Business Insurance has released finalists for their 2023 U.S. Insurance Awards. Spring’s team has been shortlisted for the Insurance Consulting Team of the Year category. You can find the full article here.

Spring Consulting Group has announced they have hired three new actuaries to support their Employee Benefits and Property & Casualty (P&C) Actuarial offerings.

As Spring’s Senior Vice President & Chief Actuary, Steven Keshner, is set to retire soon, the organization has appointed Ron Williams as Chief Actuary. In this role, Ron will lead Spring’s Employee Benefits Actuarial team, including providing strategic oversight and contributing to new business development.

Ron brings over 30 years of insurance experience across financial solutions, capital and risk management, and employee benefits. Prior to joining Spring, Ron was a Managing Director leading the Health and Benefits Risk Analytics Practice at KPMG and also held leadership roles at Willis Towers Watson, Lincoln Financial Group, and The Hartford.

Ron is also an adjunct professor of Corporate Finance within the Actuarial Science Program at the University of Connecticut, a Fellow of the Society of Actuaries, and a Member of the American Academy of Actuaries

Spring also hired MIT graduate, Andrew Stuntz as an Actuarial Analyst on the P&C team to support projects related to pricing, reserving, and captive feasibility studies. Prior to Spring, Stuntz worked on transit pricing and fare technology projects for the Massachusetts Bay Transportation Authority (MBTA) and on analysis of environmental regulations for NERA Economic Consulting. Stuntz will work on the P&C actuarial team led by Peter Johnson, Chief P&C Actuary.

Spring also recently welcomed Aaron Houtari as an Actuarial Analyst. Houtari holds two bachelor’s degrees in economics and applied Mathematics, and was Co-President of the Actuarial Club at Hillsdale College.

Houtari has held multiple finance and actuarial positions at AXA Advisors, JPMorgan, and Allen Bailey & Associates.

Commenting on these developments, Spring’s Managing Partner, Karin Landry, stated “I am thrilled about all the new additions to Spring. I know this will enhance the breadth of our actuarial services and ensure our clients continue receiving the same excellence, attention to detail, and consultative knowledge that our actuaries are known for!”

Landry also announced plans to continue expanding Spring’s actuarial resources this year in both the employee benefits and P&C space.

Every year The Risk and Insurance Management Society (RIMS) hosts their annual RISKWORLD conference, which brings together thousands of risk professionals from across the globe to network and discuss current trends and new innovations in the industry. This year the conference took place in Atlanta, GA and featured a wide range of fun activities including a pickleball tournament, a golf event, and a group of service and therapy animals to play with. Outside of all the “extracurricular” activities the conference had to offer, it helped paint a clearer picture of what is driving the risk management sector and how employers are combating different obstacles. We noticed that the following five areas got a lot of spotlight at RIMS this year.

1. Career Development

It seems like every year increasingly more sessions are focused on the future of the risk management sector and how young professionals can grow into industry leaders. As boomers begin to retire and millennials start taking on larger roles, conferences like RIMS are recognizing the need to be sure the next generation has the tools they need to be successful. Below are some of the top sessions I found most interesting:

– A session titled, “How to Take Risk Off the Books and Demonstrate Your Value to the C-Suite” focused on strategies risk professionals can take to properly explain risk mitigation strategies to C-suite executives to help elevate their value.

– Risk Directors from two different universities presented on the importance of teaching the next generation about non-traditional risks and preparing them for future barriers (ex. cyber liabilities, ESG, climate change, etc.).

– One session took a unique approach and brought together three industry leaders that were originally on the same team but all accepted different opportunities. Each presenter gave insights into their specific journey and what young professionals can do to drive the trajectory of their careers.

2. Claims Management

As inflation is top of mind for businesses across the globe, cutting costs and managing claims is a high priority for risk teams. This year presenters looked at a range of business lines and various approaches to handling claims processes.

– As cyber is still an emerging risk, a presentation titled “Cyber Claims Management: Dispelling Myths and Distilling Realities,” reviewed common misconceptions, and detailed how to integrate cyber coverage into incident response plans.

– A session on managing operational risk and internal processes in workers’ comp coverages outlined best practices for third party administrators (TPAs) and key performance indicators when evaluating a workers’ comp program.

– A lawyer and a VP of Risk Management discussed the legal landscape and settlement processes when it comes to managing and valuing claims. They also included tips for organizations to ensure they are protected in settlement efforts.

