Our Senior Vice President, Prabal Lakhanpal wrote an article for the Boston Business Journal on how employers can continue to provide strong benefit packages during a time of high inflation. You can find the full article here.

As seen in the New England Employee Benefits Council (NEEBC)’s blog.

Last year around this time, I gave a year-one progress report on the Massachusetts Paid Family and Medical Leave (PFML) program, as it had finished its first year of paying out benefits to eligible workers. Since then, the MA PFML program has continued to mature and adjust according to experience, and, around New England, Connecticut has had PFML benefits available for one year, and there are related updates from Rhode Island, New Hampshire, Vermont and Maine to report.

Massachusetts: A Year in Review

In fiscal year 2022 (July 1, 2021 – June 30, 2022), the Massachusetts Department of Family and Medical Leave (DFML) experienced1:

– Over 112,500 applications, with 20% being denied

– 59% of applications were related to medical leave, 31% for bonding, and 10% to care for a family member

– Only 32 approved applications for military exigency leave and 7 approved applications to care for a service member

– Claimants aged 31-40 had the most approved claims (40%) and more than 1.5 times as many women had an approved leave (61% of claims), compared to men (35% of claims)

– Average weekly benefits were $793.55 for family leave and $754.84 for medical leave

– Turnaround times from the time the application was submitted to an initial decision was a median of 17 calendar days

– Average duration of leave was 12 weeks, assuming a 5-day work week

– Total benefits paid was equal to about $603 million (an increase of about 245% from FY21 which accounted for January 1, 2021-June 30, 2021)

In 2023, Massachusetts will be updating maximum benefit amounts and reducing total contributions.

– The maximum weekly benefit is increasing to $1,129.82, effective 1/1/2023. This is an increase of about $45 from the 2022 weekly maximum. For any employees who may have leave that runs from 2022 into 2023, the weekly benefit that was determined when leave was approved will continue. The new maximum will not be applied until there is a new MA PFML leave application.

– Contributions, however, will be reduced in 2023. The total contribution is decreasing from 0.68% to 0.63%, for employers with 25 or more covered individuals. The medical leave contribution will be 0.52%, with employers funding 0.312% and employees responsible for up to 0.208%. The family leave contribution will be 0.11%, with employers able to collect the total contribution from employees. Employers with less than 25 employees are not required to submit the employer portion of premium.

The financial earnings requirement was also updated in 2023. Employees must have earned at least $6,000 and 30 times the PFML benefit amount during the base period to be considered eligible for MA PFML.

Connecticut: First Year Activity

Connecticut has now had PFML benefits available for 1 year. During the first six months of the program2:

– Over 44,127 applications, with 40% being denied of those that received a decision

– 44% of approved applications were related to medical leave, 29% for bonding (own child and adoption/foster care), 18% for pregnancy/childbirth, and 9% to care for a family member

– Only 15 applications were approved for family violence, 12 for organ and bone marrow donation, and 2 for qualifying exigency

– Claimants aged 26-41 had the most filed claims (53%) and more than double the number of females applied for leave (28,814), compared to males (14,213)

– Average weekly benefits paid were $562.01

– Average approved duration of leave was 6.79 weeks

– Total benefits paid was equal to about $81 million

– Almost 137,000 businesses have registered with the CT Paid Leave Authority and claim applications have been received from every city and town in the state

Based on the experience in the state in 2022, Connecticut is not making any major changes to the program in 2023. However, the social security contribution and benefit base increased to $160,200 on January 1, 2023, and CT minimum wage increases to $15/hour on June 1, 2023, which will impact benefit and contribution amounts.

Please note that the program has some key differences when compared to MA PFML, such as the availability of leave for organ and bone marrow donation, as well as leave related to family violence. Differences in benefit amounts, leave duration, and eligibility conditions also make it difficult to directly compare CT and MA PFML experience.

