader spectrum of needs beyond those that are applicable within a Flexible Spending Account (FSA) or Health Savings Account (HSA).

Pros and Cons

Many employers are considering or implementing LSAs for their employees because they provide the following key advantages:

- Entirely customizable based on what would make a positive impact on your unique employee base

- Allow for enhanced diversity, equity and inclusion (DEI) within your benefits program

- No budgetary surprises: employers decide on what they will contribute and if employees do not take advantage of the LSA, that money will not be spent, and the employer dictates whether or not funds can roll over year over year

- Generally not a big ticket item; contributions typically range from $500 – $2,000 per employee per year1

- Ability to design an LSA based on wellbeing goals that could contribute to a healthier, more productive workforce

- Demonstrates compassion and a commitment to employees that can lead to increased engagement, recruitment, and retention

- Can lessen the need for multiple point solutions which can create significant administrative burdens

- Relatively simple and fast to set up

LSAs aren’t for every company, though. Some factors that might indicate an LSA isn’t the right path are:

- Awareness: as with every facet of a benefits program, the employer will need to be thoughtful in communicating the LSA option

- Possible duplication: depending on your health plan, point solutions, and other wellness programs, you may need to be careful in designing an LSA that is not redundant to other offerings

- Compliance considerations: while typically not the case, legal and tax implications (e.g., ERISA) may exist for LSAs that account for certain health expenses

- LSAs are a taxable benefit, unlike pre-tax options like 401(k) plans, HSAs, and health insurance, so there will be different types of financial ramifications for employees who participate

Looking Ahead

LSAs are becoming more and more popular; a 2023 Benepass study shows that 51% of companies are offering this benefit, as compared to 37% in 2022. Optum’s 2022 Financial Lifestyle Benefits Research found that 37% of benefits professionals were planning to add to or update an LSA in the coming year. At Spring, it has been a topic of interest for many of our clients as we refine our strategic benefits plans and consider program enhancements. If you are interested in an LSA but need guidance around implementation, processes and best practices, please get in touch and we would be happy to help you explore the option.

Title:

Consultant

Joined Spring:

I joined Spring in July 2017, shortly after I graduated from college.

Hometown:

I was born in Maine but grew up in Stockton, NJ. It’s a really small town and my elementary school only had about 60 people in it total.

At Work Responsibilities:

I work on our Absence Management Team and primarily help clients with their absence policies, as well as health and Rx plans. I also spend a lot of my time monitoring the paid leave landscape and updating our clients on legislative developments that may impact their leave programs throughout the country.

Outside of Work Hobbies/Interests:

I recently moved back to NJ and spend a lot of my time with my family and dogs, reading, and exploring my new neighborhood.

Fun Fact:

I spent a semester studying abroad in Cape Town, South Africa!

Describe Spring in 3 Words:

Dedicated, Invested, and Fun

Favorite book (or one you’ve recently read):

I just finished All The Light You Cannot See. I don’t think I can pick an overall favorite book.

Pets:

My family dog Scout (Chocolate Lab) and my “nephew” Alan (Red Lab) but I consider them mine 😊