3. Cyber and Technology Risk

Although cyber is not a new concern the risk-world (no pun intended), we are seeing a lot of evolution and maturation in this space. This year speakers tackled cyber coverage from many different points of view, some of which included:

– In the session, “Ransomware Postmortem: The Anatomy of a Cyber Breach,” the presenters expressed what employers can do at different stages of a cyber breach to mitigate losses, and what is going through the minds of hackers during planning, execution, and post cyberattacks.

– In response to the Ukraine-Russia War, one group presented on current cyber warfare trends and how international sanctions can impact regulations and cyber claims.

– The session, “Understanding Autonomous Vehicle Risk and Insurance,” speakers gave a comprehensive review of autonomous vehicle risks and market conditions to pay attention to, such as legislative developments and availability of insurance products.

It seems like every year we are seeing new developments in the world of captive insurance on both the national and international scales. After recently attending The Captive Insurance Companies Association (CICA) 2023 International Conference, I wanted to share some of the hot topics on the minds of captive professionals around the world. As a board member of CICA and chair of CICA’s NEXTGen young and new professionals committee, I was excited to be so involved this year. The conference definitely did not disappoint; in addition to “extra-curriculars” like the golf tournament and brewery tour, the event also provided great opportunities for networking and learning about current trends and best practices in the world of captives and what the future holds for the industry. I hope you enjoy these highlights.

4. Diversity, Equity, and Inclusion (DEI)

As we progress through 2023, employers across the nation and internationally are working to develop programs that address DEI efforts. Although DEI was not the leading topic of discussion this year, I still wanted to share some of my favorite sessions that address unique social issues in the risk management/insurance space.

– Workers’ Compensation experts clarified how understanding DEI needs of injured workers can directly help with the recovery process and their return to work. Furthermore, they explained how greater communication can reduce the risk of continued disability and litigation.

– As Artificial Intelligence (AI) is making headlines globally for its potential (both negative and positive), many fear for perpetuated biases the systems may hold. One presentation investigated potential discriminatory liabilities when it comes to automating recruitment and other employment decisions and how it can intersect with different compliance regulations.

– A group of 5 female executives tackled the issue of women in leadership positions in the risk management/insurance space and tools they utilized in their career paths to help combat gendered stereotypes and achieve leadership roles.

5. Strategic and Enterprise Risk Management

When it comes to developing a concrete and concise program, risk management teams have an abundance of options and strategies to consider. This year, enterprise risk management (ERM) was a hot button topic, with sessions covering:

– The session, “Social Media: Managing the Continuous Stream of Emerging Risks” explored a new stream of liability, social media risks. Speakers from Oracle and Salesforce reviewed the history of social media risks and potential response plans for future incidents.

– Two insurance executives reviewed how the pandemic forced organizations to integrate resilient and adaptive programs, opposed to more traditional and defensive programs we saw pre-pandemic. They then laid out risks and disruptions organizations should be ready to face in the post-pandemic world.

– A representative from Merit Medical dove into her company’s approach to ERM and how they optimized their program through strong leadership support. Her session was titled, “Enterprise Opportunity Management: Optimizing the Value of ERM with a Focus on the Positive.”

As a regular RIMS attendee, I have to say, this conference was one of the best. I was able to connect with so many interesting people and deepen my understanding of best practices and trends. Aside from the socializing and happy hours, Spring had a great time exhibiting and attending the informative sessions; I look forward to next year’s conference! In the meantime, our team will continue to assure we provide clients with industry leading captive and alternative risk financing services.

In a recent article published by Captive Intelligence, our Chief Property and Casualty (P&C) Actuary, Peter Johnson, reviews current trends in the P&C industry and how risk optimization can help cut costs and increase coverages. Check out the full article here.