Other New England Updates

Massachusetts and Connecticut are not the only New England states to be seeing PFML progress. Rhode Island has an established temporary disability insurance program (TDI), which was the first statutory disability program in the country, established in 1942. In 2014, they became the third state to offer family leave benefits through temporary caregiver insurance (TCI). In addition, the state does not allow private plans, making the model slightly different than other PFML programs in the region. On January 1, 2023, a few updates to TDI and TCI became effective. The state’s taxable wage base increased to $84,000, which will impact the contribution calculation. The benefit duration also increased to 6 weeks, from 5 weeks in 2022. Finally, the financial eligibility conditions claimants must meet increased so that employees must have paid at least $15,600 in the base period or meet the alternative conditions wherein they earned at least $2,600 in one of the base period quarters and base period taxable wages equal to at least $5,200.

A new outlier is New Hampshire’s first-in-the-nation, state-sponsored voluntary plan where NH employers and eligible NH workers can purchase a paid family and medical leave plan through the state’s insurance carrier. New Hampshire selected MetLife as its insurance partner and began paying benefits on January 1, 2023.

Similarly, Vermont spent 2022 developing a voluntary program to be administered by The Hartford, their selected insurance carrier. Beginning July 1, 2023, state employees will be covered under the program, with other private and public employers with 10 or more employees eligible for coverage in 2024, and small employers and individuals able to purchase coverage in 2025.

Maine also made strides in developing the structure of their state mandated PFML program. Maine created a commission to study PFML programs and to propose a PFML model for the state, which kicked off in May 2022. Policy recommendations are expected to be presented to the Legislature in 2023.

Are You Up to Speed?

As the PFML landscape continues to evolve at the local, state and federal leaves, policies need to be monitored on an ongoing basis. Employers should ensure they are compliant with the requirements of each individual leave program, as differences exist between all established paid family and medical leave policies. If any of your employees are impacted by a state PFML policy, organizations should review plans, policies, and processes to confirm they are in line with any legislative changes. To do so, the following checklist can be followed:

– Register in any new states where employees are located, if required

– Ensure contributions are being collected appropriately

– Update employee notices and benefit documentation, as appropriate

– Confirm employee count to determine if any changes to contributions are required

– Review private plan strategies based on previous year experience and changes to contributions

– Renew private plans as appropriate

– Validate company sponsored leave programs coordinate with PFML to the extent possible

If you need assistance ensuring PFML compliance or to assess the optimal plan set up for your organization, Spring’s consultants are happy to help www.springgroup.com

As point solutions for health and benefits continue to pop up, it’s sometimes hard to understand what solution(s) might be most valuable for your workforce. Our “Point Solutions Spotlight” series is meant to hone in on one area of point solutions at a time, so you can make an informed decision. As January is Glaucoma Awareness Month, we thought this month we would spotlight a large potential risk factor for glaucoma: diabetes. A diabetes diagnosis doubles your risk for developing glaucoma1, among other vision impairments.

Executive Summary

Diabetes is one of the most common chronic health conditions in the US; in 2020 it was estimated that 34.2 million adults in the US were diagnosed with diabetes (roughly 11% of the population)2. This number is inflated even further when considering those who are undiagnosed or have prediabetes; in fact, the CDC believes one in three Americans will develop some form of diabetes in their lifetime3. Diabetes is caused by both genetic and lifestyle factors, some of which include weight, diet, and physical activity.

Employees diagnosed with diabetes often see their condition affect their work life, in the form of both productivity and absence, because some of the most common symptoms include urinating often, extreme fatigue and a constant feeling of thirst and hunger (even while eating). According to the American Diabetes Association (ADA) individuals diagnosed with diabetes spend on average $16,752 per year on medical expenses, $9,601 of which is attributed to diabetes (2.3 times more than spending by those without diabetes).

What is the impact on healthcare spending?

Diabetes is the most expensive chronic condition in the US, with an estimated $1 in every $4 of healthcare spending going towards diabetes-related care. Other top healthcare cost drivers include heart disease, cancer and musculoskeletal (MSK) conditions. In 2017, diabetes healthcare costs were $327 billion, with $237 billion accounting for medical costs and $90 billion in reduced productivity costs4.

According to the ADA, most diabetes medical spending goes towards:

- Hospital inpatient care (30% of the total medical cost)

- Prescription medications [including insulin] (30%)

- Anti-diabetic agents and diabetes supplies (15%)

- Physician office visits (13%)

The ADA also found diabetes leads to many indirect costs (often at the helm of employers):

- Increased absences ($3.3 billion)

- Reduced productivity while at work ($26.9 billion) for the employed population

- Reduced productivity for those not in the labor force ($2.3 billion)

- Inability to work because of disease-related disability ($37.5 billion)

- Lost productive capacity due to early mortality ($19.9 billion)

Our client, edHEALTH, is a consortium of 25 educational institutions that came together with the goal of reducing health and benefits costs for their employees while enhancing offerings at the same time. They consistently review the data, including diabetes, to find ways to help bring the costs down for their member-owner schools.

What solutions exist?

As diabetes has been the top chronic illness in the U.S. for some time, the distribution of costs for care (mostly towards inpatient care and prescription medications) have not changed drastically over time. As inflation continues to increase and many organizations are seeing healthcare costs rise, savvy employers are moving towards alternative models for addressing diabetes.

Employers who see a substantial impact of diabetes costs on their claims, may want to consider alternative treatment or lifestyle benefit offerings. Some of the top alternative solutions include:

- Diabetes Prevention Programs (DPPs)

- Diabetes management point solutions programs, some of which provide:

- Education of risks and potential treatments associated with diabetes

- Glucose testing/monitoring supplies and insulin pumps

- Apps that track blood sugar levels, weight, calories, and other metrics

- Digital platforms to connect employees directly with doctors

- One-to-one coaching

- Meal planning/nutrition goals

- Mental health resources

- Inpatient care coordination

- Health and wellness programs/initiatives

- Gym memberships

- Weight-loss programs

- Providing healthy food options (in the cafeteria, kitchen, vending machines, etc.)

- Mental health benefits

- Financial benefits

- To help control diabetes costs for employees

As an important note, employers may ask employees about health information following a job offer regarding diabetes, including how long said employee has had diabetes, if they need any work accommodations and if they need assistance during a low blood sugar episode. However, under The Americans with Disabilities Act (ADA), employers cannot discriminate against qualified individuals with diabetes. If your organization is seeing high diabetes healthcare costs, we suggest you revisit your healthcare plan(s) and/or adopt one or more of the alternative solutions above.

What should I do as an employer interested in a diabetes management program?

Employers must first understand the costs and trends associated with diabetes within their population/workforce. If diabetes is driving costs (medical, pharmacy and productivity), employers should consider alternative programs that align with their specific problem area(s). Identifying these patterns is key to understanding the need for tailored approaches such as preventative programs or introducing health and well-being benefits.

From there, market research will be necessary to understand pricing and select a vendor with the best program for your population. Spring’s consultants are here to help with market research, claims and data analysis, and/or a Request for Proposal (RFP) process so that you find a solution that best meets your organizational needs.

1https://www.smarteyecare.nyc/blog/the-link-between-diabetes-and-glaucoma

2https://www.singlecare.com/blog/news/diabetes-statistics/

3https://bit.ly/CDCchronicdisease

4https://diabetesjournals.org/care/article/41/5/917/36518/Economic-Costs-of-Diabetes-in-the-U-S-in-2017

When Congress passed the Consolidated Appropriations Act of 2021, this omnibus appropriations bill included the No Surprises Act (NSA). In 2022, much of the NSA focused on implementing consumer protections surrounding surprise medical bills after receiving emergency medical care. This was a big win for patients who were inadvertently receiving out-of-network care and billed non-negotiated rates in emergency situations where in-network providers and hospitals were leveraging out-of-network services and balance billing patients. The NSA specifically targeted air ambulance services and identified certain non-emergency services where notice and consent requirements must be satisfied for balance billing.