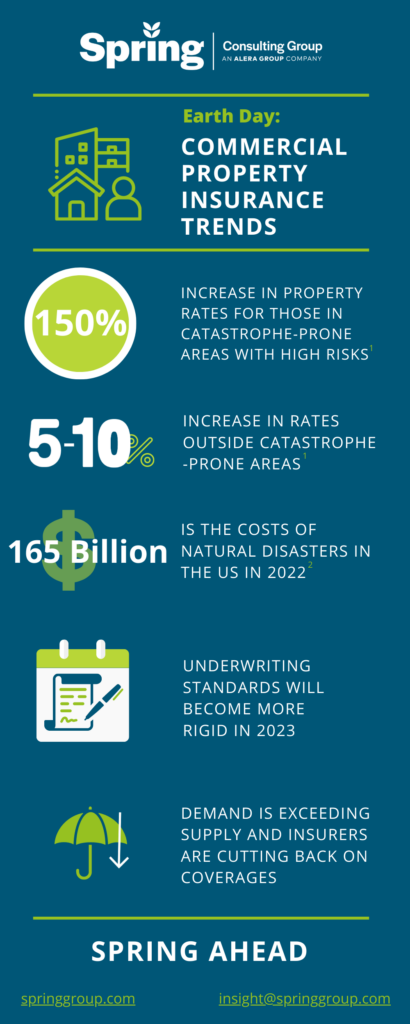

This Earth Day, we wanted to highlight the effects of climate change and natural disasters on the property & casualty insurance industry. Check out the infographic for a quick glimpse of where things stand.

Sources:

1 Alera Group’s 2023 P&C Market Outlook + Commercial Property Update

What are the biggest trends or developments we should expect to see this year in the Property and Casualty (P&C) market?

Like many other industries, inflation has been top of mind for risk managers, insurers, and P&C professionals. McKinsey & Company estimated that inflation increased the cost of P&C claims by $30 billion in 2021,1 and it continues to be a primary concern across P&C lines. Property insurance is being hit hard this year. Hurricane Ian alone is expected to cost insurance companies over $60 billion.2 In combination with other recent catastrophic events (CATs) and construction cost inflation, this is driving substantial rate increases and higher underwriting standards for property policies. Inflation in auto costs and increased driving are also forcing insurers to respond with higher auto rates this year. So, cost-control practices will continue to be a main focus throughout 2023, both for insurers and businesses.

What impact is inflation having on the P&C market? Where is it hitting the hardest?

In the current hard market, we are expecting to see price increases across all lines of business, with an overall average increase of 9.3% in rates.1 Some of the top business lines being impacted include cyber, commercial property and personal lines/private risk (including private auto).

Following Hurricane Ian, we saw drastic increases in property insurance rates, with properties with poor risk quality seeing increases of 25% all the way up to 150% at the start of 2023.3 The number of natural disasters and level of exposure have been trending up over time, and costs are compounded by the need to rebuild with inflated prices and strained supply chains. According to NOAA National Center for Environmental Information, natural disasters cost the U.S. over $165 billion in 2022.4

When it comes to cyber, one of the toughest lines of business to write, we expect rates to increase as much as 50% for more complicated risks and 15% for simpler risks.1 This is less a result of inflation and more like growing pains for a newer market. As new risks continue to emerge and underwriting practices strengthen in cyber, it is difficult to predict how significantly inflation will influence costs.

Personal lines/private risk (including auto and homeowners insurance) rates are expected to increase almost 13% on average this year, with automobile rates seeing increases of 8-10% across the nation.1 Although Hurricane Ian and CATs dominated headlines in 2022, of the 15.5% increase in net losses across all business lines, private auto liability represented the largest sector in net incurred losses.5 Supply chain issues that drove up the prices for vehicle repairs and replacement had a direct impact on auto insurance claim severity and created a rate increase need for auto insurers to cover the cost increases. For many companies these rate increases are coming in conjunction with increased underwriting scrutiny, forced up retentions, and coverage reductions.

Workers’ Compensation is an exception to the norm this year. In spite of continued inflation, rates are expected to remain unchanged or slightly drop in 2023, with stable coverage options and underwriting practices. Employment Practices Liability is also looking favorable for buyers in 2023, with modest rate increases of 7% on average. Finally, Surety is also expected to see average increases just above 7%,1 but will face increased underwriting scrutiny with potential for larger rate changes on a case-by-case basis.

Geography is an important factor as well, and not just related to climate. For example, medical professional liability severity trends have increased, but this varies significantly by region. Some states are seeing double digit severity trends and rate increases while others are experiencing very modest increases. Differences in litigiousness and jury awards drive much of these state-by-state differences.

While most buyers are seeing rate increases and some reductions in coverage, high-risk clients are affected the most by continued inflation and other cost increases. This includes businesses with adverse loss histories, located in CAT-prone areas, or with frame construction buildings. Unfortunately, we are not seeing an influx of new players or investment to mitigate rising rates.

When looking at the industry level, Alera Group reports that the two sectors with the most unfavorable market situations are nonprofit organizations and the hospitality and gaming sector. Although nonprofits don’t make up a large portion of organizations in the U.S., they often require specialty insurers which can be costly and hard to find. Nonprofits are also often targets for cyberattacks and face unique underwriting processes that differ from other industries. The industry most impacted by inflation and unfavorable market conditions is the hospitality and casino industry where we expect to see increases in rates, reduced insurer options, and stricter underwriting processes across cyber, employment practices, general liability, property and umbrella.