Two components of the NSA received much less fanfare and were not implemented on the original timeline. This includes: (1) requirements for providers to make good faith estimates (GFE) of charges for services within three hours (if immediate) or three days (if scheduled) and (2) the requirements around Advanced Explanation of Benefits (AEOB). The Department of Health and Human Services (HHS) delayed enforcement of these requirements for insured individuals, originally slated for plan years beginning on or after January 2022, given the lack of infrastructure for providers to transmit the necessary data on the GFE, which also directly impacted the ability to supply AEOBs.

The Centers for Medicare and Medicaid Services (CMS) and HHS asked for public comment related to the GFE and AEOB requirements. Comments were due November 15, 2022, and we expect clarifications or revisions to the regulations based on the feedback received. Implementation of the GFE and AEOB will demonstrate the fragmented health care structure that currently exists and that health plans, including self-insured plans, need to carefully monitor the impact.

GFE will impact every provider. Small, independent practices will likely experience the biggest disruption, which may translate into further consolidation. In addition, most services require coordination between multiple providers and ambiguity exists around ownership of those GFEs.

Although GFEs are a provider responsibility, health plans – including self-insured employer plans – are not immune to these pending guidelines. Compliant AEOBs must be supplied by health plans and one component is information related to the GFE. Therefore, information not only needs to be shared from providers to patients, but also from providers to health plans, so that it can be included in the AEOB.

In short, the No Surprises Act will likely be full of surprises in 2023 as CMS and HHS begin to address the following questions:

- How will data be exchanged (i.e., FHIR-based API or other means)?

- Is electronic notification sufficient, or will hard copy documents be required?

- How much time will be given for compliance (i.e., system updates, IT development, testing, printing, production, etc.)?

- Will any self-service options exist

As additional guidance is released and these questions are answered, we look forward to sharing our thoughts and recommendations in accordance. In the meantime, please reach out with questions related to the No Surprises Act, AEOB Compliance, or anything related.

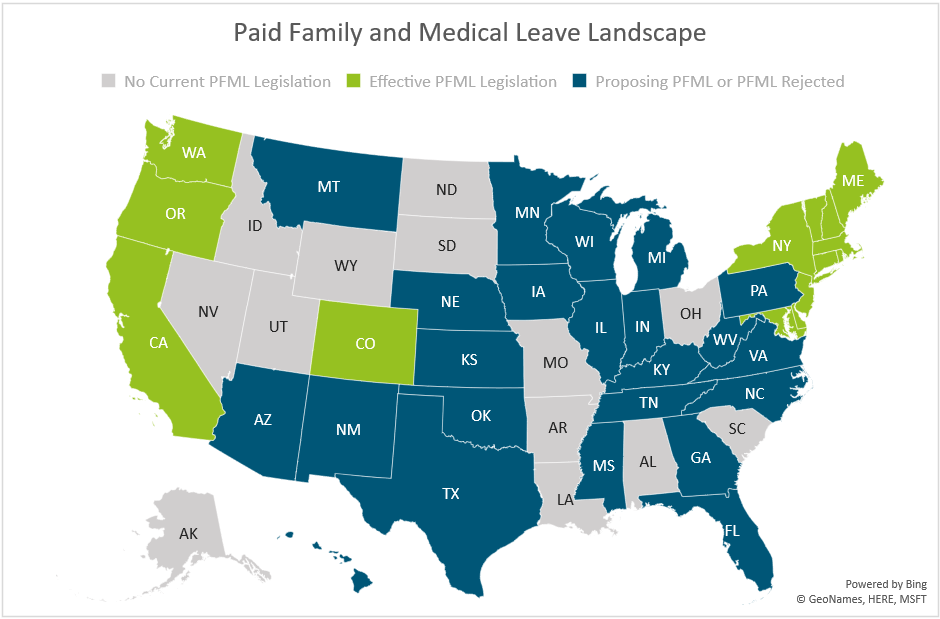

Paid Family and Medical Leave continues to be a confusing point for employers, compounded by new legislation being proposed at a seemingly constant pace. As leaders in the disability and absence management space, we are dedicated to staying on top of updates around PFML, among other areas. After a busy year in that regard, with another on the horizon, we wanted to share this brief overview.

In 2022, there was more movement towards state PFML laws being passed after decreased activity in previous years, largely due to the COVID-19 pandemic. For example:

- Delaware and Maryland both passed laws establishing PFML programs

- Virginia established insurance rules, allowing carriers in the state to provide insured PFML plans to clients

- Colorado and Oregon began collecting contributions on 1/1 and have been working to ensure they are prepared to do so, while establishing other rules for the effective administration of PFML

- New Hampshire worked to develop their voluntary PFML program selecting MetLife as its insurance partner and began coverage on 1/1/2023

- Vermont selected The Hartford as its insurance partner for its voluntary PFML program

- Maine made strides in developing the structure of their state mandated PFML program

In 2023, we expect continued activity. Pennsylvania and Michigan have outstanding proposals for PFML, which will likely be decided upon in 2023, one way or another. Additional states may also put forward proposals in upcoming legislative sessions.

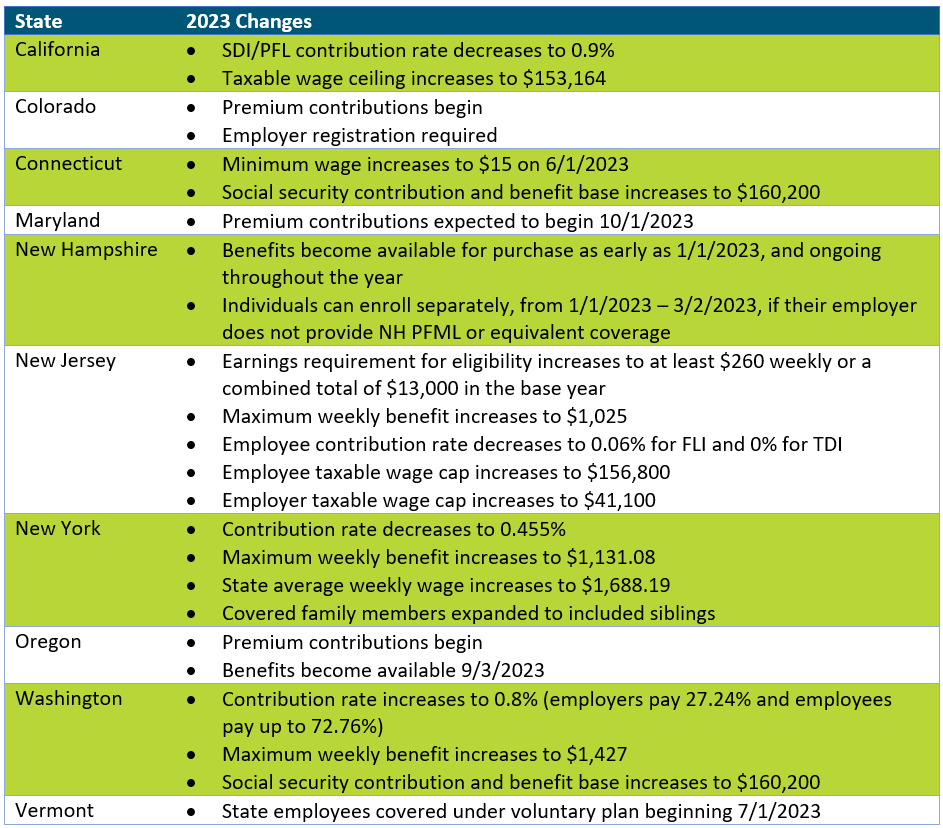

In addition, and as seen in the updates below, states with existing legislation continue to make adjustments to their PFML programs. Adjustments to contributions and benefits are typically expected, most commonly, but not always, at the end of the calendar year.