In wake of recent natural disasters, what’s the outlook for property insurance underwriting and rates? On a practical level, what should buyers expect?

Property rates remain high and are expected to remain high for a while. Hurricane Ian caused big disruptions for property reinsurers, who in turn are pushing carriers for better valuation and stricter underwriting — especially in catastrophe-prone areas. As for how this will realistically play out, buyers may see fewer coverage options and new requirements like recent appraisals, insurance-to-value increases, engineering reports and complete applications. More underwriting processes will also focus on fire suppression systems, difficult-to-place risks and limits on high-rise structures.

According to Alera Group’s P&C Market Outlook, cyber liability pricing is expected to increase by 15% in 2023. What do you think this says about the market and what can organizations do to control their spend?

The cyber market is still relatively young and new risks can emerge quickly. Although rates are expected to increase by 15% on average for the simpler risks in 2023, more complicated cyber risks will see increases as much as 50%, often with difficult underwriting processes. Terms and conditions are changing to better clarify challenging coverages, resulting in longer underwriting processes. Employers and buyers of cyber insurance should ensure they are working with experienced underwriters and that they properly understand the specific cyber risks associated with their business so they can prioritize coverage selections.

Are there any emerging P&C lines that will take the spotlight in the years to come? What about in the captive space?

I cannot say for certain we will see completely new lines of business emerge in the next few years in the P&C market. But I do expect to see changes in coverage within different lines of business, particularly as our economy evolves and new technologies and products are utilized by both individuals and commercial industry. Artificial intelligence and other product innovations are expected to have an impact on both frequency and severity of loss outcome and will influence actuarial pricing indications for various insurance products.

I think captives will continue to emerge as a critical part of the ecosystem. As coverage capacity in lines like commercial property goes down or as new risks emerge in lines like cyber, captives offer organizations new options for layering the coverage they need at a price that truly reflects their own loss history and level of exposure. Captives are able to fill in the coverage gaps in cases where the commercial market has yet to come up with a competitive solution. This happened for cyber risks about a decade ago.

How are actuaries poised to help organizations and risk managers tackle some of the challenges mentioned?

Actuaries specialize in quantifying risks using statistics, whether for a business or an insurer or an entire industry and using that information to manage risks in a cost-effective way. This runs the gamut from reviewing a company’s loss history and current insurance policies to informing better choices in the commercial insurance market, all the way to setting up a captive insurance company tailored to the needs and experience of a specific business. In an environment like today with rising premiums and reductions in capacity and coverage options happening for many P&C lines, actuaries can provide organizations with tools and a higher level of confidence around managing their risks and their costs effectively. As an example, actuarial proforma financial models can be leveraged in a captive solution and aid a company’s decision-making around the appropriate balance between retaining risk and utilizing available market options to transfer risk in a cost-effective way.

The pandemic had certain influences on insurance underwriting. Have we transitioned past these pandemic issues yet?

Court room closures, significant reductions in vehicles on the road, delayed healthcare surgeries and procedures and other changes at the onset of the pandemic had a big impact on the underwriting experience of insurance companies for most property and casualty lines of business. As one would expect, when our economic engine slows the frequency of claims also does. As we are now well past these issues and our economy is mostly back up and running, we are now working through other, likely temporary issues that are currently impacting the underwriting experience within the commercial market and driving the need for rate increases. We are certainly seeing this in the auto insurance market. After over a decade of low treasury yields and a low inflationary environment, we are now in a high inflationary environment for personal lines auto. Supply chain issues during the pandemic resulted in significant increases in vehicle costs and have resulted in rising auto claim severities and the need for auto rate increases in the market.

Any final thoughts on the P&C landscape?

It’s a difficult year for property and auto costs, and cyber risks continue increasing. Some of the bottom-line impacts of these changes are unavoidable, but rate and coverage changes in the commercial insurance market are also driven by broad industry patterns that might not apply to a specific organization. I expect to see more businesses taking a close look at their own risk profile and exploring all of their options to close coverage gaps and take advantage of alternative risk funding structures when appropriate.