The map below shows a summary of states with existing PFML legislation and programs in place, those who have proposed legislation without it being passed, and those that have not had any activity related to PFML in recent years.

Massachusetts

In 2023, Massachusetts will be updating maximum benefit amounts and reducing total contributions.

The maximum weekly benefit is increasing to $1,129.82, effective 1/1/2023. This is an increase of about $45 from the 2022 weekly maximum. For any employees who may have leave that runs from 2022 into 2023, the weekly benefit that was determined when leave was approved will continue. The new maximum will not be applied until there is a new MA PFML leave application.

Contributions, however, will be reduced in 2023. The total contribution is decreasing from 0.68% to 0.63%, for employers with 25 or more covered individuals. The medical leave contribution will be 0.52%, with employers funding 0.312% and employees responsible for up to 0.208%. The family leave contribution will be 0.11%, with employers able to collect the total contribution from employees. Employers with less than 25 employees are not required to submit the employer portion of premium.

Other State Updates

Other states have made updates to their programs effective January 1, 2023, unless otherwise noted below. Some states may make changes off calendar year (e.g., District of Columbia, Rhode Island), which are not included if they have not yet been released.

Recommended Approach

Employers should review their PFML plans, policies, and processes to confirm they are in line with any legislative changes. To do so, the following checklist can be followed:

– Update employee notices and benefit documentation, as appropriate

While formal notices may not always be required, especially if contributions are decreasing, communicating updates to employees is recommended, especially if the change will impact their pay. Most states provide sample notices that can be customized to fit an employer’s needs. Keep in mind that there may be timing requirements in place (e.g., 30 days in advance).

– Confirm employee count to determine if any changes to contributions are required

Some states require contributions from both employers and employees however do not require employer contributions from “small” employers. This definition of small varies by state (e.g., less than 25, less than 50 employees). Confirming the total number of employees will verify the contributions being remitted to the state are accurate.

– Review private plan strategies based on previous year experience and changes to contributions

Whether or not a private plan is an ideal method for an employer to provide PFML to employees may vary from year to year. This can largely be based on the cost of a private plan versus going with the state plan, but the employee experience also plays a major role. From a cost perspective, a private plan, in most states, will be based on that employer’s leave experience. If an employer has high PFML incidence rates, insurance carriers or TPAs may charge more than is required to be paid under the state plan. From an employee experience perspective, having to file PFML claims to the state and what are often concurrent disability, FMLA or other leave claims to the employer or its vendor partner, can be confusing and require more effort for both employees and employers. While the driving factors will vary by employer, both cost and employee experience should be considered.

– Renew private plans as appropriate

When a private plan is in operation, states may require these be renewed at certain intervals. Massachusetts, for instance, requires this annually, while Connecticut only requires it every three years, unless a material change to the plan is made. Employers should review the timing of their private plan approval and guarantee it is up to date.

If you need assistance ensuring PFML compliance or assessing the optimal plan set up for your organization, Spring’s consultants are happy to help.

Background

On election day, Massachusetts voters were asked to approve or reject four ballot questions when casting their votes for Governor and Attorney General. The 2nd ballot question focused on regulating Dental Insurance, which if passed would “require that a dental insurance carrier meet an annual aggregate medical loss ratio for its covered dental benefit plans of 83 percent1” In layman’s terms, this means dental insurers will have to spend at least 83% of premiums on patient care instead of administrative costs, salaries, profits, overhead, etc. The legislation mandates that if an insurance carrier does not meet that 83% minimum requirement, they will have to issue rebates to their customers. It further allows state regulators to veto unprecedented hikes in premiums and requires that carriers are more transparent with their spending allocation.

Prior to election day, Massachusetts did not have a fixed ratio when it came to dental insurance and will soon be the first state in the nation to have a fixed dental insurance ratio. Although MA requires reporting from dental plans, there were no regulations on premiums. The proposed law sets up a protocol similar to what the Affordable Care Act (ACA) requires of health insurers, where in Massachusetts health insurance carriers must spend at least 85%-88% of premiums on care.

Over 70% of voters voted in favor of regulating dental insurance, the most one-sided response of all four ballot questions. Although at face value regulating dental insurance may seem beneficial for patients, the impacts are not cut-and-dry, and the legislation may affect multiple parties, from consumers to carriers and dentists and practice owners.

Leading up to election day, general reactions about the legislation from dental insurance carriers were negative, while it was supported by most dental practitioners. In fact, the ballot initiative was brought to fruition, in large part, due to an Orthodontist in Somerville. As we can see from the polling results, the general population, or consumers/patients, were also in favor of question #2 passing.

Potential Impacts

For patients: On the intangible side for patients/consumers, the law would provide some peace of mind that the money they pay for their dental insurance was going, in large part, to their care. There is also an indirect advantage to increased transparency, mitigating the typical confusion that surrounds insurance plans and payments. More tangibly, the change could mean that insurers are willing to cover more procedures as a means to hit their minimum requirement (good), however that could result in dental practitioners charging more (not so good).

For employers: We anticipate that the new law will give employers who sponsor a dental insurance benefit plan more control over pricing and protection against unreasonable rate increases. Since many businesses do not offer a dental plan, or offer it on a voluntary basis, the effects should be relatively small. On the other hand, if the law were to create a change in the number of carriers in the marketplace, this could have an impact on plan and network options and negotiating power.

For dental practitioners: With the change, one perspective is that dental practitioners will be able to better focus on the best care for each patient. They may also see an increase in business and revenue if insurers are allocating more dollars towards care and procedures.

For dental insurance carriers: Dental insurers largely opposed question #2 for obvious reasons, such as restrictions on how much they can charge and additional requirements they need to adhere to, but also for less obvious reasons. For example, some carriers argue that the law will require them to make up for profit loss by raising premiums, warning that they could increase by as much as 38% in the state2. They have reason to believe this law will lead to less competition in the dental insurer marketplace, which typically does not benefit the consumer.

Conclusion

Having worked with Massachusetts employers of all sizes on their benefits, including but not limited to dental insurance, as well as interfacing with insurance carriers, being the broker representative for a large percentage of dental offices in the state and working with MDS, we are looking at this update from all angles. Our expertise and decades of experience in this industry enables us to make the following conjectures about passing of ballot question #2:

- Dental insurance premiums may rise, but at a minimal rate

- We ultimately believe this is a step in the right direction as an advocate both for our employer clients and their employees, and that transparency is a positive attribute largely missing from the healthcare experience today

- Immediate impacts will also be minimal, but we may see some of the other factors mentioned above play out over the next few years

If you have specific questions about how the new law might impact your dental plan(s) or practices, please get in touch. In the meantime, you might be interested in watching our recent webinar, “Why Long COVID Needs Short-Term Attention” as you develop your 2023 benefits strategies.

1https://www.sec.state.ma.us/ele/ele22/information-for-voters-22/quest_2.htm

2https://www.wbur.org/news/2022/10/18/massachusetts-ballot-question-2-explainer

It is estimated that ~44 million Americans are experiencing long COVID symptoms. During a recent Spring webinar, our SVP, Teri Weber was joined by a pulmonologist and a representative from Goodpath to review common long COVID symptoms and how it is impacting productivity and claims. You can access the webinar here.