1 Alera Group’s 2023 P&C Market Outlook

2 https://wusfnews.wusf.usf.edu/economy-business/2022-12-01/hurricane-ian-is-expected-to-drive-more-property-insurers-out-of-business

3 https://www.businessinsurance.com/article/20230104/NEWS06/912354660/Some-rates-will-stabilize-less-optimal-risk-profiles-will-see-hikes-

4 https://www.climate.gov/news-features/blogs/2022-us-billion-dollar-weather-and-climate-disasters-historical-context

5 S&P Global Market Intelligence, March 2023

Captive Review has released a Q&A featuring our Chief Property and Casualty Actuary, Peter Johnson, where he explains the impact of inflation on insurance and risk management practices and how how it intersects with captive insurance. Check out the full Q&A here.

Spring Consulting Group provides a wide range of Captive Services when it comes to the Employee Benefits and Property & Casualty (P&C) industries. In this Whitepaper, you can learn more about our captive services and how we approach captive implementation/optimization.

Last week we wrapped up Business Insurance’s 2023 World Captive Forum (WCF) in Miami, FL. This year’s conference brought together hundreds of stakeholders in the captive space to network and discuss leading trends in the industry. As a member of the advisory board, I’m glad the event was such a success; below are some of the topics I found most prevalent during this year’s conference.

1) Captive Updates

When it comes to captive regulations, we have seen many changes in just the last year. With the growth and development of different domiciles all around the world comes new regulations to which captive owners and employers must adhere. Below I have included a couple interesting sessions that explain how regulations surrounding captives have changed across the globe.

– Government insurance representatives from North Carolina, Vermont, Oklahoma, Bermuda and Michigan discussed trends, best practices and laws impacting the captive industry (and their respected domiciles).

– As Latin America has been growing their position in the captive space, a session featuring the Official Advisor for Latin American Affairs from the Government of Bermuda spoke about current LATAM trends and what we can expect to see from the region moving forward.

2) Cyber Captives

Although writing cyber liability coverage into a captive is not a new practice, it is still nowhere near as common as placing medical stop-loss or property & casualty lines into a captive. This year cyber coverage was a hot-button topic at the conference and will most likely continue to be, as cyber attacks continue to pose substantial risks.

– In a breakout session titled “Cyber Captives” a group of risk experts discussed current trends in cyber insurance and the limitations for captive coverage in cyber.

– In a session titled “Secrets Cyber Criminals Don’t Want the Insurance Industry to Know”, the CEO of BlackShield Cyber, Dioly Alexandre, explained how cybercrime has changed over time and what insurance companies need to do to keep up.

3) Healthcare & Captives

Whether an employer in the retail space is looking to use a captive to fund health benefits, or whether a hospital organization is leveraging a captive for its medical malpractice and other unique liabilities, captives and healthcare have always been closely intertwined. At WCF this year some highlights of this dynamic included:

– Spring’s Managing Partner, Karin Landry, presented on trends in medical stop-loss (MSL) and how this tactic can help employers proactively manage healthcare costs and lessen the impact of catastrophic claims. The discussion included a deep dive into what is driving upticks in healthcare costs; walk-throughs of case studies illustrating MSL advantages, including an overview of Canon USA’s captive story; and a detailed explanation of Medical Expense Cost Containment (MECC) and how it comes into play.

– The first session of the final day reviewed implications of medical malpractice coverage following the Supreme Court’s decision on abortion services and best practices for healthcare providers.

– In the session “Global Medical Claims Developments – Covid-19, Hyperinflation, Musculoskeletal and Mental Health,” the panelists discussed how captive managers should address specific medical conditions and unusual medical claim patterns.

4) The Future of Captives

Although nobody knows for certain the future of the captive industry, we are seeing various patterns that suggest we will see many changes to come. Aside from new domiciles and new types of coverages, we are also seeing different approaches when it comes to current captive practices.

– In a session on “Hybrid Captives,” I presented on innovations in the property & casualty market that allow captives to more meaningfully control property exposures and premiums.

– As a newer member to the World Captive Forum Advisory Board, I was joined by University of California’s Karen Hsi in a roundtable for younger professionals entering the industry, including a discussion of what the next generation of talent is looking for and how they can get themselves on a promising career trajectory.

– As diversity, equity, and inclusion (DE&I) is a current top priority for many companies, this session discussed how by reinvesting underwriting profits, captive programs can be used to finance DE&I strategies to meet the needs of a diverse workforce.

Getting a break from Boston winter was a plus, but the ability to reconnect with industry leaders and collaborate on strategies was the real draw. We are excited to see what the World Captive Forum holds in store for us next year and we will continue to keep you up-to-date with developments in the captive space.