Within the last couple of years, we have seen drastic shifts in the wants and needs of employees nationwide. The COVID era sparked and enhanced new practices and benefits that were not popular in the past, such as mental health resources for remote workers, utilizing tech in HR and addressing burnout. Now that COVID effects are less severe and we have returned to more normalcy in many ways, employers must grapple with remote, on-site, and hybrid work models while keeping their workforce happy and engaged. These trends were evident in this year’s Annual Conference hosted by the Northeast Human Resources Association (NEHRA). NEHRA is one of the leading organizations that brings together HR industry professionals to network and share best practices. This year’s conference took place in Newport, RI and Spring had the pleasure of attending and exhibiting.

Here are some of the areas most focused on this year:

1) Adapting to a Hybrid Workforce

Although hybrid and remote work may seem like the norm for many of us, employers are still struggling to keep their workforce connected and satisfied while retaining efficiency. During the peak of the pandemic, many organizations moved to fully remote and are now looking at whether they will require employees to be in the office full-time, part-time, or not at all. Below are some of the sessions that best tackled this issue.

– A session titled “Driving Career Development in a Hybrid World” explored how the adoption of technologies during the pandemic has led to an increase in professional career development tools, but on the other hand, has prevented many employees from showcasing their true talents.

– In the Closing Keynote Panel, three local HR executives from Mersana, Progress and Ocean State Job Lot explained how their organizations have maintained award-winning workplace cultures with a dispersed workforce.

2) Acquiring/Retaining (Next Gen) Talent

As baby boomers are exiting the workforce and Gen Zers are entering, it has caused a great shift in office culture and employee benefits. Gen Z grew up in a technological world with an emphasis on mental health, and often expect their organization to reflect the same standards. Here are a couple of noteworthy sessions related to attracting and retaining next gen talent:

– During “Bridging the Generational Gap through Wellness Initiatives,” a representative from the Town of Barrington, Rhode Island, described how their wellness initiatives have helped increase retention and alleviate burnout among cross-generational employees.

– Experts from Apprentice Learning and FHL Boston explained how organizations can introduce a workplace culture that attracts young people of color in their “Engage Your Employees to Build an Equitable Workforce for the Future” presentation.

3) Reinforcing Employee Wellness

At previous NEHRA conferences and other industry-related events we have seen a giant emphasis on mental health. This year the topic of mental health resources has taken a back seat and many industry leaders chose to focus on the related subject of employee wellness practices instead, spotlighting the importance of…

a) Creating a Culture

Creating a workplace culture with employees of different ages, experiences, locations, and expectations can be a daunting task as an employer. Below are a few of the sessions that provided insights on how to best establish an inclusive company culture.

– National Behavior Health Leader, Dr. Joel Axler discussed signs and symptoms of someone struggling with mental health challenges employers should look out for during his session “Empathy in the Workplace.”

– Roman Music Therapy Services, Meredith Pizzi spotlighted unique ways HR teams can generate workplace cultures that reflect the company’s vision while also inspiring employees.

b) Just Add Joy!

Creating a workplace culture with employees of different ages, experiences, locations, and expectations can be a daunting task as an employer. Below are a few of the sessions that provided insights on how to best establish an inclusive company culture.

– In the Keynote Presentation titled “Create a Workplace People Love – Just add Joy!” the Co-Founder of Menlo Innovations, Rich Sheridan, suggested organizations move away from outdated corporate traditions and adopt new approaches based on what employees want.

– In the breakout session, “What is Stealing Your Joy? Simple Steps to Bring it Back,” attendees had the chance to openly discuss what obstacles are weighing them down at work and possible solutions.

All in all, the conference was a great success and provided an excellent atmosphere for networking and discussing industry trends. Every year I feel like I’m seeing more young talent, which gives me a good feeling about the future of our industry. I am already excited to see what next year’s conference brings!

Our Senior Vice President, Teri Weber published an article explaining how employers can better gauge the efficiency of their leave management programs and highlight areas for process improvement using the secret shopper model. Check out the full article published by the Disability Management Employer Coalition (DMEC) here.